It seems like everyday there is another reason showcasing the reason why more and more investors are choosing to stay debt-free when investing in Delaware Statutory Trust (DST) properties in a 1031 exchange.

Headlines Show Dangers Surrounding Leveraged Real Estate

Just look at any business or real estate-related publication, and you will see the headlines are full of examples of real estate firms that have been forced to relinquish assets because they succumbed to the lurking liabilities of leverage. In many cases, these firms were led by highly skilled executives with years of experience and files of successful transactions. However, even these world-class real estate firms are creating a case for staying debt-free.

Here are just a couple of examples in the news to illustrate the point:

- Recently, one large firm was forced to give a large office campus in the Southwest back to lenders after the private investment firm stopped making the payments on its roughly $300 million loan on the office campus1.

- One of the nation’s largest real estate investment firms located in the Midwest is struggling with the bitter taste of lender foreclosure after its bank filed a roughly $100 million foreclosure lawsuit against the real estate firm over a recent investment gone awry2.

- After failing to repay its loan on a Class B complex in the South, an international investment firm was forced to turn the asset over to the lender3.

- One global real estate firm recently handed back a large East Coast building to its lender after the building’s anchor tenant left the building4.

- Fannie Mae recently announced it was prepping for possible losses in the multifamily housing sector as lenders anticipate loan losses from developers and private equity players who used heavy leverage within the multifamily housing sector5.

- In the hotel sector, a prominent New York City hotel developer is facing foreclosure after failing to repay a mezzanine loan to a private equity group6.

- An upstate New York lender recently announced it was going to move forward with foreclosure proceedings after the owner was unable to make payments on a large self-storage facility near Midtown Manhattan7.

The most recent example comes from Yahoo! Finance whereby a major real estate investor has defaulted on $161 million dollars of loans tied to an office portfolio in the Washington DC area that it owns.

Just a thought, but maybe this portfolio would have been better suited as a debt-free acquisition to protect investors from default and a complete loss of equity. Kay Properties is a leader in proving investors with debt-free real estate investment options for their 1031 exchange and direct cash investments. Here is a video on some of the benefits of investing in debt-free DST real estate. Surprisingly, very few real estate investment firms acquire properties on an unleveraged basis. However, now more than ever, investors should consider debt-free real estate investments as a prudent strategy.

Recent Black Swan Events Expose the Dangers of Debt

The good news is that now, more and more investors are waking up to the reality that investing in leveraged offerings may not be a prudent situation for them and that taking on an extra layer of risk may not be a good choice.

For wealth advisers and investors alike, recent events such as the war in Ukraine, bank failures, and of course, the COVID-19 pandemic serve as reminders that black swan events are real and that using leverage comes with risk. The bottom line is that the risk of lender foreclosure, which is always mentioned but rarely considered a realistic possibility, has suddenly become much more of a reality.

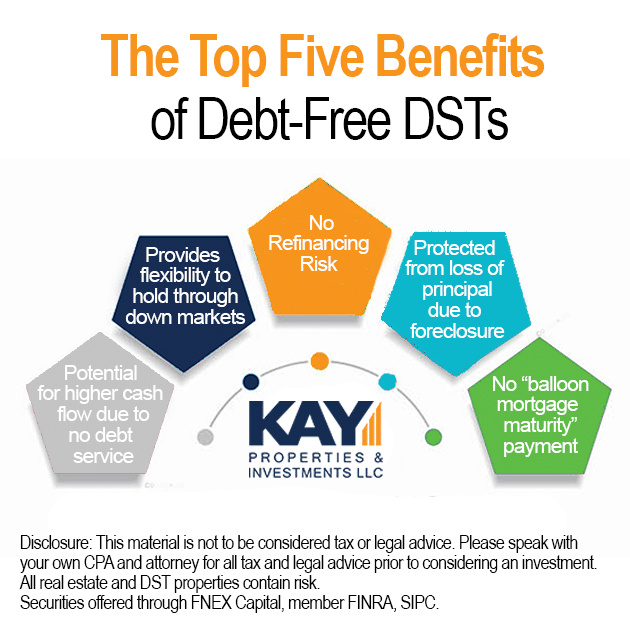

Here are five specific reasons why debt-free DSTs should potentially be a part of a 1031 exchange investor’s portfolio today.

- Debt-Free DST Assets Provide Investors with Zero Risk of Lender Foreclosure.

- Debt-free DSTs Give Sponsors More Flexibility to Respond to Unforeseen Circumstances.

- Debt-Free DSTs Have No Monthly Debt Service to a Lender.

- Debt-Free DSTs Provide Investors the Ability to Diversify a Portion of Their Portfolio into Unlevered Assets to Lower Potential Risk.

- Debt-Free DSTs Protect Investors From Lender Cash-Flow Sweeps Associated with Tenant Credit-Rating Fluctuations.

DSTs without debt are considered by many to have a much lower risk profile than those with leverage. Debt-free DSTs have zero risk of lender foreclosure, protecting investors from a complete loss of principal invested. Also, debt-free DSTs provide protection from a balloon payment associated with loan maturity, which many real estate firms are very concerned about in today’s market.

On a leveraged property, many asset management and leasing initiatives require lender approval before they can be executed. This limits the real estate operator in the speed at which they can operate the property and, at times, may limit the options available to them.

In a debt-free DST setting, however, there is no lender that needs to approve an asset management or leasing initiative, so the sponsor has the ability to potentially act quickly on behalf of the property and thereby investors.

A leveraged DST has monthly debt-service payments that must be made first and in full each month, allowing remaining funds to be paid out to investors. In economic downturns, an asset’s revenues may be reduced. The equity investors in a leveraged DST bear the burden of this revenue reduction because debt-service payments must still be made, potentially impairing investor monthly distributions.

Many entrepreneurs who have invested heavily in the stock/bond markets turn to all-cash/debt-free Delaware statutory trust properties as a strategy to diversify away from stocks and bonds. Since these products do not contain the risks of a loan, they are especially interesting to direct cash investors.

In the event a tenant’s credit rating decreases, under certain loan terms, the lender would have the right to sweep the cash flow until the tenant’s credit rating improves. This is a major risk found in many net lease DST offerings with leverage. In a debt-free DST, if the tenant’s credit rating gets lowered, there is no lender to effectuate a cash-flow sweep, thereby potentially protecting investors’ monthly distributions.

In summary, each of these arguments supporting the wisdom of investing in debt-free assets stands on its own. Put them all together, and debt-free DSTs are not just something to consider during higher interest rate environments, but an important investment strategy for DST investors for the foreseeable and long-term future as well.

To sign up for a free list of all-cash/debt-free DST properties for 1031 exchange and cash investors please register at www.kpi1031.com