(Los Angeles, CA) Kay Properties & Investments, a national leader in Delaware Statutory Trust equity placements and 1031 exchange investor education, announced it has included The Peanut Factory Lofts, a dynamic multifamily asset in historic downtown San Antonio, TX to its nationally recognized online marketplace located at www.kpi1031.com. According to Dwight Kay, CEO and Founder of Kay Properties, this unique asset was an all-cash acquisition and is considered a high-quality Delaware Statutory Trust for 1031 … Read More

Dwight Kay Provides Real Examples of Investors Who Used Kay Properties for Legacy and Estate Planning Purposes Regarding their Rental Property and Real Estate Investment Portfolios

By Dwight Kay, Founder & CEO Kay Properties & InvestmentsMore and more, our team of 1031 exchange DST experts at Kay Properties & Investments is being asked about legacy and estate planning. Every day we hear questions like: How are my children going to inherit my properties? What will the tax consequences be? How do we handle the potential for in-fighting or competing priorities amongst our heirs or kids? Preserving wealth across multiple generations requires … Read More

Why the Glory Days of Independent Real Estate Investing Is a Thing of the Past, and What Some Smart Investors Are Doing About it

By Dwight Kay and the Kay Properties TeamIndependent real estate investors seem to be taking it from all sides these days. Not only are interest rates, property taxes, and construction costs up significantly from just a few years ago, but also more and more legislation continues to be introduced, making the management of real estate (especially single family rentals and apartment buildings) more difficult, expensive, and heavily regulated. In addition to these growing restrictive rental … Read More

The 721 Exchange UPREIT Exit Strategy for Delaware Statutory Trust Investors Explained

One of the most important questions Delaware Statutory Trust real estate investors need to ask themselves is, “What is my long-term, exit strategy?” Most Delaware Statutory Trust (DST) investments are typically held for approximately 5-10 years (although it could be shorter or longer). After that, the DST investment will typically go “Full-Cycle”, a term used to describe a DST property that is purchased on behalf of investors and then after a period of time is … Read More

(Exclusive Aerial Video) A Closer Look at the Pharmacy Net Lease 65 DST in Downtown Encinitas, CA

By Dwight Kay, Founder and CEO of Kay Properties & Investments One of current Delaware Statutory Trust offerings available for 1031 exchange as well as direct cash investment, is the Pharmacy Net Lease 65 DST, a Regulation D Rule 506 (c) offering in downtown Encinitas, CA. 100% Debt-Free AcquisitionThe Pharmacy Net Lease 65 was purchased as an all-cash, 100% debt-free acquisition as a purposeful strategy to mitigate risk associated with potential lender foreclosure or cash … Read More

Why Kay Properties Stands Out as an Expert Delaware Statutory Trust Firm

The Delaware Statutory Trust (DST) investment strategy has become one of the most popular choices for accredited investors seeking replacement properties for their 1031 exchanges. Kay Properties is often considered the preferred choice for1031 exchange DST investors in this space who want an expert Delaware Statutory Trust firm. investment strategy has become one of the most popular choices for accredited investors seeking replacement properties for their 1031 exchanges. Kay Properties is often considered the preferred … Read More

Why Investors Choose Delaware Statutory Trust Properties vs. NNN Properties for 1031 Exchanges

By Dwight Kay, Founder and CEO of Kay Properties and Investments Over the years, I have seen many clients that started to purchase a NNN property for a 1031 exchange ultimately decide to invest in a Delaware Statutory Trust 1031 property instead. In many cases these clients are drawn to NNN properties because they think that is the only choice to achieve passive ownership of real estate but are concerned about placing such a large … Read More

4 Reasons Why Investors Should Consider Qualified Opportunity Zone Funds for Tax Advantages and Potential Returns

By Dwight Kay, Founder and CEO, Kay Properties and InvestmentsQualified Opportunity Zone Funds (QOZF) have become an integral part of the investment landscape in recent years for those investors seeking to defer capital gains taxes on the sale of appreciated assets. At Kay Properties, our team has helped many accredited investors nationwide understand and participate in Qualified Opportunity Zone Fund investments. What is a Qualified Opportunity Zone? Qualified Opportunity Zone Funds were implemented by the … Read More

A Comprehensive Guide and Video on Why Investors Should Consider Debt-Free Delaware Statutory Trust (DST) Properties

Learn eight specific and compelling issues 1031 exchange and Delaware Statutory Trust investors might not be aware of when it comes to risks associated with leverage. By Dwight Kay, Founder and CEO, Kay Properties and InvestmentsIn the world of 1031 exchanges and Delaware Statutory Trust investments, mitigating risks where possible is paramount. One strategy that has gained traction among savvy investors is the all-cash or debt-free Delaware Statutory Trust (DST). As the founder of Kay … Read More

What are the Best Properties for a 1031 Exchange?

