Recently, Kay Properties founder and CEO, Dwight Kay, sat down to discuss some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace for accredited investors for their 1031 exchange or direct cash investments. These properties are just a handful of current offerings from approximately 20-40 different DST offerings available from roughly 25 DST sponsor companies. These current Delaware Statutory Trust offerings range from single-tenant net lease DST properties to multifamily DST buildings with annual rent increases.

If you are interested in Delaware Statutory Trust investments for either a 1031 exchange or direct cash investments, this video will provide straightforward and informative insight into current DST real estate properties that are currently available through Kay Properties and Investments.

About Dwight Kay

Dwight Kay is a nationally recognized expert on Delaware Statutory Trusts and is considered to be the first person to have authored a book exclusively on Delaware Statutory Trusts and 1031 exchanges.

Key Takeaways from this webinar include:

✔️ Learn more about a Net Lease Pharmacy in Miami Beach, FL

✔️ What is a Debt-Free Delaware Statutory Trust offering?

✔️ The Importance of an Essential Business in a Real Estate Portfolio.

✔️ Learn more about a Pharmacy Net Lease DST in Encinitas, CA

You can view the full webinar here:

All right everybody, thanks so much for joining us today. This is Dwight Kay, with Kay Properties and Investments. Really appreciate you taking the time out of your day. To learn more about the Delaware statutory Trust opportunities that we have available on the kpi1031.com marketplace. Today we're going to be going over a few of those opportunities, some current DST properties for 1031 exchange. These are custom DST opportunities for our accredited investors. We're only discussing Regulation D Rule 506C offerings today. As an investor with Kay Properties, if you log in at kpi1031.com, you're going to be able to have access to, we typically have around 25 different DST sponsor companies, and those are the companies that go out and purchase the properties. They package them as a Delaware Statutory Trust and make them available for accredited investors to invest into.

So that's the DST sponsor company. We have about 25 of them that have their properties on our marketplace at kpi1031.com. And then from there, there's typically, depending on the time, the year, the market, et cetera, we're typically around 20 to 40 different DST offerings available from those roughly 25 DST sponsor companies. When working with Kay Properties and Investments, you're going to have access to a large number of DST sponsor companies and DST opportunities. But today we're going to just go into a handful of offerings, current DST properties for 1031 exchange. Thanks for joining with us. We're going to jump into some risks and disclosures, so bear with us.

1:47 Risks and Disclosures (Back to Top)

All DST properties shown are regulation D, rule 506C offerings. All offerings are subject to availability. There can be a no assurance that any DST properties and offerings shown will be available for purchase. DST 1031 properties are only available to accredited investors, which is generally described as having a net worth of over a million dollars, exclusive of primary residents, possessing an annual income of over 200,000 or $300,000 with a spouse, and expects the same or greater for the current year. As well as accredited entities, which are generally described as an entity owned entirely by accredit investors, and/or owning investments in excess of $5 million, or gross assets over $5 million. We ask that you please check with your CPA or attorney to determine if you were an accredited investor prior to considering an investment. This material is not to be considered tax or legal advice, please speak with your own CP and attorney for all tax and legal advice and guidance prior to considering an investment. The Internal Revenue Code, IRC section 1031, section 1033, and section 721 are complex tax codes, therefore, you should consult your tax or legal professional for details regarding your situation.

All real estate and DST properties contain risk. Please read the full private placement memorandum prior to considering an investment. Please do not invest in real estate or DST properties if you cannot afford to lose your entire principle amount invested. Potential cash flow, potential returns, and potential appreciation are never guaranteed and could be lower than anticipated, and/or be negative. And lastly, this material contains information that has been obtained from sources believed to be reliable. However, Kay Properties and Investments the FNEX Capital and their representatives do not guarantee the accuracy and validity of the information herein. Investors should perform their own investigations before considering any investment. Past performance does not guarantee or indicate the likelihood of future results, and diversification does not guarantee returns and does not protect against loss. Securities offered through FNEX Capital member FINRA, and SIPC.

