“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments More than 150 accredited investors from across the United States showed up for the Kay Investor Day investment conference, hosted by Kay Properties & Investments, a leading national real estate investment firm specializing in Delaware Statutory Trust (DST), 1031 exchange and 721 UPREIT offerings. Hosted in Torrance, CA, the Kay Properties … Read More

Hypothetical Case Study: Tired of Encroaching Rent Control Regulations, Investor Turns to Kay Properties & Investments to Help Build a Diversified DST 1031 Exchange Strategy

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments *Diversification does not guarantee profits or protect against lossesClick to see detailed case study portfolioOverview: Meet Tom, a Seasoned Real Estate Investor Who’s Tired of Active Management and the Headaches of Increasing Rent Control Regulations Tom quickly recognized he needed to complete a 1031 exchange to help defer taxes and find … Read More

721 Exchange UPREITs and Delaware Statutory Trust Offerings – Essential Items to Consider before Investing

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments By Dwight Kay, Founder & CEO Kay Properties & InvestmentsOver the years, the use of the 721 Exchange as a Delaware Statutory Trust exit strategy has become increasingly popular among investors for a number of reasons, including the ability to provide tax deferral benefits, the potential for portfolio diversification, the potential … Read More

Why Politics, Demographics, Pandemics, and Economics Are Forces That will Likely Ensure 1031 Exchanges and Delaware Statutory Trusts are Here to Stay

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments It doesn’t seem that long ago when the winds surrounding the commercial real estate industry were rustling with whispers of Joe Biden’s plans of repealing the current 1031 exchange laws and quashing alternative like-kind exchange vehicles such as Delaware Statutory Trusts. However, with Donald Trump’s successful re-election bid, policies like the … Read More

Kay Properties Adds Dynamic “The Peanut Factory Lofts” – a High-Quality Multifamily Acquisition to Its Nationally Recognized Online Marketplace

(Los Angeles, CA) Kay Properties & Investments, a national leader in Delaware Statutory Trust equity placements and 1031 exchange investor education, announced it has included The Peanut Factory Lofts, a dynamic multifamily asset in historic downtown San Antonio, TX to its nationally recognized online marketplace located at www.kpi1031.com. According to Dwight Kay, CEO and Founder of Kay Properties, this unique asset was an all-cash acquisition and is considered a high-quality Delaware Statutory Trust for 1031 … Read More

Why the Glory Days of Independent Real Estate Investing Is a Thing of the Past, and What Some Smart Investors Are Doing About it

By Dwight Kay and the Kay Properties TeamIndependent real estate investors seem to be taking it from all sides these days. Not only are interest rates, property taxes, and construction costs up significantly from just a few years ago, but also more and more legislation continues to be introduced, making the management of real estate (especially single family rentals and apartment buildings) more difficult, expensive, and heavily regulated. In addition to these growing restrictive rental … Read More

(Exclusive Aerial Video) A Closer Look at the Pharmacy Net Lease 65 DST in Downtown Encinitas, CA

By Dwight Kay, Founder and CEO of Kay Properties & Investments One of current Delaware Statutory Trust offerings available for 1031 exchange as well as direct cash investment, is the Pharmacy Net Lease 65 DST, a Regulation D Rule 506 (c) offering in downtown Encinitas, CA. 100% Debt-Free Acquisition The Pharmacy Net Lease 65 was purchased as an all-cash, 100% debt-free acquisition as a purposeful strategy to mitigate risk associated with potential lender foreclosure or … Read More

What are the Best Properties for a 1031 Exchange?