Let’s say you are about to sell your investment property, and your CPA tells you that there is a large tax bill lurking around the corner. In order to avoid paying capital gains and depreciation recapture tax, your CPA advises you to consider exchanging into another property via a 1031 exchange. But what exactly are the best properties for a 1031 exchange and what are some risks associated with some of these 1031 exchange investment … Read More

Mastering DST Properties with Dwight Kay

Kay Properties and Investments Book on Delaware Statutory Trust Properties Remains One of the Best Resources for 1031 Exchange Readers Interested in How DSTs Work Article Highlights: Why did Dwight Kay write a book on Delaware Statutory Trusts? The book talks about Delaware Statutory Trust pros and cons. More than 30,000 copies have been distributed to DST 1031 exchange investors. The book was written in a straight-forward, easy-to-read style. When Dwight Kay, founder and CEO … Read More

What Is A DST 1031 Exchange?

By: Kay Properties and Investments, LLC Key Takeaways: A 1031 Exchange helps investors defer capital gains taxes. How are Capital Gains Taxes Calculated? What are the benefits of a DST 1031 Exchange for real estate investors? How does the Kay Properties online marketplace at www.kpi1031.com help DST 1031 exchange investors? While most real estate investors have heard of the 1031 exchange, they may not understand how the Delaware Statutory Trust or “DST” can be incorporated … Read More

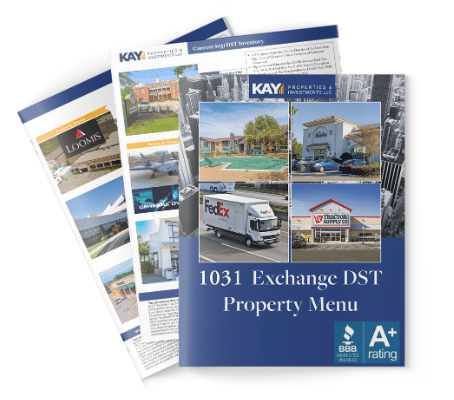

Why Investors Love the Kay Properties Online Marketplace for DST Investment Opportunities?

Many real estate investors looking for quality DST investment opportunities come to Kay Properties and Investments’ online 1031 exchange and real estate investment marketplace located at www.kpi1031.com. While most real estate investments made on the Kay Properties platform are for DST 1031 exchange replacement properties, the online marketplace is also drawing significant attention from direct cash investors as well. The reasons why investors choose to invest in DST properties as a purely discretionary cash investment … Read More

Why Delaware Statutory Trusts are a Great Resource for 1031 Exchanges

By Brent Wilson, Vice President, Kay Properties and Investments 1031 Exchange investors have probably noticed that over the past year, the Federal Reserve has been increasing interest rates to control the higher-than-normal rate of inflation. When this happens, one of the things that is triggered is that banks start to tighten their own lending standards because with a higher Fed Funds rate, it’s more expensive for banks to borrow from each other. This reality was … Read More

What are Pros and Cons of the Delaware Statutory Trust for Investors?

Cracking the Code: Understanding the Pros and Cons of Delaware Statutory Trusts for 1031 Exchange Real Estate Investors By Dwight Kay, Founder and CEO, Kay Properties and InvestmentsIn the realm of real estate investing, the 1031 exchange Delaware Statutory Trust can provide savvy real estate investors a unique opportunity to achieve passive management, the potential for regular monthly distributions, and a way to enter one of the most tax efficient real estate investment strategies available … Read More

What is a Delaware Statutory Trust: The Basic Facts on DSTs and 1031s

By The Kay Properties Team If you are new at commercial real estate investing, you likely have questions about the different types of real estate ownership structures and specific tax benefits that may be available to them. One of the most popular forms of commercial real estate investing is Our Delaware Statutory Trust 1031 Exchanges. But just what are DSTs and 1031s? This article will specifically answer fundamental questions, including: What is a Delaware Statutory … Read More