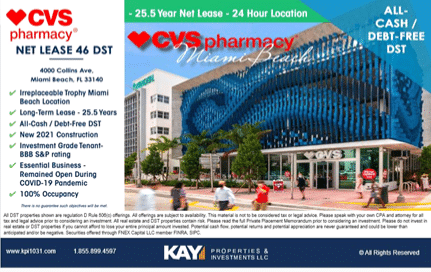

3:58 – Net Lease Pharmacy in Miami Beach (Back to Top)

All right, so jumping in here. First offering that we're going to be going over today is the net lease 46 DST. And this is a CVS pharmacy in Miami Beach. It's on Collins Avenue, so 4000 Collins Avenue, Miami Beach, Florida. A couple things about this deal.

4:33 Irreplaceable Trophy Asset in Prime Location (Back to Top)

First off, irreplaceable trophy, Miami Beach location. We all know the old real estate adage, location, location, location. But somehow many investors involved in 1031 exchanges start sacrificing location for cash flow. They want to get a higher projected cash flow out in the middle of nowhere, in a cornfield somewhere, and they forget about location, location, location. Well, this offering has not forgotten about that. We've called this a trophy asset. It's a irreplaceable location on Collins Avenue in Miami Beach. It's got a long-term lease, it's brand new construction, about a year old with a starting lease term of 25 and a half years.

You've got the fact that it's an all cash, debt-free DST, so there's no risk of a lender foreclosure. If CVS, for instance, were to decide, hey, we don't want to operate at this location anymore, we're not making any money. Which as a side note, it's very difficult for them to keep beer, wine, sunscreen, et cetera on the shelves in this location because of the heavy foot traffic at the beaches here in Miami on Collins Avenue. And that's why they signed a 25 and a half year lease when they moved in on this new construction asset. But say they decided they didn't want to be here anymore, they could shut down the location, that's totally fine, but they would still be obligated to pay the rent each and every month. And the beautiful thing is that this is a debt-free DST.

5:38 Debt-Free Delaware Statutory Trust Offering (Back to Top)

There would be no cash flow suite provision in the loan, like many leveraged offerings. A lot of DSTs in the market are typically leveraged. And leverage can be potentially a good thing for those of you that need to take on equal or greater debt and equal or greater purchase price in your 1031 exchange for full tax deferral. We have many offerings that have leverage and financing associated with them on the kpi1031.com. marketplace. But the neat thing about this particular offering is that it's debt-free . If CVS were to stop operating out of this location, they'd still be obligated to pay the rent each and every month. And there's no lender that would be able to sweep cash flow. I've seen DSTs where a tenant takes the store or the location dark. The tenant might be doing very well, but for whatever reason they took that location dark, and the lender now has the ability to sweep all the excess cash flow.

6:41 Benefits of Debt-Free Delaware Statutory Trust Real Estate (Back to Top)

And so the investors in the DST stop receiving monthly distributions. And that's a risk of real estate in DSTs. But the neat thing being debt-free, we don't have the risk of a lender cash flow sweep. We also don't have a risk of a lender foreclosure on this asset. So debt-free DST, it's a new 2021 construction, so brand new construction asset. CVS pharmacy is a investment grade rated tenant by Standard & Poor. So they have a BBB credit rating, by Standard & Poors, which is a nice place to be as an investor to know that your tenant is investment grade and paying you rent each and every month, and has an investment grade rating. Next, it's an essential business. CVS is a very interesting tenant because they were able to stay open. Many businesses were mandated that they shut down, that they stop operating their businesses by the federal government and state and local governments shut down.

7:43 Importance of an Essential Business in a Real Estate Portfolio (Back to Top)

You're not able to operate your business. And then therefore those businesses had a very hard time paying rent to the landlord of the buildings that they were operating out of, even if they had a long-term lease. CVS is a tenant that's been deemed an essential business and it remained open and paying rent during the COVID-19 pandemic. Also, back in the great financial crisis, CVS was a tenant and other pharmacies in a number of DSTs that we had clients involved in, and they continue to pay their rent all through the recession as well. And so fast-forward, turned out in a pandemic these essential businesses, these recessionary resistant retailers did fairly well. And obviously past performance guarantee future results, so there's no guarantees that the next pandemic CVS will be able to stay open. Or God forbid if there's a next pandemic in our lifetimes. But it's something that worked out very well for our clients that were invested in CVSes during the Coronavirus and also during the great financial crisis 2008 and 2009. And then lastly, 100% occupied.

