“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments More than 150 accredited investors from across the United States showed up for the Kay Investor Day investment conference, hosted by Kay Properties & Investments, a leading national real estate investment firm specializing in Delaware Statutory Trust (DST), 1031 exchange and 721 UPREIT offerings. Hosted in Torrance, CA, the Kay Properties … Read More

721 Exchange UPREIT Insight Series The 721 Exchange Option – Not the Obligation

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments By Dwight Kay, Founder & CEO Kay Properties & InvestmentsIn today’s complex real estate market, understanding the nuances of 721 UPREIT DST structures is essential for any investor. One of the critical features of these arrangements is that the REIT holds the option—but not the obligation—to purchase the DST’s property through … Read More

Due Diligence 101 on 721 Exchange UPREIT DST Investments

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments By Dwight Kay, Founder & CEO Kay Properties & InvestmentsIn recent years, non-traded and perpetual life REITs have emerged as attractive vehicles for real estate investors, especially within the 721 UPREIT DST structure. While these vehicles offer tax-deferred exchange benefits and diversified exposure to real estate, investors must scrutinize several key … Read More

Breweries, HVAC Contractors, E-Commerce Businesses, Pet Daycare, 3D Printing and More: Why the Small Bay Industrial Asset Class is Poised for Potential Growth and a Compelling Delaware Statutory Trust Property Type for 1031 Exchange Investors

By Dwight Kay, Founder and CEO, Kay Properties & Investments. When most people think of industrial real estate as an asset class for Delaware Statutory Trust 1031 exchange investments, they probably conjure up images of a 200,000 square foot, single tenant, large-scale bulk distribution warehouse designed for a major logistics operator. However, an often-overlooked sector in the industrial real estate asset class for DST investors are small bay industrial buildings—compact, often infill located, versatile flexible … Read More

721 Exchange UPREITs and Delaware Statutory Trust Offerings – Essential Items to Consider before Investing

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments By Dwight Kay, Founder & CEO Kay Properties & InvestmentsOver the years, the use of the 721 Exchange as a Delaware Statutory Trust exit strategy has become increasingly popular among investors for a number of reasons, including the ability to provide tax deferral benefits, the potential for portfolio diversification, the potential … Read More

Why Politics, Demographics, Pandemics, and Economics Are Forces That will Likely Ensure 1031 Exchanges and Delaware Statutory Trusts are Here to Stay

“Currently, the appeal for 1031 exchange strategies such as DSTs has never been stronger,” said Dwight Kay, Founder and CEO, Kay Properties and Investments It doesn’t seem that long ago when the winds surrounding the commercial real estate industry were rustling with whispers of Joe Biden’s plans of repealing the current 1031 exchange laws and quashing alternative like-kind exchange vehicles such as Delaware Statutory Trusts. However, with Donald Trump’s successful re-election bid, policies like the … Read More

Dwight Kay Provides Real Examples of Investors Who Used Kay Properties for Legacy and Estate Planning Purposes Regarding their Rental Property and Real Estate Investment Portfolios

By Dwight Kay, Founder & CEO Kay Properties & InvestmentsMore and more, our team of 1031 exchange DST experts at Kay Properties & Investments is being asked about legacy and estate planning. Every day we hear questions like: How are my children going to inherit my properties? What will the tax consequences be? How do we handle the potential for in-fighting or competing priorities amongst our heirs or kids? Preserving wealth across multiple generations requires … Read More

Why the Glory Days of Independent Real Estate Investing Is a Thing of the Past, and What Some Smart Investors Are Doing About it

By Dwight Kay and the Kay Properties TeamIndependent real estate investors seem to be taking it from all sides these days. Not only are interest rates, property taxes, and construction costs up significantly from just a few years ago, but also more and more legislation continues to be introduced, making the management of real estate (especially single family rentals and apartment buildings) more difficult, expensive, and heavily regulated. In addition to these growing restrictive rental … Read More

(Exclusive Aerial Video) A Closer Look at the Pharmacy Net Lease 65 DST in Downtown Encinitas, CA