Let’s say you are about to sell your investment property, and your CPA tells you that there is a large tax bill lurking around the corner. In order to avoid paying capital gains and depreciation recapture tax, your CPA advises you to consider exchanging into another property via a 1031 exchange. But what exactly are the best properties for a 1031 exchange and what are some risks associated with some of these 1031 exchange investment … Read More

Mastering DST Properties with Dwight Kay

Kay Properties and Investments Book on Delaware Statutory Trust Properties Remains One of the Best Resources for 1031 Exchange Readers Interested in How DSTs Work Article Highlights: Why did Dwight Kay write a book on Delaware Statutory Trusts? The book talks about Delaware Statutory Trust pros and cons. More than 30,000 copies have been distributed to DST 1031 exchange investors. The book was written in a straight-forward, easy-to-read style. When Dwight Kay, founder and CEO … Read More

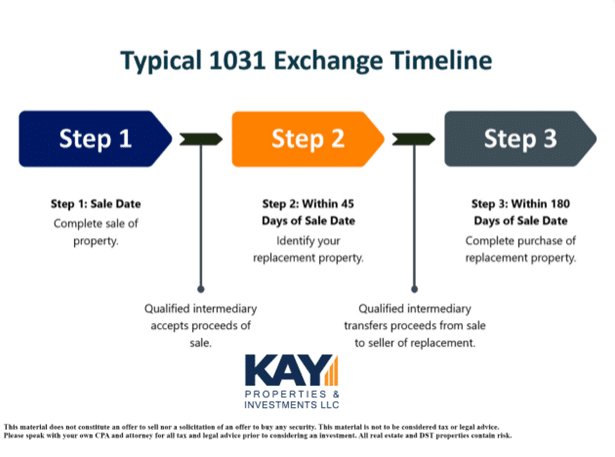

How to Make Smart Real Estate Investment Decisions with a 1031 Exchange

By Dwight Kay, Founder and CEO, Kay Properties and Investments If you are a real estate investor, the 1031 Exchange is potentially one of the most powerful wealth-building strategies you have at your disposal. Sometimes called a tax-deferred exchange or like-kind exchange, the 1031 Exchange is a provision outlined in the Internal Revenue Code (Section 1031), which outlines how real estate investors can defer capital gains taxes on the sale of investment properties by reinvesting … Read More

A 1031 Exchange Expert’s Advice on Investing in DSTs

By Orrin Barrow, Senior Vice President, Kay Properties and InvestmentsIn the world of Delaware Statutory Trust investments, the position of Senior Vice President plays an important link between the client, the investment real estate asset, and the sponsor company who is presenting potential offerings. Over the course of the past several years as a Senior Vice President with Kay Properties and Investments, I have worked with hundreds of clients on their 1031 Exchanges and Delaware … Read More

An Easy Guide to Delaware Statutory Trust Investing

Investors interested in Delaware Statutory Trust properties could benefit from a guide that clearly explains Delaware Statutory Trust properties for a 1031 exchange and provides valuable information on topics like: Key Highlights: What is a Delaware Statutory Trust? What is the history surrounding the Delaware Statutory Trust? What are the important dates that impacted the Delaware Statutory Trust? What are some of the benefits of the Delaware Statutory Trust? What are some of the risks … Read More

Delaware Statutory Trusts: Triple Net Lease Properties

Join a couple of our Kay Properties Delaware Statutory Trust experts Betty Friant, Executive Vice President and Matt McFarland, Senior Vice President as they unpack the nuances of triple net lease properties. Triple net real estate investment properties are a popular choice for 1031 exchanges. Kay Properties Executive Vice President and Managing Director Betty Friant and Senior Vice President Matt McFarland take a closer look at NNN properties, and how they fit into the Delaware … Read More

Delaware Statutory Trust Real Estate: Latest Offerings

Recently, Kay Properties founder and CEO, Dwight Kay, sat down to discuss some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace for accredited investors for their 1031 exchange or direct cash investments. These properties are just a handful of current offerings from approximately 20-40 different DST offerings available from roughly 25 DST sponsor companies. These current Delaware Statutory Trust offerings range from single-tenant net … Read More

Delaware Statutory Trusts for Accredited Investors

By Dwight Kay, Founder and CEO, Kay Properties and Investments Key Takeaways: What is the definition of an Accredited Investor? Why does the Securities and Exchange Commission require some investors to be accredited? Do Delaware Statutory Trusts require Investors to be accredited? What is the history of investor accreditation? The combination of aging demographics, stock market volatility, and a desire to find an investment strategy that delivers passive income are all contributing to the growing … Read More