9:06 – Pharmacy Net Lease 65, Encinitas, CA (Back to Top)

Next we're jumping into another deal. This is another Delaware Statutory Trust offering. It's the pharmacy net lease 65 DST. Very similar to the one in Miami Beach, but this is in Encinitas. And Encinitas, California is a beach town in San Diego. And also another pharmacy, another essential related business in the pharmacy net lease 65 DST. It's a Walgreens pharmacy with a new 15-year absolute triple net lease. Walgreens, who is the tenant, is responsible for all the maintenance, taxes, and insurance at the property level, not the landlord, not the DST. The tenant, all those expenses and upkeep items are on the shoulders of the tenant, not the landlord. We really like that in these types of assets.

A new 15-year absolute net lease . Again, it's an all cast debt-free DST offering, so you have no risk of a lender foreclosure. Number three, recent lease extension. Walgreens took the lease out another 15 years, and that shows what we believe to be strong tenant commitment to the location. So we like it for that reason. Also, Walgreens corporate, which is similar to CVS, has a Standard & Poors rating of BBB, which is investment grade credit. So you've got an investment grade tenant responsible to pay that monthly rent to the DST investors each and every month. Zero landlord obligations, 11,370 square feet building there in beautiful Encinitas, California. It's North County, San Diego, beautiful beach town, very, very special location. Again, this is a trophy location. Location, location, location, that's very important in real estate.

10:44 The Importance of the Encinitas, CA Location (Back to Top)

And it's important to know that the long-term viability of your location, that if this tenant's not there in 15 or 20 years, then somebody else will want to be there. And that's that intrinsic value in the land where if you're buying a Walgreens or CVS in the middle of a cornfield, Iowa or Mississippi or Tennessee, not that they're bad locations by any means, and those businesses do very well in those locations. But when you can have the strength of the tenant, the strength of the lease term, and then also on top of that a very high quality trophy location like the CVS on Collins Ave. in Miami Beach, as well as like this Walgreens in Encinitas, California, we feel that is a potential recipe for success for our investors. Obviously, no guarantees, but we really like the location of this asset.

It's got a cost segregation study for enhanced tax efficiency and write-off potential. For those of you looking for increased tax efficiencies, talk to your CPA and your tax attorney. This offering may be a potential fit for you as you're looking for those efficiencies. It is a top performing location with strong reported store sales, located in a major retail trade area right on Encinitas Boulevard, high daily traffic accounts, with also a number of national tenants in the surrounding area. So you've got Sprouts, Farmer's Market, Kohl's, Pete's Coffee, LA Fitness, and many other national retailers in this area.

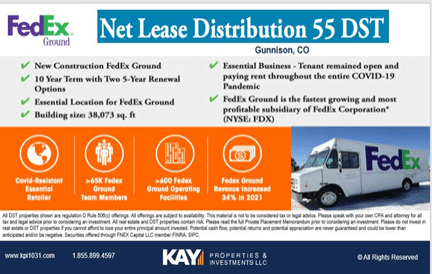

12:24 - Net Lease Distribution 55 Delaware Statutory Trust in Gunnison, Colorado (Back to Top)

Moving on here, we have the net lease distribution 55 DST, and this one's in Gunnison, Colorado. Brand new construction, FedEx Ground. You've got a 10-year term with two five year renewal options. And this is also considered an essential location for FedEx Ground. Brand new construction, 38,000 square feet approximately. And again, FedEx Ground is considered an essential business, so this tenant remained open and paying rent throughout the entire COVID-19 pandemic. And obviously, like I said earlier, past performance does not guarantee future results, but it's something to be aware of. How did the tenant do during COVID? Did they shut down? Were they forced to be shut down? Did they pay their rents? Did they ask for rent reduction or rent relief? How did they do?

13:12 – Why We Like FedEx as a Delaware Statutory Trust Tenant (Back to Top)

And for our clients that were invested in various FedExes, FedEx Grounds, FedEx Freight locations, we've got clients in probably 20 plus of those types of assets throughout the country. Rent kept coming in each and every month during COVID-19 because of the size of the tenant and that they were deemed essential logistics tenants. And then lastly, FedEx Ground is the fastest growing and most profitable subsidiary of FedEx Corporation. FedEx Corporation [inaudible 00:13:44] New York Stock Exchange, again, a COVID resistant essential retailer. 65,000 FedEx Ground team members, 600 FedEx Ground operating facilities. And FedEx Ground's revenue, which is an important thing to look at, increased by 34% in 2021.