Three 1031 Exchange Investment Options

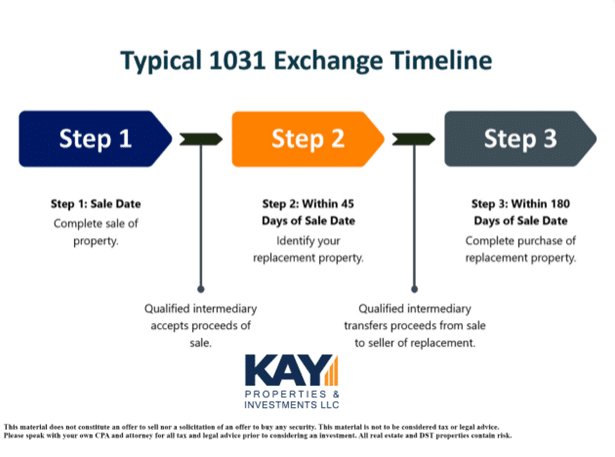

It’s both an exciting time and a very trying time when an investor sells a property and wants to defer taxes in a 1031 Exchange. A 1031 Exchange is when an investor sells a property that was held for business or investment use and then exchanges into another property of equal or greater value in an effort to defer taxes. There are three basic choices that investors can make in 1031 Exchange investment opportunities. Before … Read More

What is a DST 1031 Property?

By Dwight Kay, Founder and CEO, Kay Properties and Investments Key Highlights: What do the initials “DST” stand for? What is the typical investment amount for a DST 1031 investment? What does the term “beneficial interest” mean for DST properties? Why investors like DST properties for 1031 exchanges? A DST stands for Delaware Statutory Trust and is an entity that is used to hold title to investment real estate. In some ways this is similar … Read More

(VIDEO) Echoes of Success Through Kay Properties DST Investor Reviews and Testimonials

Over the years, Kay Properties and Investments has worked with literally thousands of satisfied investors on their 1031 exchanges and Delaware Statutory Trust investments, helping them understand both the pros and cons of DSTs. In many cases, these DST investors felt compelled to write members of the Kay Properties team to express their heartfelt gratitude and appreciation for the assistance Kay Properties provided them in their 1031 exchange and Delaware Statutory Trust investment. Listen to … Read More

How to Make Smart Real Estate Investment Decisions with a 1031 Exchange

By Dwight Kay, Founder and CEO, Kay Properties and Investments If you are a real estate investor, the 1031 Exchange is potentially one of the most powerful wealth-building strategies you have at your disposal. Sometimes called a tax-deferred exchange or like-kind exchange, the 1031 Exchange is a provision outlined in the Internal Revenue Code (Section 1031), which outlines how real estate investors can defer capital gains taxes on the sale of investment properties by reinvesting … Read More

A 1031 Exchange Expert’s Advice on Investing in DSTs

By Orrin Barrow, Senior Vice President, Kay Properties and InvestmentsIn the world of Delaware Statutory Trust investments, the position of Senior Vice President plays an important link between the client, the investment real estate asset, and the sponsor company who is presenting potential offerings. Over the course of the past several years as a Senior Vice President with Kay Properties and Investments, I have worked with hundreds of clients on their 1031 Exchanges and Delaware … Read More

History of DSTs and Current Marketplace Conditions

Join our Kay Properties Delaware Statutory Trust experts, Brent Wilson, Vice President and Alex Madden, Senior Vice President as they dive into the ins and outs of the Delaware Statutory Trust historical and current market conditions. The Delaware Statutory Trust has had a fascinating history for real estate investors dating all the way back to the 1970’s. How are investors using the Delaware Statutory Trust in today’s economic environment?Listen to this fascinating look at how the … Read More

An Easy Guide to Delaware Statutory Trust Investing

Investors interested in Delaware Statutory Trust properties could benefit from a guide that clearly explains Delaware Statutory Trust properties for a 1031 exchange and provides valuable information on topics like: Key Highlights: What is a Delaware Statutory Trust? What is the history surrounding the Delaware Statutory Trust? What are the important dates that impacted the Delaware Statutory Trust? What are some of the benefits of the Delaware Statutory Trust? What are some of the risks … Read More

Debt Free Net Lease 55 DST

Delaware Statutory Trust 1031 Current Offering Net Lease Distribution 55 DST Recently, Dwight Kay, founder and CEO of Kay Properties, sat down to discuss in detail some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace at www.kpi1031.com for accredited investors for their 1031 exchange or direct cash investments. These DST 1031 properties are just a handful of current offerings from approximately 20-40 different DST … Read More

