Delaware Statutory Trust 1031 Current Offering Net Lease Distribution 55 DST

Recently, Dwight Kay, founder and CEO of Kay Properties, sat down to discuss in detail some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace at www.kpi1031.com for accredited investors for their 1031 exchange or direct cash investments. These DST 1031 properties are just a handful of current offerings from approximately 20-40 different DST offerings available from roughly 25 DST sponsor companies. One of these current offerings is Net Lease Distribution 55 Delaware Statutory Trust in Gunnison, CO.

Key Takeaways from this article:

- What is an essential business, and why are they a potentially good investment for Delaware Statutory Trusts?

- Learn more about why the recent pandemic helped identify stable tenants for net lease DST assets.

- Why Kay Properties likes FedEx Ground as a tenant.

- What makes the Net Lease Distribution 55 a potentially good asset for a Delaware Statutory Trust.

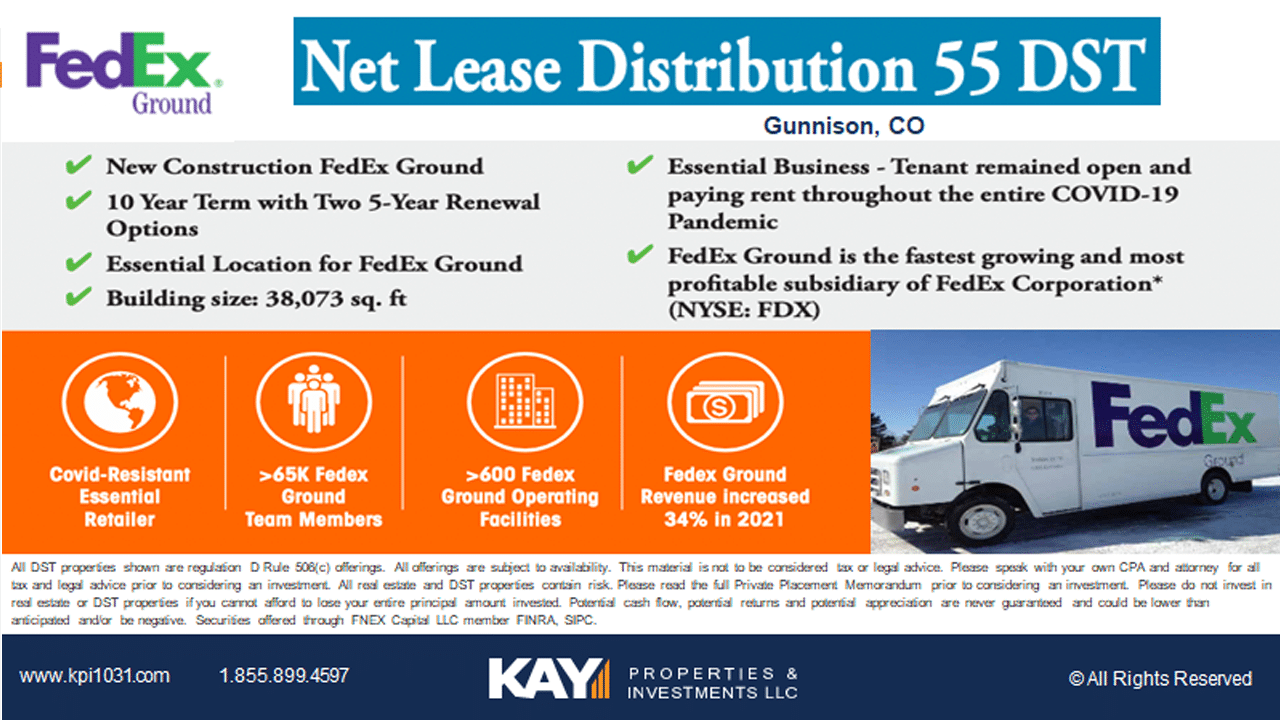

Net Lease Distribution 55 Delaware Statutory Trust Offering Investment Highlights

Brand New Construction:

This net-lease industrial DST 1031 exchange property is another interesting DST real estate asset for 1031 exchange and direct cash investors. For example, Net Lease Distribution 55 Delaware Statutory Trust is a brand new 38,000-square-foot industrial distribution warehouse DST. The building sits on approximately 7.5 acres and is constructed with steel, wood, metal, concrete, and stone to create a functional and attractive asset.

