Easily Find DST Replacement Properties for your 1031 Exchange

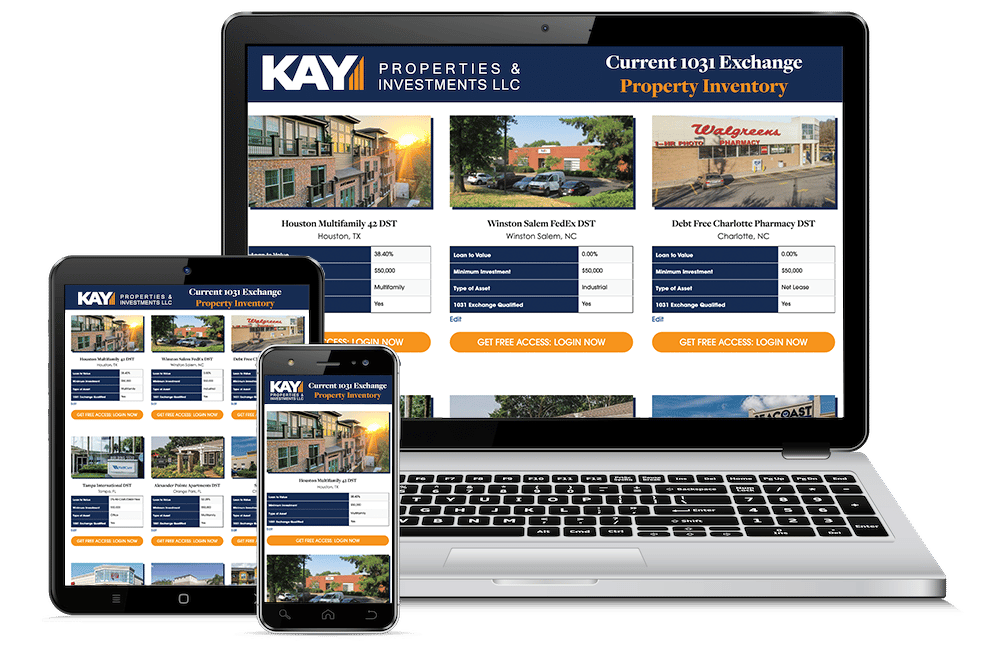

The Kay Properties Platform provides access to the marketplace of 20-40 DSTs from over 25 different sponsor companies, custom DSTs only available to Kay clients and a DST secondary market.

12,000+

DST, 1031, 721, & Real Estate Transactions4,015+

Investors Nationwide Have Chosen to Invest with Kay Properties$50B

In Total DST 1031 Offerings Participated340

Years of Team Member Real Estate Experience25+

DST Sponsor Companies20-40

DST OfferingsAlready a Member to the Kay 1031 Marketplace?

Login to access the Kay1031 Marketplace and view the different DST sponsor companies and available DST 1031 Investment Properties

New Visitors

Register for Access to the Kay 1031 Marketplace and Receive Free Access to Over 25 Different DST Sponsor Companies and between 20-40 different DST 1031 Investments

DST Testimonials

Kay Properties has helped thousands of investors nationwide for nearly two decades complete over 9,100 DST, 1031 and 721 exchange investments. Read more from our clients and their experience working with us.

This book was written with the specific purpose of helping Investors navigate the 721 Exchange UPREIT strategy.

Free Access to DST Investments: Get Your Password Today

Get your free access to DST investments from over 25 different Delaware Statutory Trust sponsor companies available on the www.kpi1031.com marketplace.

1031 DST Inventory

*All offerings are subject to availability.

Sidbury Station BFR Housing DST

Castle Hayne, NC

| Loan to Value | 51.17% |

| Minimum Investment | $50,000 |

| Type of Asset | Multifamily |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

General Time Industrial Park Opportunity 84 DST

Athens, GA

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $25,000 |

| Type of Asset | Multi-Tenant |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Essential Net Lease 81 DST

NC, GA, FL

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $25,000 |

| Type of Asset | Single Tenant Net Lease Portfolio |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

San Antonio Multifamily 74 DST

San Antonio, TX

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $25,000 |

| Type of Asset | Multifamily |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Net Lease Distribution 64 DST

Frankfort, NY

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $25,000 |

| Type of Asset | Industrial Net Lease |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Tractor Net Lease 79 DST

Quinlan, TX

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $25,000 |

| Type of Asset | Single Tenant Net Lease |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Parkland Apartments DST