By Dwight Kay, Founder and CEO of Kay Properties & Investments One of current Delaware Statutory Trust offerings available for 1031 exchange as well as direct cash investment, is the Pharmacy Net Lease 65 DST, a Regulation D Rule 506 (c) offering in downtown Encinitas, CA. 100% Debt-Free Acquisition The Pharmacy Net Lease 65 was purchased as an all-cash, 100% debt-free acquisition as a purposeful strategy to mitigate risk associated with potential lender foreclosure or … Read More

Why Kay Properties Stands Out as an Expert Delaware Statutory Trust Firm

The Delaware Statutory Trust (DST) investment strategy has become one of the most popular choices for accredited investors seeking replacement properties for their 1031 exchanges. Kay Properties is often considered the preferred choice for1031 exchange DST investors in this space who want an expert Delaware Statutory Trust firm. investment strategy has become one of the most popular choices for accredited investors seeking replacement properties for their 1031 exchanges. Kay Properties is often considered the preferred … Read More

Why Investors Choose Delaware Statutory Trust Properties vs. NNN Properties for 1031 Exchanges

By Dwight Kay, Founder and CEO of Kay Properties and Investments Over the years, I have seen many clients that started to purchase a NNN property for a 1031 exchange ultimately decide to invest in a Delaware Statutory Trust 1031 property instead. In many cases these clients are drawn to NNN properties because they think that is the only choice to achieve passive ownership of real estate but are concerned about placing such a large … Read More

4 Reasons Why Investors Should Consider Qualified Opportunity Zone Funds for Tax Advantages and Potential Returns

By Dwight Kay, Founder and CEO, Kay Properties and InvestmentsQualified Opportunity Zone Funds (QOZF) have become an integral part of the investment landscape in recent years for those investors seeking to defer capital gains taxes on the sale of appreciated assets. At Kay Properties, our team has helped many accredited investors nationwide understand and participate in Qualified Opportunity Zone Fund investments. What is a Qualified Opportunity Zone? Qualified Opportunity Zone Funds were implemented by the … Read More

A Comprehensive Guide and Video on Why Investors Should Consider Debt-Free Delaware Statutory Trust (DST) Properties

Learn eight specific and compelling issues 1031 exchange and Delaware Statutory Trust investors might not be aware of when it comes to risks associated with leverage. By Dwight Kay, Founder and CEO, Kay Properties and InvestmentsIn the world of 1031 exchanges and Delaware Statutory Trust investments, mitigating risks where possible is paramount. One strategy that has gained traction among savvy investors is the all-cash or debt-free Delaware Statutory Trust (DST). As the founder of Kay … Read More

Mastering DST Properties with Dwight Kay

Kay Properties and Investments Book on Delaware Statutory Trust Properties Remains One of the Best Resources for 1031 Exchange Readers Interested in How DSTs Work Article Highlights: Why did Dwight Kay write a book on Delaware Statutory Trusts? The book talks about Delaware Statutory Trust pros and cons. More than 30,000 copies have been distributed to DST 1031 exchange investors. The book was written in a straight-forward, easy-to-read style. When Dwight Kay, founder and CEO … Read More

What are Pros and Cons of the Delaware Statutory Trust for Investors?

Cracking the Code: Understanding the Pros and Cons of Delaware Statutory Trusts for 1031 Exchange Real Estate Investors By Dwight Kay, Founder and CEO, Kay Properties and InvestmentsIn the realm of real estate investing, the 1031 exchange Delaware Statutory Trust can provide savvy real estate investors a unique opportunity to achieve passive management, the potential for regular monthly distributions, and a way to enter one of the most tax efficient real estate investment strategies available … Read More

