By Dwight Kay, Founder and CEO, Kay Properties and Investments

Key Takeaways:

- What is the definition of an Accredited Investor?

- Why does the Securities and Exchange Commission require some investors to be accredited?

- Do Delaware Statutory Trusts require Investors to be accredited?

- What is the history of investor accreditation?

The combination of aging demographics, stock market volatility, and a desire to find an investment strategy that delivers passive income are all contributing to the growing popularity of Delaware Statutory Trusts (DSTs) among accredited investors. In addition, accredited investors are also hoping to capitalize on one or more of the potential benefits DST investments provide, including:

- Ability to Step Away from the Three Ts (Tenants, Toilets, Trash) of Active Management

- Access to Monthly Income Potential

- Create the Potential for Portfolio Diversification* by Geography and Property Types

Delaware Statutory Trusts: Most Frequently Asked Questions

As one of the nation’s most experienced Delaware Statutory Trust investment firms, Kay Properties is often asked many questions regarding the pros and cons of DSTs investments.

Below is a recently recorded video titled, “Delaware Statutory Trusts: Most Frequently Asked Questions”.

However, while DSTs can potentially provide investors with many advantages, they are only available to accredited investors.

What is an Accredited Investor?

According to the United States Securities and Exchange Commission (SEC), an accredited investor is someone who is qualified to invest in securities that aren’t registered with the SEC. For example, publicly traded stocks or bonds do not require investors to be accredited. However, investment vehicles such as hedge funds, private equity funds, private placements, real estate funds, and asset-backed investments like Delaware Statutory Trusts do require investors to be accredited.

To qualify as an accredited investor, individuals must satisfy the following requirements:

- A single income greater than $200,000 over the past two years.

- Joint income with a spouse of greater than $300,000, over the past two years.

- An individual net worth, or joint net worth with a spouse, exceeds $1 million, excluding the value of your primary residence, at the time of the investment.

- An entity with gross assets over $5 million.

Why Does the SEC Require Accreditation Verification?

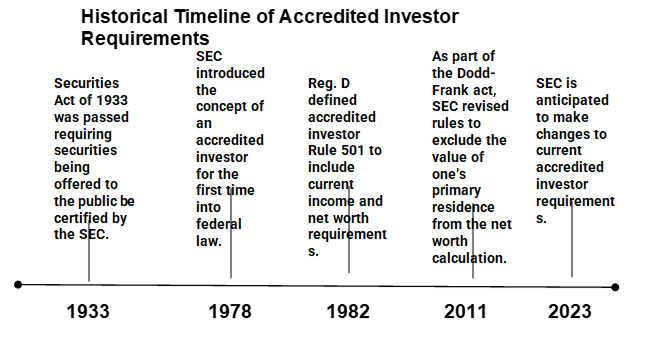

The SEC introduced the concept of accreditation for investors into federal law in 1978 because it wanted to ensure that all investors have the financial sophistication and resources to understand the risks associated with certain investments. By requiring accreditation status, the SEC felt this was a legitimate way to protect investors from taking on risks they may not fully understand or be able to handle. Accreditation is also important for making sure investors are investing in suitable investments that meet their financial and risk objectives. Because like all real estate, whether it's a single-family home rental, commercial property, industrial warehouse, net leased asset, or apartment complex, carries no guarantees that there will be appreciation, income, or regular distributions, Delaware Statutory Trust investments require that all investors be accredited.

Robust Educational Program Specifically for Accredited Investors

Kay Properties & Investments believes firmly in education. In fact, many have said that no one in the country does more to educate accredited investors and anyone interested in DST Investments for their 1031 exchange than Kay Properties does. With a comprehensive platform of educational options, Kay Properties is considered by many nationwide to be the preeminent authority and expert in DST 1031 exchanges and investment strategies. Obviously, a big part of our educational programs includes explaining exactly what an accredited investor is.

For more information on Delaware Statutory Trust resources, please visit our resource page.

Please visit our YouTube channel to learn more about Delaware Statutory Trusts from the Kay Properties team of experts.

To hear more about Delaware Statutory Trust investment strategies, please visit our On-Demand Webinar page.

*Diversification does not guarantee profits or protect against losses.