100% Occupied with 10-Year Long-Term Net Lease in Place

The Net Lease Distribution 55 Delaware Statutory Trust offering is also 100% occupied by FedEx Ground with a long-term 10-year net lease in place with two five-year renewal options.

Strength of Tenant:

This unique distribution facility is 100% occupied by FedEx Ground, the fastest-growing and most profitable subsidiary of FedEx Corporation. One of the strengths of FedEx Ground is that it is considered an essential business, and as such, this tenant remained open and paid rent throughout the entire COVID-19 pandemic. While past performance does not guarantee future results, this is an important aspect that Kay Properties considers when evaluating Delaware Statutory Trust properties. Specifically:

- How did the tenant do during COVID?

- Did they shut down?

- Were they forced to be shut down?

- Did they pay their rent?

- Did they ask for rent reduction or rent relief?

- How well did they do throughout COVID-19?

Why Kay Properties Likes FedEx as a Delaware Statutory Trust Tenant

Kay Properties has approximately 20 of these types of FedEx facilities across the country. Whether it’s FedEx Ground, FedEx Freight or other FedEx distribution assets, investors received their pro-rata portion of the rent each and every month because of the size of the tenant and because they were deemed essential logistics tenants. FedEx Ground has 65,000 team members working in more than 600 FedEx Ground operating facilities across the country. Revenue for FedEx Ground - another important thing to look at - increased by 34% in 2021.

Another interesting point to note here is that Delaware Statutory Trust 1031 exchange investors are not investing in the stock of FedEx. If the share price of the stock goes up by 20% or goes down by 20%, DST investors are not the owner of the stock. They are the landlord of the DST property and FedEx Ground is the tenant paying monthly rent to the landlord.

Read more about why Kay Properties likes FedEx as a tenant for Delaware Statutory Trust properties.

Debt-Free Delaware Statutory Trust Offering

Like many of the DST 1031 offerings on https://www.kpi1031.com/marketplace/, the Net Lease Distribution 55 Delaware Statutory Trust in Gunnison, CO is a 100% debt-free DST offering. This is important for many reasons, not the lease of which includes that debt-free Delaware Statutory Trust 1031 properties typically have a much lower risk profile than those with leverage. The reason for this is that debt-free DSTs have zero risk of lender foreclosure, protecting investors from a complete loss of principal invested. Also, debt-free DSTs provide protection from a balloon payment associated with loan maturity, which many real estate firms are very concerned about in today’s market.

Location:

Gunnison, CO is a growing region within the State of Colorado. The Gunnison area is nestled in the Elk Mountains Range of the Rocky Mountains in west-central Colorado, making the region a remarkable location for outdoor sports enthusiasts and tourists. In addition, Gunnison is also the primary transportation gateway to Crested Butte via car or jet.

Gunnison, CO at a Glance:

- Transportation gateway to Crested Butte

- Home of Western Colorado University

- County seat and population center

- United Airlines provides daily flights to

- Gunnison-Crested Butte Regional Airport (GUC)

- Double the annual population growth rate of the U.S.

- Average Household Incomes between $68,044 to

- $122,851, with an average of $79,786

Net Lease Distribution 55 Delaware Statutory Trust is an Industrial Real Estate Offering

Another attractive component of the Net Lease Distribution 55 Delaware Statutory Trust offering in Gunnison, CO is that it is considered an industrial real estate asset.

While it must be noted that past performance does not guarantee future results, Kay Properties feels industrial real estate has several factors that make it a potentially attractive investment option for Delaware Statutory Trust investors.

- Rising Rental Rates

- Low Vacancy Rates

- Benefits from Growing E-Commerce Industry

- Many Essential Businesses Need Industrial Real Estate

Learn more about our Delaware Statutory Trust current offerings from Kay Properties by registering for FREE access to the Kay Properties Marketplace of Delaware Statutory Trust listings, or access more Delaware Statutory Trust resources here.

To view 1031 Delaware Statutory Trust offerings available only to accredited investors, please contact Kay Properties at 855.899.4597 or visit www.kpi1031.com.

*Diversification does not guarantee profits or protect against losses.