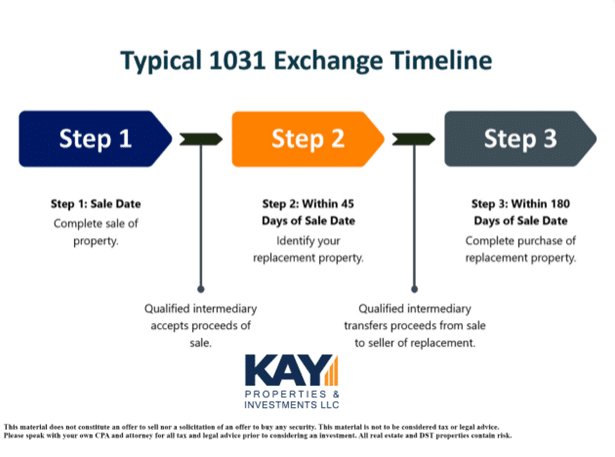

How to Make Smart Real Estate Investment Decisions with a 1031 Exchange

By Dwight Kay, Founder and CEO, Kay Properties and Investments If you are a real estate investor, the 1031 Exchange is potentially one of the most powerful wealth-building strategies you have at your disposal. Sometimes called a tax-deferred exchange or like-kind exchange, the 1031 Exchange is a provision outlined in the Internal Revenue Code (Section 1031), which outlines how real estate investors can defer capital gains taxes on the sale of investment properties by reinvesting … Read More

Debt Free Net Lease 55 DST

Delaware Statutory Trust 1031 Current Offering Net Lease Distribution 55 DST Recently, Dwight Kay, founder and CEO of Kay Properties, sat down to discuss in detail some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace at www.kpi1031.com for accredited investors for their 1031 exchange or direct cash investments. These DST 1031 properties are just a handful of current offerings from approximately 20-40 different DST … Read More

Key Investment Highlights of Net Lease Distribution 64 DST Offering

Recently, Dwight Kay, founder and CEO of Kay Properties, sat down to discuss in detail some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace at www.kpi1031.com for accredited investors for their 1031 exchange or direct cash investments. These DST 1031 properties are just a handful of current offerings from approximately 20-40 different DST offerings available from roughly 25 DST sponsor companies. One of these … Read More

Delaware Statutory Trust Real Estate: Latest Offerings

Recently, Kay Properties founder and CEO, Dwight Kay, sat down to discuss some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace for accredited investors for their 1031 exchange or direct cash investments. These properties are just a handful of current offerings from approximately 20-40 different DST offerings available from roughly 25 DST sponsor companies. These current Delaware Statutory Trust offerings range from single-tenant net … Read More

Delaware Statutory Trusts FAQ: Frequently Asked Questions on DSTs

By Dwight Kay, Founder and CEO, Kay Properties and Investments Forward: As one of the nation’s leading expert real estate investment firms specializing in Delaware Statutory Trust investments, Kay Properties is regularly asked about the nuances and strategies surrounding Delaware Statutory Trust investments for 1031 exchanges or direct cash investments. Recently, I sat down to discuss some of Frequently Asked Questions investors ask regarding Delaware Statutory Trusts and 1031 exchanges. I recorded and transcribed this … Read More

Delaware Statutory Trusts for Accredited Investors

By Dwight Kay, Founder and CEO, Kay Properties and Investments Key Takeaways: What is the definition of an Accredited Investor? Why does the Securities and Exchange Commission require some investors to be accredited? Do Delaware Statutory Trusts require Investors to be accredited? What is the history of investor accreditation? The combination of aging demographics, stock market volatility, and a desire to find an investment strategy that delivers passive income are all contributing to the growing … Read More

DST Properties and 1031 Exchange Real Estate Investment Options

Recently, Kay Properties founder and CEO, Dwight Kay, sat down to discuss some of the DST real estate properties his firm recently had available for accredited investors. These properties are now fully subscribed, however they represent good examples of DST properties that are available on the kpi1031.com marketplace, and examples for 1031 exchange real estate options. The interview was recorded and transcribed so investors can have easy access and use it as a reference for … Read More