Obviously, we're not buying when you invest into the net lease distribution 55 DST, you're not buying the stock of FedEx. If the share price of the stock goes up 20% or goes down by 20%, you're not an owner of the stock, you're the landlord. The DST is the landlord, owns the industrial facility. It's a brand new building purpose-built for FedEx Ground with a long-term 10-year lease with two five year renewal options. You're the landlord. FedEx Ground would be the tenant paying monthly rent to the landlord.

14:43 – Tractor Net Lease 60 DST (Back to Top)

Next here we have Tractor net lease 60 DST. This one, again, is an all cash debt-free DST offering. Many of our investors are looking for a way to potentially lower the risk in a real estate or a DST investment. There are risks with real estate, with DST investments, property values can go up, property values can go down.

Tenants can stay in business and pay rent every month, or they can go out of business and not pay any rent because they went bankrupt. Cash flows can go up and be paid every month, cash flows can go down or not be paid. Rent cannot be paid. There's no guarantees with real estate. And a lot of our clients that are at a stage in their life where they've owned and operated their own properties, whether it be apartments or commercial buildings, or owned farms or wineries, or whatever it was, medical buildings. A lot of our clients have been doctors over the years and have owned medical practices. They're wanting to get out of active management and they're wanting to lower their risk potential. And many of those investors, they paid off their mortgages already. They paid off their mortgages, they own their buildings free and clear. And that was a moment of great pride when they wrote their last mortgage payment and paid off that building's mortgage or that piece of property's mortgage.

14:53 – The Majority of DST Sponsor Companies Only Provide Leverage Offerings (Back to Top)

And the problem with the DST space is that, off the top of my head, probably at any given time 90 to 95% of the offerings brought out by sponsors, DST sponsors in this space, a huge amount of them, 90% plus or minus are leveraged. They have loans on them. And again, for those investors that need to purchase equal or greater value for full tax deferral, that may potentially make sense for them. But for those investors that have already paid off their buildings free and clear, they don't want the risk of a lender foreclosure. Going into a property that has a 50% loan to value, although that's moderate leverage, you still have the risk of a lender foreclosure. And many of our clients came to us years ago saying, we don't want extra risk. We don't want to have the risk of a lender.

And that's why Kay Properties has been such a big proponent for all cash debt-free offerings. Don't over-leverage yourself at a point in your life when you're trying to lower your headaches and lower your risk potential.

17:08 – About Tractor Supply Company (Back to Top)

This Tractor net least 60 DST, it's an all cash debt-free offering, and it's in West Palm Beach, Florida. The West Palm Beach MSA, it's a area called Riviera Beach. And so that's very rare for this type of a tenant. And this tenant Tractor Supply Company has a over $23 billion market capitalization. They're publicly traded on the NASDAQ. They've done incredibly well over the years. Again, doesn't guarantee that they're going to do well in the future, but it's definitely something to look at and consider. How well has this tenant done over the last 10, 20, 30 years?

And we're very comfortable with Tractor Supply. And the location's really interesting because it's a very dense infill location, where many tractor supplies are in rural parts of the country. And that doesn't mean that it's bad. We've got clients that have been invested in Tractor Supply DSTs over the years in very rural markets, and the properties have done very well for those investors in terms of monthly cashflow potential because of the tenant. But this one is interesting because we have that same strong credit tenant, and then we also have a 15-year lease in the West Palm Beach MSA. Again, it's a rare trophy location for Tractor Supply. It's, again, an essential business. Tractor Supply paid their rent all throughout the COVID-19 pandemic. Very important to note, it's 100% occupied. And for those of you that don't know, Tractor Supply is the largest national farm and ranch retail store brand in the nation.

This property is adjacent to Sam's Club, a Walmart Supercenter, Restaurant Depot, and other national retailers. And the interesting thing about Palm Beach County, they're estimated to have over 1.4 billion in agricultural sales. It's a large agricultural area, along with all the beaches and the tourism and industry that the Palm Beach area brings to mind. It's also a large agricultural sale area. And so that's why Tractor Supply wanted to be here for 15 years. Again, Tractor Supply is a public company whose stock is traded on the NASDAQ under the symbol TSCO, and they do carry an investment grade credit rating by Standard & Poors of BBB. To recap, all cash debt-free, 15-year long-term net lease, available for 1031 exchange, as well as direct cash investment. We've got clients that have done 1031 exchanges over the years, and then after we've done well for them, they've said, "Hey, what else do you have that we could invest in? We are pulling money out of the stock market, or we're looking for something as an alternative to T-bills or CDs or just sitting in cash."