Key Investment Highlights of Net Lease Distribution 64 DST Offering

Recently, Dwight Kay, founder and CEO of Kay Properties, sat down to discuss in detail some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace at www.kpi1031.com for accredited investors for their 1031 exchange or direct cash investments. These DST 1031 properties are just a handful of current offerings from approximately 20-40 different DST offerings available from roughly 25 DST sponsor companies. One of these … Read More

Delaware Statutory Trusts: Triple Net Lease Properties

Join a couple of our Kay Properties Delaware Statutory Trust experts Betty Friant, Executive Vice President and Matt McFarland, Senior Vice President as they unpack the nuances of triple net lease properties. Triple net real estate investment properties are a popular choice for 1031 exchanges. Kay Properties Executive Vice President and Managing Director Betty Friant and Senior Vice President Matt McFarland take a closer look at NNN properties, and how they fit into the Delaware … Read More

Delaware Statutory Trust Real Estate: Latest Offerings

Recently, Kay Properties founder and CEO, Dwight Kay, sat down to discuss some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace for accredited investors for their 1031 exchange or direct cash investments. These properties are just a handful of current offerings from approximately 20-40 different DST offerings available from roughly 25 DST sponsor companies. These current Delaware Statutory Trust offerings range from single-tenant net … Read More

Delaware Statutory Trusts FAQ: Frequently Asked Questions on DSTs

By Dwight Kay, Founder and CEO, Kay Properties and Investments Forward: As one of the nation’s leading expert real estate investment firms specializing in Delaware Statutory Trust investments, Kay Properties is regularly asked about the nuances and strategies surrounding Delaware Statutory Trust investments for 1031 exchanges or direct cash investments. Recently, I sat down to discuss some of Frequently Asked Questions investors ask regarding Delaware Statutory Trusts and 1031 exchanges. I recorded and transcribed this … Read More

Delaware Statutory Trusts for Accredited Investors

By Dwight Kay, Founder and CEO, Kay Properties and Investments Key Takeaways: What is the definition of an Accredited Investor? Why does the Securities and Exchange Commission require some investors to be accredited? Do Delaware Statutory Trusts require Investors to be accredited? What is the history of investor accreditation? The combination of aging demographics, stock market volatility, and a desire to find an investment strategy that delivers passive income are all contributing to the growing … Read More

DST Properties and 1031 Exchange Real Estate Investment Options

Recently, Kay Properties founder and CEO, Dwight Kay, sat down to discuss some of the DST real estate properties his firm recently had available for accredited investors. These properties are now fully subscribed, however they represent good examples of DST properties that are available on the kpi1031.com marketplace, and examples for 1031 exchange real estate options. The interview was recorded and transcribed so investors can have easy access and use it as a reference for … Read More

Delaware Statutory Trusts: Asset Class Rejection

Listen to Delaware Statutory Trust experts Alex Madden, Senior Vice President, and Orrin Barrow, Senior Vice President as they review the significance of Delaware Statutory Trust Asset Class Rejection. Specifically, they will be discussing: ✔️ What exactly is an asset class for real estate and Delaware Statutory Trusts? ✔️ Why is asset class rejection important when investing in Delaware Statutory Trusts? ✔️ Consider some of the risks of senior care assets in Delaware Statutory Trusts. … Read More

Delaware Statutory Trusts: The History of the DST for 1031 Exchanges

Recently Kay Properties’ senior team of Delaware Statutory Trust experts Jason Salmon, Executive Vice President and Managing Director, and Senior Vice President, Matt McFarland sat down to discuss the history of the Delaware Statutory Trusts. Specifically, Jason and Matt will be discussing the following: ✔️ How the 1031 exchange laws were formed out of Revenue Ruling 2004-86? ✔️ What exactly is the Delaware Statutory Trust structure? ✔️ What is meant by “passive ownership”? ✔️ How … Read More

Another Reason to Stay Debt Free in a 1031 DST Exchange

By Dwight Kay, Founder & CEO, Kay Properties and InvestmentsIt seems like everyday there is another reason showcasing the reason why more and more investors are choosing to stay debt-free when investing in Delaware Statutory Trust (DST) properties in a 1031 exchange. Headlines Show Dangers Surrounding Leveraged Real Estate Just look at any business or real estate-related publication, and you will see the headlines are full of examples of real estate firms that have been … Read More