Delaware Statutory Trust Investor Reviews and Complaints

Interested in learning more about Delaware Statutory Trust 1031 investments? Make sure to do a thorough job of researching Delaware Statutory Trusts prior to investing in a DST real estate offering, including reviewing client reviews and testimonials, reading published materials, and understanding potential complaints investors may have with Delaware Statutory Trust investments. Please note that testimonials may not be representative of the experience of other clients. Past performance does not guarantee or indicate the likelihood … Read More

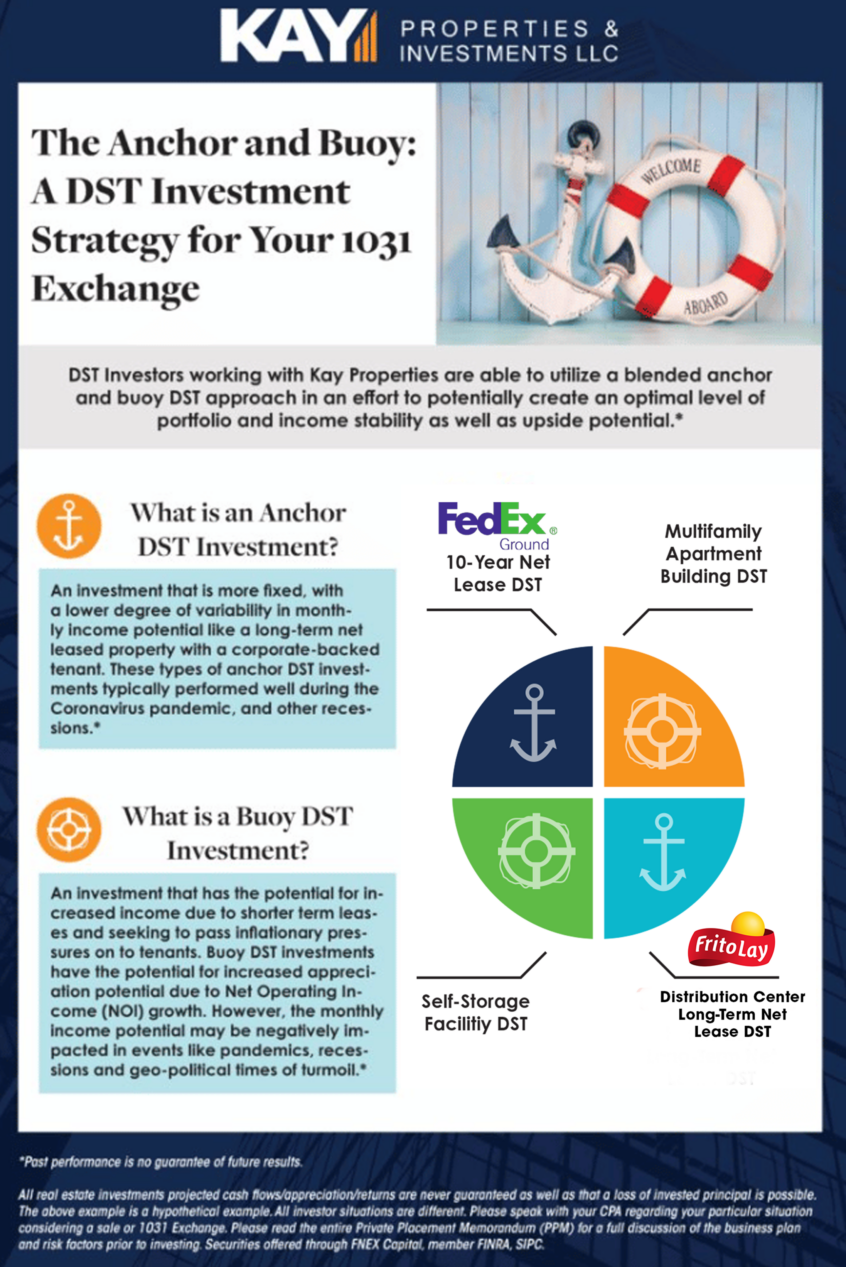

Why Delaware Statutory Trust Investors Should Practice “The Anchor and the Buoy Investment Strategy”