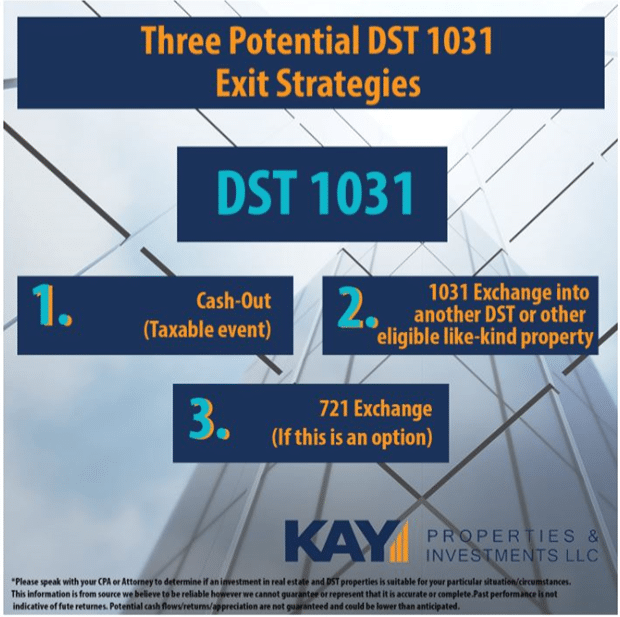

19:59 – DST Available for 721 Exchange Exit Potential(Back to Top)

And another thing to note, that investors are interested in this one for, is that it's a income tax-free state. Florida, there's no income taxes in Florida.

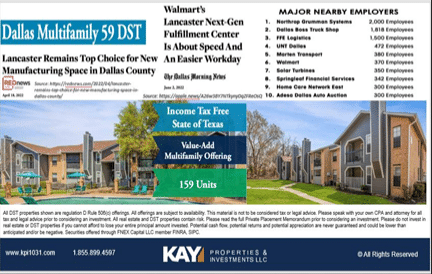

21:15 – Dallas Multifamily 59 DST (Back to Top)

22:11 Value Add Potential (Back to Top)

But with this one, we have the value-add opportunity to potentially raise rent. So there's 159 units, and it's in Lancaster. Like I said, it's a submarket of Dallas. And it's pretty interesting, this area, there's a lot of industrial in the area. If you see the article here on Red News, Lancaster's top choice for manufacturing space in Dallas County. And also another article in the Dallas Morning News that Walmart's Lancaster nextgen fulfillment center is about speed and an easier workday. So it's a new fulfillment center by Walmart in this area. And so being that this is a Class B multifamily offering with a value-add potential, we like that it's got all that industrial job centers all around the property here. And then nearby major employers, you've got Northrop with 2,000 people, Dallas bus truck stop with 1,800 employees, FFE Logistics, UNT Dallas, Martin Transport, Walmart, Solar Turbines. You've got a large amount of employers in the area for this property.

23:19 – Pepsi Distribution 64 DST (Back to Top)

Again, brand new construction. It's got a long-term 10-year lease, and this one also has a 721 exchange roll-up as a potential exit strategy.

24:24 – Texas Net Lease 63 Delaware Statutory Trust (Back to Top)

Next is the Texas Net Lease 63 DST. And the tenant here is Guidepost Montessori. Guidepost Montessori, they've got about 95 different locations nationally and globally. They've been growing at about 40 different schools annually. And this is a preschool, it's a Montessori preschool. They have plans to grow to 500 locations by 2026. And this property is in Dallas, Texas. It's in the Lewisville submarket of Dallas, Texas. High growth, high population growth. And it's located in Castle Hills, which is a really dynamic suburban community. And that's located in the Dallas-Fort Worth metroplex. The property has a brand new 20-year corporate net lease with annual rental increases. We like annual rental increases where we can have them, because you're growing the net operating income at the property level annually.

That potentially helps with the future value of the building to hopefully increase the value of the building because the income stream is growing annually. Again, this one also is an all cash debt-free DST offering. As I was saying earlier, many of our clients are wanting to lower their risk potential and not have the risk of a lender foreclosure. If the tenant were to go out of business, the rent payments would stop because the tenant went out of business. But we have what we believe to be a solid location and in a market where there's lots of job growth, lots of population growth, and you would have to find a new operator to come in there and run this facility, run the preschool. That is a risk, and we'll dig into the risk further in the private place memorandum. But being that it's all cash debt-free, you don't have a risk of a lender foreclosure.