Parkland, FL

| Loan to Value | 40.99% |

| Minimum Investment | $50,000 |

| Type of Asset | Multifamily |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Texas Small Bay 85 Flex DST

San Antonio, TX

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $25,000 |

| Type of Asset | Flex-Industrial |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Net Lease Industrial 77 DST

TX & AR

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $50,000 |

| Type of Asset | Income Fund |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Eastwood Village Opportunity 71 DST

Birmingham, AL

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $25,000 |

| Type of Asset | Industrial Portfolio |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Rogers Business Park 73 DST

Fulshear, TX

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $25,000 |

| Type of Asset | Multi-Tenant |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Zero Coupon LV Training Facility DST

Henderson, NV

| Loan to Value | 78.70% |

| Minimum Investment | $100,000 |

| Type of Asset | Single Tenant Net Lease |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Net Lease Distribution 69 DST

Luling, LA

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $25,000 |

| Type of Asset | Industrial |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Tractor Net Lease 60 DST

Various

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $50,000 |

| Type of Asset | Single Tenant Net Lease |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Lyric at Norton Commons Apartments DST

Prospect, KY

| Loan to Value | 39.02% |

| Minimum Investment | $50,000 |

| Type of Asset | Mixed Used - Residential & Retail |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Net Lease Distribution 50 DST

Rigby, ID

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $100,000 |

| Type of Asset | Single Tenant Net Lease |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Dallas Multifamily 59 DST

Dallas-Fort Worth MSA

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $100,000 |

| Type of Asset | Multifamily |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Net Lease Distribution 55 DST

Gunnison, CO

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $50,000 |

| Type of Asset | Single Tenant Net Lease |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Medical Net Lease 43 DST

Columbus, GA

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $50,000 |

| Type of Asset | Single Tenant Net Lease |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Parkdale Commons Opportunity 62 DST

Waco, TX

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $50,000 |

| Type of Asset | Retail |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Pearland Business Park Opportunity 76 DST

Pearland, TX

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $25,000 |

| Type of Asset | Multi-Tenant |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

NorthPark Shopping Center Opportunity 78 DST

Monticello, AR

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $25,000 |

| Type of Asset | Multi-Tenant |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Tapestry West Apartments DST

Richmond, VA

| Loan to Value | 42.58% |

| Minimum Investment | $50,000 |

| Type of Asset | Multifamily |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

Ridge DST

Indian Land, SC

| Loan to Value | 0% - All-Cash/Debt-Free |

| Minimum Investment | $100,000 |

| Type of Asset | Multifamily |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

As Showcased in these Leading Business Publications

What is a 1031 Exchange DST?

“Going forward, we are very happy with our monthly paycheck and the knowledge that we are part-owners of professionally managed real estate in good markets with strong tenants"

David A., Severna Park, MD

"I’ve really enjoyed working with Orrin and Chay. They have a tremendous knowledge of all the intricacies of 1031 exchanges and are able to recommend high quality properties to invest in. I feel as though they do a great job reviewing and evaluating different options before they present them to me"

Bruce G., Manhattan Beach, CA

“Hi, Betty: Thanks for all the help and guidance into the world of the Delaware Statutory Trust. The assistance helped me make de-cisions which will affect my legacy for my children, and my philan-thropy for the years to come. Thanks to you and Orrin, I didn’t wind up with just one Pizza Hut ,but with some real estate which might fuel some of my larger dreams. The education is invaluable. I hope to see you more frequently.”

Dr. Paul E., Ed.D, Washington D.C.

Betty Friant did a tremendous job of assisting us with the DST process. With her wealth of experience, she was able to field all our questions and help us find the DST properties that suited us best.

Rob E. - Bethesda, Maryland

I would like to express my appreciation for exemplary service from Jason Salmon. I was a novice to the world of the DST and 1031 exchange process. Jason worked with me every step of the way to guide me through what was initially for me, a very confusing and intimidating investment vehicle. He exhibited great patience and knowledge to help me achieve my goals. I look forward to working with Jason again in the future.

Ronald J. - Westhampton Beach, NY

Chay Lapin was an invaluable resource for me as he helped me work through my recent exchange. He was very accessible and worked hard to find just the right replacement property to meet my needs. He also had technology that made finding the right match to my set of unique numbers, so much easier. I would recommend him to anyone with this particular need.

Vera D. - Palo Alto, CA