Real estate investors currently considering a Delaware Statutory Trust (DST) investment for a 1031 exchange or even a direct-cash investment, one of the first things to consider is what specific investment strategy should you pursue? For example, is the goal to achieve greater appreciation even if it means investing in an asset that carries greater risk? Or is your long-term strategy to have steady monthly income even if it means lower overall appreciation potential? I … Read More

10 Reasons We Like FedEx as a Tenant for DST 1031 Exchange Investments in 2022

By Dwight Kay, Founder & CEO of Kay Properties & Investments Kay Properties & Investments is a fully integrated real estate investment firm that is an expert at sourcing deals, closing acquisitions, and performing necessary due diligence/analysis on Delaware Statutory Trust properties for 1031 exchanges and direct-cash investments. While no one has a crystal ball and can predict the performance of any real estate asset, we are encouraged by one corporation that leases thousands of … Read More

Founder & CEO, Dwight Kay Featured on Forbes.com for Insight on Utilizing Delaware Statutory Trust (DST) Investments for Potential Passive Retirement Income

The founder & CEO of Kay Properties and Investments, Dwight Kay, was recently featured in an article on Forbes.com regarding the potential benefits and risks of DST 1031 investments. The media, 1031 exchange investors, CPAs, Attorneys, DST sponsor companies and other industry participants, often turn to Kay Properties for guidance regarding 1031 DST offerings, and Forbes.com is another example of this. Please enjoy the Forbes article here: Building A Passive Real Estate Portfolio For Retirement … Read More

As Seen on Kiplinger.com: Retirement Planning? Don’t Forget About Investment Real Estate

Investment properties have the potential to generate monthly income and appreciation as part of a diversified* portfolio. But you don’t have to be a hands-on landlord. You can make passive real estate investments and avoid the 3 a.m. calls about clogged toilets! by: Dwight Kay You’re planning ahead for retirement and determined to invest in a diversified basket of stocks, bonds, and alternative investments. Maybe you have no exposure to income properties now, or maybe … Read More

As Seen on Kiplinger.com: A Risk-Averse Approach to Real Estate Investing

You can invest in income property in a decidedly defensive way. Here are four conservative strategies to minimize risk while you pursue income and appreciation from investment real estate. By Dwight Kay, CEO & Founder, Kay Properties & Investments, LLC The highest profile professional real estate developers and investors are typically those who have won big or lost big — they made their names taking oversized risks that in some cases paid off handsomely and … Read More

How do I use a DST for replacing the debt in a 1031 Exchange

Fractional Ownership of DSTs Creates more Options What happens if I don’t replace the full sale price? By: Dwight Kay, CEO and Founder of Kay Properties and Investments and the Kay Properties team When doing your calculation on replacement value for a 1031 Exchange, don’t leave out an important part of the equation – replacement debt. One of the basic 1031 Exchange requirements necessary to qualify for a full tax deferral on capital gains taxes … Read More

As Seen on GlobeSt.com: Kay Properties Closes Record Deal Volume in 2020, Up 77%

View the article here. Kay Properties closed 2020 with a substantial increase in deal volume. Last year, the firm, which operates a 1031 exchange marketplace, completed $408 million in deals, a 77% increase from 2019 when deal volume totaled $230 million. While high net worth investors drove the activity, the firm also saw new investors from a wide range of disciplines. “New investors who have discovered our marketplace, more specifically highly sophisticated real estate developers, institutions, … Read More

How to guard against the pitfalls of financing used in DSTs

Investors going into a DST investment are often laser focused on the property they are buying. Where is their money going – perhaps it’s an apartment complex in Dallas or a portfolio of dollar stores in the Midwest? Investors often “kick the tires” so to speak looking at factors such as the location, occupancy, rental income and credit quality of the tenants. One question that often gets pushed lower on that checklist is what type … Read More

As Seen on WeathManagement.com: An Alternative to Dividend Stocks? Real Estate Investments with Monthly Income Potential

View the press release here. Dividend-paying stocks and interest-bearing bonds aren’t the only ways to generate potential investment income. Real estate has the potential to meet that objective as well. In fact, income generation is a key reason why many people diversify* their investment portfolios to include different types of real estate assets, be they commercial, net lease, self-storage, medical or multifamily. Many real estate investments are predictable and durable in their ability to generate … Read More

Do DSTs work for a 1033 exchange due to eminent domain or involuntary conversion?