26:14 – About Guidepost Montessori School and Higher Ground Education (Back to Top)

And then from there, on top of Guidepost Montessori, is the tenant being a strong operator with over 95 locations nationwide. But we also have on this property a full corporate guarantee from Higher Ground Education. And Higher Ground Education is the parent company of Guidepost Montessori. Next we have a 721 exchange exit potential on this asset as well. We have an income tax-free state of Texas, so tax efficiencies for investors looking for those income tax-free states. That's a Texas net lease 63 DST.

26:50 – Essential Net Lease 58 DST (Back to Top)

28:00 – Strategy of DST with Multiple Properties(Back to Top)

And one of the things with DSTs, is that a lot of times a DST will have a single asset in it, which we saw earlier. And then other times we have DSTs that will have multiple properties in. We still do encourage somebody, if they have an exchange, don't think, oh, well, this is a multi-property portfolio, so I'll put my whole entire exchange amount into this one portfolio. No, because these three properties are completely connected, they're in the same portfolio. Two of them could do very well, if one doesn't do well, it could drag down the potential returns to the whole portfolio. That's the whole reason why you would want to invest in a DST, to diversify your equity. And so we encourage clients, yeah, diversified portfolio is nice, but it's still one DST offering, even though it might have 3, 5, 10, 15 different properties in it. You don't want to over concentrate into one different DST offering. Using it as a tool to get enhanced diversification, but not over concentrating in one DST.

With this one, there's three different properties. Again, a Frito-Lay distribution center, Walgreens Family Dollar, and a BMO Harris Bank. They provide a strong essential net lease portfolio, and it's potentially both recession and pandemic resistant because of the tenants and the makeup of their businesses. The Frito-Lay distribution center was constructed in 2022, so brand new industrial building with a long-term 10-year lease. The BMO Harris Bank was built in 2017, and just had a lease extension by BMO Harris. They are an investment grade rated tenant, and they like the location so much that they just extended and took the lease out to another 10 years. And then the Walgreens Family Dollar was built in 2005. All long-term net leases and all corporately backed by investment grade corporations. That's the essential net lease 58 DST. It's also a debt-free DST with no risk of our lender foreclosure.

Those were just a few of the examples of the opportunities that we have on the kpi1031 marketplace available for 1031 exchange and direct investment. If you want to see the full entire list of DSTs on our marketplace, sign up, you'll get free access for the accredited investors that qualify. Again, over 25 DST sponsor companies, as well as typically 20 to 40 different DST offerings available on the marketplace.

30:33 – Opportunistic and Income Oriented Real Estate Funds for Direct Cash Investors (Back to Top)

And then the last bullet point here, we also have opportunistic and income oriented real estate funds for direct cash investors. So for those that are not in a 1031 exchange, looking to diversify outside of the stock market, build some exposure to real estate, we have these direct cash investments in the form of opportunistic and income oriented real estate funds.

If you visit kpi1031.com, you'll be able to log in for free access. And then also you'll get a number of different resources available to our investors on kpi1031.com. You get a free book on 1031 DST properties, so we'll send you a copy of that. A free subscription to the 1031 DST Digest Magazine, which has all sorts of case studies, tenant overviews, educational resources, and articles in the 1031 DST Digest. You'll get access to free educational 1031 DST conference calls. We hold host weekly conference calls every week with our investors on various topics in it regarding 1031 exchanges, asset classes, financing, debt-free, zero coupon offerings, different strategies to use when thinking about a 1031 exchange into DST properties. You get very, very educational conference calls. We'll get you access to those.

Also, a weekly webinar on 1031 DSTs, so you have access. And then also we do host educational dinner events for our investors throughout the country on 1031 exchanges and DSTs, so you can come out and meet us live and in person. If you register, you'll get free access on www.kpi1031.com. And with that, we really appreciate you taking the time to join us today. As always, our entire team is here to assist you in any way possible, and we are your dedicated 1031 DST resource. Feel free reach out to us at 1-855-899-4597, or feel free to just log in and we will register you to get you access to all these valuable resources at www.kpi1031.com. With that, thank you everybody. We really appreciate your time, and enjoy the rest of your day.