Four Ways to Use Delaware Statutory Trusts for Your 1031 Exchange

By Tommy Olsen, Vice President Kay Properties & Investments Key Highlights: How DSTs help investors successfully complete a 1031 exchange Can DSTs potentially provide investors greater diversification? How DSTs are utilized to help investors easily replace debt for their 1031 exchange DSTs can provide investors a good back-up option for a 1031 exchange Regardless of what economic trends are taking place, Delaware Statutory Trusts provide investors four timeless benefits for their 1031 Exchanges including deferring … Read More

Six Potential Benefits of Exchanging into Delaware Statutory Trust Properties

By Dwight Kay, Founder and CEO Kay Properties & Investments There are a number of potential benefits associated with exchanging into a Delaware Statutory Trust (DST) 1031 property. However, it is important to note that these potential benefits should also always be carefully weighed with the potential risks that are possible with DST investments, and as with all real estate investments, investors should consult their tax attorney and or Certified Public Account before investing in … Read More

Delaware Statutory Trust Investor Reviews and Complaints

Interested in learning more about Delaware Statutory Trust 1031 investments? Make sure to do a thorough job of researching Delaware Statutory Trusts prior to investing in a DST real estate offering, including reviewing client reviews and testimonials, reading published materials, and understanding potential complaints investors may have with Delaware Statutory Trust investments. Please note that testimonials may not be representative of the experience of other clients. Past performance does not guarantee or indicate the likelihood … Read More

Kay Properties & Investments DST Essentials Podcast: Liquidity & Exit Strategies

Join Kay Properties along with Matthew McFarland, Senior Vice President and Tommy Olsen, Vice President for a podcast on Delaware Statutory Trust liquidity and Exit Strategies. What We Will Be Covering: Various DST Exit Strategies DST Hold Period Expectations DST Secondary Market Transactions Estate Planning Transcriptions Tom Wall: Hi everyone, my name is Tom Wall, senior associate here at Kay Properties, and thank you so much for joining us this Friday for our investor conference … Read More

Why Delaware Statutory Trust Investors Should Practice “The Anchor and the Buoy Investment Strategy”

Real estate investors currently considering a Delaware Statutory Trust (DST) investment for a 1031 exchange or even a direct-cash investment, one of the first things to consider is what specific investment strategy should you pursue? For example, is the goal to achieve greater appreciation even if it means investing in an asset that carries greater risk? Or is your long-term strategy to have steady monthly income even if it means lower overall appreciation potential? I … Read More

Why Real Estate Income Funds Have Distinct Benefits for Investors

By: Kay Properties and Investments, LLC The recent fluctuations in the United States stock market have many investors looking for more conservative and less volatile investments. On top of that, traditional investment instruments like stocks and bonds are similarly not looking very attractive because of their lackluster yield performances. Therefore, more and more investors are attracted to Real Estate Income Funds. While Kay Properties & Investments is best known for its expert-level knowledge of Delaware … Read More

How to Plan Your Delaware Statutory Trust to Remove the Stress of a 1031 Exchange

By: Matt McFarland, Senior Vice President, Kay Properties and Investments Any investor who is considering selling a piece of investment real estate will undoubtedly consider a 1031 Exchange. A 1031 Exchange refers to the IRS code that allows significant tax advantages for investors. How? When you sell an investment property and you have a profit, you normally are required to pay capital gains tax. A 1031 Exchange allows you to sell your investment real estate … Read More

Seven DST 1031 Exchange Terms Every Real Estate Investor Should Know

Kay Takeaways: Knowing key terms for a 1031 Exchange is important for investors What is the definition of “beneficial interest” and how does it relate to DST’s? What is a Tenant In Common Investment? Do you know what a Qualified Intermediary is? Becoming a serious 1031 Exchange real estate investor can involve a significant learning curve. For example, there are many investment terms that every investor shouldknow and understand in order to better understand the … Read More

How Kay Properties Helped Three Different Sized Investors Match Their Specific Investment Goals, Objectives, and Risk Tolerances

By: Kay Properties & Investments Key Takeaways: Most Delaware Statutory Trust investors are looking for a specific solution to their particular investment situation. Three examples of how Kay Properties helped three different-sized investors with their DST investments. Not all investors entering Delaware Statutory Trust investments have the same investment objectives. Whether a large or small investor, Kay Properties puts a tremendous emphasis on client education and an emphasis on each investor’s specific situation and education … Read More