By Dwight Kay, CEO of Kay Properties and Investments and the Kay Properties Team Understanding the rules of a 1033 Exchange aka Involuntary Conversion DSTs provide replacement options for a property sold under eminent domain. Property owners initiating a 1031 Exchange often end up in that situation by choice after deciding to sell an investment property or business. However, a 1033 Exchange is used when the government steps in to acquire a property by exercising … Read More

As Seen on Kiplinger.com: 4 Ways to Invest in Real Estate for Monthly Income

Owning your own home can be a good investment for a number of reasons, but it’s not the same as owning income properties, which have the potential to produce cash income on a regular monthly basis. Consider the range of potential ways to invest in real estate for income. Please view Kiplinger article here. By Dwight Kay, CEO & Founder, Kay Properties & Investments, LLC Earlier this year, the homeownership rate in the U.S. hit … Read More

Kay Properties Helps Family Complete $36 Million 1031 Exchange Amid COVID Pandemic

By: Kay Properties and Investments, LLC Kay Properties is proud to announce the successful completion of a family’s 36-million-dollar 1031 exchange diversified* into 15 Delaware Statutory Trusts. Chay Lapin commented, “At Kay Properties we have specialized in providing a far higher level of DST investing services than found at typical providers of DSTs. We specialize in DST investments thereby allowing us to provide full-service resources for our clients as they are going through their 1031 … Read More

Five Steps to Construct a Diverse Real Estate Investment Portfolio

Dwight Kay Founder of Kay Properties recently published in National Real Estate Investor Magazine. Here are some guidelines on maximizing returns and minimizing risks when building your commercial real estate portfolio. Please view the article on NREI here. Millions of Americans invest in alternative assets, including real estate. It’s an important step to diversify* a portfolio with investments that don’t necessarily correlate with the stock or bond markets. Here are five tips to help construct a … Read More

How to Identify a 1031 Exchange with the 200% Rule

By Dwight Kay, Founder & CEO; Betty Friant, Senior Vice President and The Kay Properties Team “Is that your final answer?” You may recognize the question made famous by the popular TV game show Who Wants to Be a Millionaire? Choosing the right answer in this game gives you a shot at winning big money, while the wrong answer leaves you with nothing. Investors conducting a 1031 Exchange face a similar make or break decision … Read More

How to Build a Diversified Real Estate Investment Portfolio

As Seen on Kiplinger Having a diversified* commercial and multifamily real estate portfolio is important to potentially reduce risk and create multiple opportunities for potential income and appreciation. Diversification is even more important in tumultuous times like these. Here’s a look at how to build a diverse real estate investment portfolio. Please view Kiplinger article here. By Dwight Kay, CEO & Founder, Kay Properties & Investments, LLC Recent survey research by National Real Estate Investor magazine indicates … Read More

1031 Exchange Coming Up? Know the Options Before You Reinvest

By Dwight Kay, Founder and CEO at Kay Properties & Investments, LLC Please view article here. If you have a 1031 exchange coming up, you have multiple choices to reinvest the proceeds from your sale. That’s a good thing, because coming out of your prior investment, maybe you’re tired of the three Ts — tenants, toilets and trash — and you’d rather leave the day-to-day property management to others. A 1031 exchange (also known as … Read More

As Seen on Kiplinger.com: Considering Real Estate? Know the ABCs of DSTs, TICs and 1031s

Having commercial and multifamily real estate in your investment portfolio provides diversification*, and can potentially generate income and help you build wealth. Before diving in, consider the range of ownership structures and the potential tax advantages of real estate investing. Please view Kiplinger article here. By Dwight Kay, CEO & Founder, Kay Properties & Investments, LLC Investment real estate is the largest asset class in the U.S. behind the equity and bond markets. Millions of … Read More