DST Properties and 1031 Exchange Real Estate Investment Options

Recently, Kay Properties founder and CEO, Dwight Kay, sat down to discuss some of the DST real estate properties his firm recently had available for accredited investors. These properties are now fully subscribed, however they represent good examples of DST properties that are available on the kpi1031.com marketplace, and examples for 1031 exchange real estate options. The interview was recorded and transcribed so investors can have easy access and use it as a reference for … Read More

Delaware Statutory Trust Investor Reviews and Complaints

Interested in learning more about Delaware Statutory Trust 1031 investments? Make sure to do a thorough job of researching Delaware Statutory Trusts prior to investing in a DST real estate offering, including reviewing client reviews and testimonials, reading published materials, and understanding potential complaints investors may have with Delaware Statutory Trust investments. Please note that testimonials may not be representative of the experience of other clients. Past performance does not guarantee or indicate the likelihood … Read More

How Delaware Statutory Trust Investments Can Play an Important Part of Wealth Preservation

By Jason Salmon, Senior Vice President and Managing Director of Real Estate Analytics, Kay Properties & Investments Key Takeaways: Delaware Statutory Trust Investments Help Investors Defer Capital Gains Taxes Real Estate Investments Are Popular for Building Generational Family Wealth Delaware Statutory Trusts Offer the Potential for Step-Up in Basis Tax Benefits Delaware Statutory Trusts Offer Investors the Ability to Enjoy More Free Time Many people believe that the best thing about a Delaware Statutory Trust … Read More

Kay Properties Helps Place over $130M in Delaware Statutory Trust 1031 Exchange Investments For Family-Owned Real Estate Firm

Kay Properties is pleased to announce the completion of a three-phased 1031 exchange project resulting in an investment into over $130M of Delaware Statutory Trust (DST) properties. Over the course of multiple months, Kay Properties President, Chay Lapin, and Vice President, Steve Haskell, helped a family-owned real estate firm navigate three complex 1031 exchanges into a highly diversified* portfolio of DST properties. In the summer of 2020, the family-owned real estate firm began liquidating their … Read More

Kay Properties and Investments Successfully Completes a $13.68M Exchange on Behalf of Midwest Family

By Matt McFarland, Vice President, and Thomas Wall, Associate, Kay Properties & Investments Kay Properties announces the completion of a 1031 DST exchange for a family that has owned and operated various businesses and real estate for many years. The group was excited to move away from active, hands-on management into a more passive, diversified* investment vehicle while taking advantage of the tax deferral offered through the 1031 exchange. They utilized the Kay Properties 1031 … Read More

Using 1031 Exchange Delaware Statutory Trust Properties to Give Back – How a Kay Properties Client Gave Back

Please view press release here. Real Estate investors come in all types and many want to invest in a way that aligns with their values. Alex Madden, Vice President with Kay Properties and Investments explained: “When one of our Clients reached out and explained she wanted to invest in 1031 exchange Real Estate which offered a potential ‘Social Good’ Kay Properties and Investments leapt at the opportunity to help. We helped evaluate properties that provided … Read More

Proceed with Caution – Hotel 1031 DST Offerings

By Dwight Kay and The Kay Properties & Investments Team Investing into real estate always comes with risk. Vacancies, downward pressure on rents due to new developments coming online, the economy, loans maturing, and wider market forces often impacts how an asset performs over time. Integral to the investment’s potential success is the ability for the investor to weigh the risks and to decide if the risk is worth the potential return. Certain asset classes … Read More

The Risks in Purchasing a Triple Net Lease Property and a Potential Solution

Purchasing a Triple Net Lease Property (NNN) provides many benefits to investors. They’re usually single tenant retail, medical or industrial properties where the tenant is responsible for the majority of if not all of the expenses including insurance and maintenance costs. They also provide a potentially steady cash flow to the investor as leases are often 10-15 years in length with multiple renewal options. For this reason, many potential investors look for single tenant NNN properties for sale with the goal of securing a steady cash flow. However, just like any investment, there are risks involved in triple net properties (NNN), which we examine below:

Kay Properties Process in Spanish

EL PROCESO DE KAY PROPERTIES Planificación y dirección en cambio de DST 1031 Consulta de presentación La llamada de presentación iniciará un diálogo para que nosotros comprendamos su situación: sus preferencias, necesidades y requerimientos para su próximo cambio de 1031. Desarrollo de recomendaciones preliminares Empezaremos a transformar sus palabras en un plan estratégico 1031 teniendo en cuenta las metas y objetivos del cliente obtenidos en la consulta inicial. Empezaremos a recomendar algunas inversiones. Lo cual … Read More

The Kay Properties Process

1031 Exchange DST Planning and Guidance Introductory Consultation The introductory call will begin a dialogue for us to understand your situation – your preference, needs, and requirements for your upcoming 1031 exchange. Develop Preliminary Recommendations Using the client goals and objectives from our initial consultation, we will begin to transform your words into a strategic 1031 plan. We will provide some initial recommendations for investments. Which will be a starting point to change as needed. … Read More

Qualified Opportunity Zone Funds – A Tax Efficient Investment Vehicle for Those Selling Appreciated Assets

By: Kay Properties & Investments What is a Qualified Opportunity Zone (QOZ)? A QOZs as described under the 2017 Tax Cuts and Jobs Act is a social program with the intent of redeveloping impoverished districts throughout the country by driving private capital to over 8,700 underserved communities and 35M Americans throughout by offering tax incentives to investors¹. What is a Qualified Opportunity Zone Fund (QOF)? A QOF is a legal entity (partnership or corporation) used … Read More

Questions to Ask When Investing in DSTs

By: Kay Properties and Investments, LLC Investors often approach Kay Properties and Investments to expand their investment research into Delaware Statutory Trusts (DSTs) after speaking with a friend, registered rep, or advisor about the opportunity. Unfortunately, we continue to discover that whoever is advising the client has been providing incorrect or incomplete information. DSTs are sophisticated investment vehicles that require a niche expertise. We have developed a series of questions for investors to ask their … Read More

Do you own investment real estate? Have you recently assessed its value and considered selling the property? If so, we have important news for you….

By Dwight Kay and the Kay Properties Team A 1031 exchange is considered by many to be the most effective tax deferral tool available. Under IRS code section 1031, investment real estate owners are able to defer the capital gain tax on the sale of appreciated investment property if they reinvest in “like-kind” property. Real estate held for business or investment purposes can qualify as “like-kind” property. This includes single-family rentals, apartment complexes, office buildings, … Read More

The Case for Class B Apartments. Class A Buyers Beware.

Overall, the Class B segment of the multifamily apartment market has outperformed the Class A segment in the past several years; and that trend is forecast to continue. While new supply is greatly affecting the Class A apartment market with rent concessions, it is not having a material effect on the class B sector where we are focused. Although we do like Class A apartments at the right price point and in certain unique circumstances … Read More

Investments for High Net Worth Accredited Real Estate Investors

High-net-worth, accredited investors may be looking for an investment that is an alternative to traditional investments such as stocks, bonds, mutual funds, etc. High net worth real estate investors may be looking for an investment that is an alternative to traditional investments such as stocks, bonds, mutual funds, etc. Such investors may want to consider investing in one of Kay Properties and Investments, LLC real estate offerings. These investment offerings are designed to potentially provide … Read More

Kay Properties 2016 Economic Update With Dr. Peter Linneman

Kay Properties and Investments, LLC hosts 2016 Economic Update conference call with Dr. Peter Linneman from the Wharton School of Business at the University of Pennsylvania. Clients were able to learn from one of the most renowned real estate economists of our time as Dr. Linneman covered topics such as: What to potentially expect in 2016 as an investment real estate owner. The differences of Main Street verses Wall Street. What real estate asset classes … Read More