DST Essentials Podcast: Building a Crisis Resistant Real Estate Investment Portfolio

Listen to the DST Essentials with Kay Properties along with Betty Friant, Executive Vice President & Managing Director and Matthew McFarland, Senior Vice President for a podcast diving into a few tips on building a crisis resistant real estate investment portfolio. We will be discussing: The Importance of Diversification Asset Class Rejection Various Real Estate Access Points The Significance of Avoiding Leverage if Possible Transcriptions Victor Coronado: Hi everyone, this is Victor Coronado, senior Associate here … Read More

Kay Properties Headlines Panel on Delaware Statutory Trusts and Why So Many Investors are Interested in Them

Kay Properties & Investments team of Delaware Statutory Trust 1031 Exchange experts Chay Lapin, President, Betty Friant CCIM Senior Vice President, and Jason Salmon, Senior Vice President and Managing Director of Real Estate Analytics assembled to discuss why more and more real estate investors are selling their investment properties and turning to DST 1031 Exchange investments. The presentation was part of “Wealth Management Real Estate’s Guide to Investing in CRE: Second Quarter Review” targeting high … Read More

10 Reasons We Like FedEx as a Tenant for DST 1031 Exchange Investments in 2022

By Dwight Kay, Founder & CEO of Kay Properties & Investments Kay Properties & Investments is a fully integrated real estate investment firm that is an expert at sourcing deals, closing acquisitions, and performing necessary due diligence/analysis on Delaware Statutory Trust properties for 1031 exchanges and direct-cash investments. While no one has a crystal ball and can predict the performance of any real estate asset, we are encouraged by one corporation that leases thousands of … Read More

DST CASE STUDY: How Kay Properties Helps Investor Complete 15 DSTs in 30 Days

Key Takeaways: Kay Properties registered representatives spent more than one year educating the client on DST investments. Kay Properties worked closely with client’s CPA and real estate attorneys to create a custom investment strategy that fit perfectly with the client’s specific goals. Kay Properties created a workflow plan that achieved the closing of 15 DST investments in 30 days without a hitch. Background: A high-net worth accredited investor spent more than 40 years building a … Read More

How Delaware Statutory Trust Investments Can Play an Important Part of Wealth Preservation

By Jason Salmon, Senior Vice President and Managing Director of Real Estate Analytics, Kay Properties & Investments Key Takeaways: Delaware Statutory Trust Investments Help Investors Defer Capital Gains Taxes Real Estate Investments Are Popular for Building Generational Family Wealth Delaware Statutory Trusts Offer the Potential for Step-Up in Basis Tax Benefits Delaware Statutory Trusts Offer Investors the Ability to Enjoy More Free Time Many people believe that the best thing about a Delaware Statutory Trust … Read More

The Importance of the Private Placement Memorandum (PPM) for Delaware Statutory Trust 1031 Exchange Investors

Key Takeaways: PPMs are part of all Delaware Statutory Trust Investments PPMs provide investors a full picture of the overall investment, including the potential risks PPMs include important information for investors including the DST trust agreement, summary of third-party reports, lease agreements, and most recent property appraisal. All Kay Properties Delaware Statutory Trust 1031 Exchange real estate investments must be accompanied by a unique Private Placement Memorandum (PPM) as part of its due diligence and … Read More

Consider These Potential DST 1031 Exit Strategy Options: Cash Out, 1031 Exchange or 721 Exchange

By Dwight Kay, Founder and CEO of Kay Properties and Investments One of the most important questions all real estate investors should ask themselves is, “What is my long-term strategy?” In the case of Delaware Statutory Trust (DST) investors, exit strategies come into play once the investment period has concluded, or gone “Full Cycle”. Full Cycle is a term used to describe DST property that has been sold on behalf of investors after a period … Read More

Kay Properties & Investments Team of 1031 Exchange Experts Lead Bisnow Webinar on “Why Investors Choose DST Properties”

Presentation covers the top three reasons investment owners are selling their rental properties and looking for alternative investment strategies like Delaware Statutory Trust 1031 Exchanges Recently, Kay Properties & Investments 1031 Exchange experts Chay Lapin, President, and Orrin Barrow and Matt McFarland, Vice Presidents, recently participated in a Bisnow webinar where they discussed some of the most common reasons investment property owners are selling their investment real estate, and why Delaware Statutory Trust 1031 Exchanges … Read More