Before You Do a 1031 Exchange, Consider These 4 Alternative Investment Options

As Seen on Kiplinger 1031 exchange investors have multiple choices – not just direct ownership of an income property. By Dwight Kay, Founder and CEO, Kay Properties & Investments, LLC One of the most attractive real estate tax benefits available in the U.S. is the like-kind exchange, which is governed by Section 1031 of the Internal Revenue Code. About one-third of all commercial and multifamily property sales in the U.S. involve a like-kind exchange, … Read More

As Seen on Kiplinger.com: Before You Invest in ‘Crowdfunded’ Real Estate, Consider the Tax Implications

Many syndicated real estate investments miss out on a major tax benefit, but there are some ways to do your deal that avoid that issue. By Dwight Kay, CEO & Founder, Kay Properties & Investments, LLC The rise in online real estate investing in recent years has been remarkable. As the global consulting firm EY estimates, the online real estate investing market worldwide is expected to be $8.3 billion in 2020, with no sign of … Read More

Kay Properties Online Real Estate Marketplace Platform

By Dwight Kay, CEO and Founder, Kay Properties and Investments, LLC and Chay Lapin, Senior Vice President, Kay Properties and Investments, LLC At Kay Properties we have created an online real estate platform and marketplace at www.kpi1031.com that provides investors the opportunity to explore various 1031 exchange investment opportunities across the entire country and across multiple real estate asset classes. More importantly, we have created an extensive real estate and 1031 exchange educational platform. Over … Read More

Founder, Dwight Kay Featured on Forbes.com For Insight on the 1031 Exchange and DST Investment Industries

The founder of Kay Properties and Investments, Dwight Kay, was recently featured in an article on Forbes.com regarding the potential benefits and risks of DST 1031 investments. The media, 1031 exchange investors, CPAs, Attorneys, DST sponsor companies and other industry participants, often turn to Kay Properties for guidance regarding 1031 DST offerings and Forbes.com is another example of this. Please enjoy the Forbes article here: A Better Way To Co-Invest In Real Estate: DSTs And … Read More

Dwight Kay Featured in National Real Estate Investor

The founder of Kay Properties and Investments, Dwight Kay, was recently featured in an article in National Real Estate Investor (NREI) which is a national publication on all things commercial and investment real estate. Kay Properties is recognized by many to be a thought leader on 1031 exchanges and Delaware Statutory Trust (DST) investments and is frequently featured in various magazines and newspapers nationwide. Please enjoy the article here: https://www.nreionline.com/investment/downside-crowdfunding-every-real-estate-investor-should-know

7 Deadly Sins Q&A with Dwight Kay

7 Deadly Sins: What a funny title for a law about DSTs! Betty Friant, Senior Vice President overseeing the Washington DC office of Kay Properties recently interviewed CEO and Founder, Dwight Kay about a very important topic for anyone investing in DST Properties Betty Friant: Dwight, thanks for taking the time to dig into a very important part of what a DST is and how it works. We’ve all heard of Snow White and the … Read More

Listen to an audio version of the DST 1031 Book by Dwight Kay

Discover what every 1031 exchange investor should consider when thinking about investing into Delaware Statutory Trust (DST) 1031 exchange properties. Learn about how DST 1031 properties are structured, financed and packaged for 1031 exchange investors as well as their potential benefits and risks. Learn about various types of DST 1031 properties available to qualified accredited investors as well as why 1031 exchange investors are increasingly choosing DST 1031 properties over traditional Triple Net Leased (NNN) … Read More

Dwight Kay Interviewed on WOCA 1370AM

Dwight Kay interviewed on WOCA 1370AM in Ocala – Gainesville, Florida with Larry Whitler and Robin MacBlane on the topic “Can a Popular Tax Strategy Be Saved”

Dwight Kay Interviewed on Sunrise America

Dwight Kay interviewed on nationally syndicated radio show Sunrise America on the 1031 exchange and its importance to the US economy.