Delaware Statutory Trust Blog

Categories

Filter Categories

Show All

1031 Exchange DST Tools

1031 Exchange Market Info

1031 Tax Info

721 UPREIT Exchange

Can I 1031 Exchange into a REIT?

DST 1031 Case Study

DST 1031 Insights

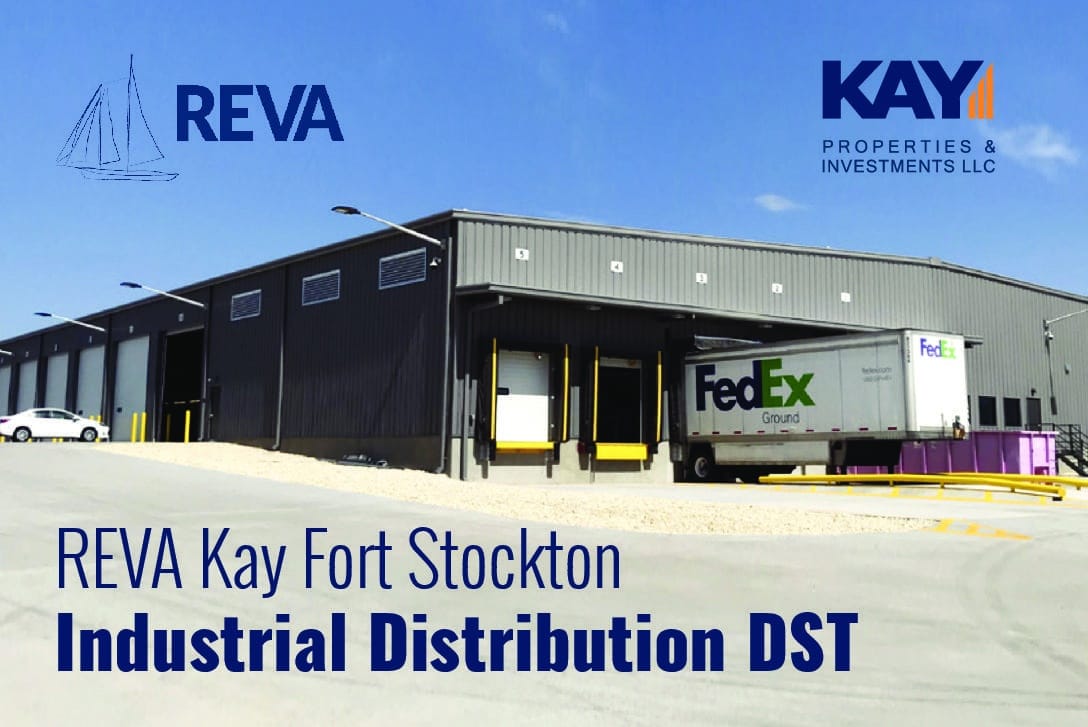

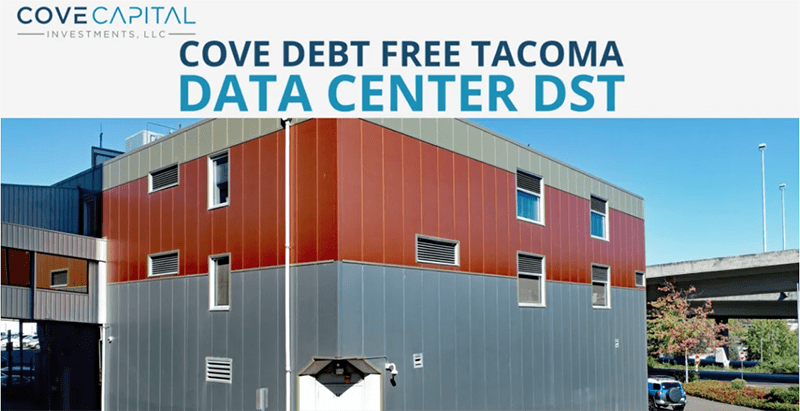

DST Investment Properties

DST Properties for Sale

DST Secondary Market

DST Testimonials

Debt Free DST

Dwight Kay

Investment Insights

Investors

Kay Properties & Investments

Landlord Retirement

NNN Triple Net Leased Properties

Passive Investments

Podcasts

Press Releases

Taxes

Videos

Why Kay Properties?

To Subscribe To Our DST Blog Call 1-(855) 899-4597 or Complete The Form Below!

Looks like your offerings were the best, not to mention the value you added when we talked. I will keep you in my DST file for myself and other potential DST buyers. Thanks for your help, Lou M. - Orange County, CA

We very much appreciated the knowledge, professionalism and assistance you gave us over the past months in deciding what investments were most beneficial for us. We look forward to doing business with you in the future.Marie E. -Westchester County, NY

In 2017, I had come to the conclusion that I wanted to sell our rental property and while expecting a big capital gain, I wanted to learn more about 1031 exchanges to delay the tax consequence…. Betty Friant of Kay Properties rose above the crowd of potential investment partners very quickly. It was clear she knew her business. She answered every one of my questions which came to me in waves through my due diligence. Her patient teaching style was exactly what I needed. After getting comfortable with 1031 exchanges and the Delaware Statutory Trust structure, it was easy to turn to examine and compare the investment choices offered by Kay. Here again, Betty was not only patient, but resourceful in getting me in front of the best experts to answer more questions. She even arranged a telephone conference for my CPA as he had never handled DST’s before. We sold our rental and with Betty’s help, we diversified the proceeds into 4 commercial properties within the Kay Properties network…. The property management is solid. It is a great blessing to have those checks coming every month…. We have just made another investment with Kay and next year, when we sell our last rental, we already know where we will invest – Kay Properties with Betty Friant.David A. - 1031 DST Investment Owner - Anne Arundel County, MD

I am doing well and am happy with the DST’s I invested in with your company; the expertise you provide and the professionalism with which you operate your business.Rod T. - 1031 DST Property Investor - San Diego, CA

These testimonials may not be representative of the experience of other clients. Past performance does not guarantee or indicate the likelihood of future results. These clients were not compensated for their testimonials. Please speak with your attorney and CPA before considering an investment.