By Dwight Kay, Founder and CEO, Kay Properties and Investments

Real estate investors love Delaware Statutory Trusts for their 1031 exchanges because they can provide individuals a unique opportunity to defer capital gains taxes, eliminate active management responsibilities, and achieve the potential for regular monthly cash distributions. However, the first step to using the DST 1031 exchange real estate investment strategy is to first understand the pros and cons of the Delaware Statutory Trust.

This article jumps directly into very specific advantages and disadvantages of DST 1031 exchanges and provides readers a comprehensive look into this popular investment strategy.

Key Takeaways:

- Why are Delaware Statutory Trust 1031 Exchanges growing in popularity?

- What are some of the potential benefits of Delaware Statutory Trust 1031 Exchanges?

- What are some of the risks of Delaware Statutory Trust 1031 Exchanges to consider?

- What are Some Examples of Delaware Statutory Trust Properties?

- Frequently Asked Questions Regarding the Pros and Cons on Delaware Statutory Trust Properties

Also, to learn more about Delaware Statutory Trust investments, Kay Properties has created one of the most robust educational DST resource libraries to help investors learn such important DST pro and con subjects as:

- What is the purpose of a Delaware Statutory Trust?

- Is a DST a Good Investment?

- Read and Learn More About DST Reviews

- What is the Delaware Statutory Act?

Kay Properties Weekly Delaware Statutory Trust Podcast

In addition, Kay Properties has a created a weekly podcast series that covers everything a Delaware Statutory Trust investor would want to know including a complete analysis of the benefits and risks of Delaware Statutory Trusts, detailed looks at new DST Listings, and why investors should make Delaware Statutory Trusts an important option for your 1031 exchange.

Make sure to view Dwight Kay, Founder and CEO of Kay Properties, as he shares in-depth insights and reviews the pros and cons of Delaware Statutory Trust based on his experience of investing in more than 50 Delaware Statutory Trust properties.

Are DSTs Good Investments?

Delaware Statutory Trusts or DSTs are growing in popularity among real estate investors across the United States. The combination of aging demographics, low investment returns from traditional banking investments, and highly appreciated real estate values are all contributing to the steadily growing popularity of DSTs. According to https://Globest.com , since 2004, an estimated $20 billion has been raised in securitized 1031 co-ownership, primarily structured as Delaware Statutory Trusts. It's safe to say that DST’s have rightfully earned this position and answered the question of whether they are good investments given that they offer investors a number of potential advantages.

However, like all real estate related investments, Delaware Statutory Trusts have their pros and cons. Investors should carefully read the offering’s Private Placement Memorandum for the full business plan and risk factors prior to considering an investment.

This article discusses some of the potential advantages that are available to investors using DSTs for their 1031 exchange, along with a few disadvantages that investors should consider as well. Before we explore the benefits offered by a DST let’s first explain what exactly is meant by a DST 1031 exchange.

What is a DST 1031 Exchange?

A Delaware Statutory Trust is an entity that qualifies as “like-kind” real estate for the purposes of a 1031 exchange to defer capital gains taxes when selling an investment property. To realize this benefit, investors direct the proceeds from the sale of their relinquished property towards purchasing a beneficial interest in professionally managed, high-quality institutional real estate. The type of real estate investors can choose for a DST 1031 exchange can be a variety of property types, including medical office, distribution industrial center, or multifamily apartment complex.

Once the Delaware Statutory Trust investment goes full-cycle, the investor can also exchange the DST into a REIT (via a 721 UPREIT) but it may entail a lengthy process. The term “full cycle” refers to the complete life cycle of a DST investment, from when the real estate asset was initially acquired all the way through its ultimate disposition or sale.

As can be seen, there’s a number of Delaware Statutory Trust pros and cons, which we will inspect in the next section.

Delaware Statutory Trust: Frequently Asked Questions

To learn more about Delaware Statutory Trust advantages, make sure to listen to Dwight Kay, Founder and CEO of Kay Properties and Investments discuss DST 1031 basics and Frequently Asked Questions investors ask about Delaware Statutory Trust and 1031 exchanges.

Benefits Offered By a DST

It’s worth examining the Delaware Statutory Trust pros and cons if you’re considering an investment. A 1031 exchange into a DST has several benefits for real estate investors, including the following:

- Eliminating the Headaches of Tenants Toilets, and Trash

- Accessing Long-Term NNN Properties

- Using Potentially Non-Recourse Debt

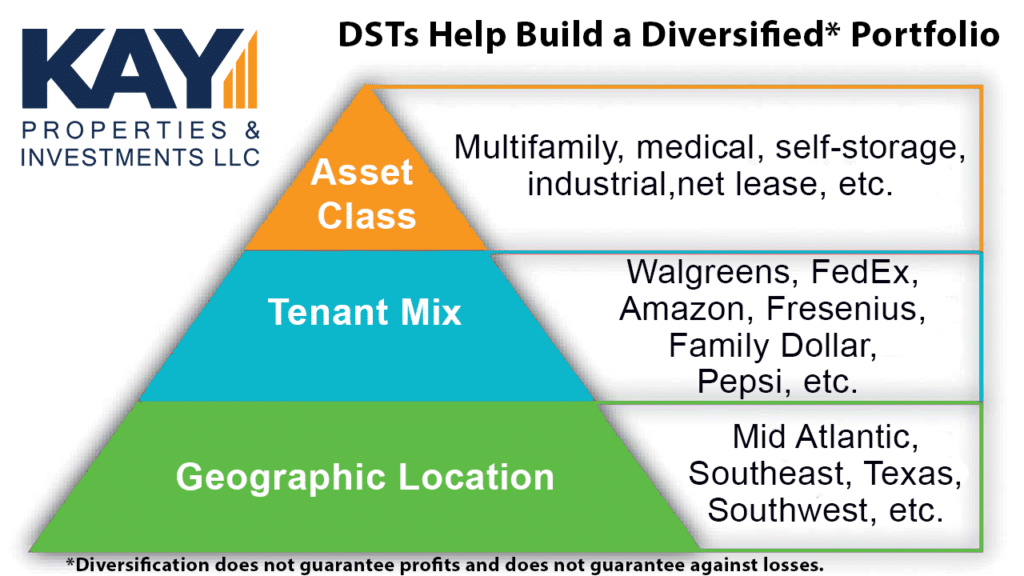

- Achieving the Potential for Diversification*

- Investing in High-Quality Real Estate Assets

The ability to free yourself from the three Ts of active management

The proverbial three T’s of active real estate management include, tenants, toilets and trash. Many investors are attracted to Delaware Statutory Trusts because they offer the potential for a passive income stream. This feature is especially popular among those investors transitioning from an active real estate management role via a 1031 tax-deferred exchange. Active real estate management can be a time-consuming and tiring occupation which many property owners don’t want to continue into retirement. However, cashing out of a property held over a lifetime will usually incur a substantial capital gains tax hit that will erase much of the wealth that has been accumulated. Delaware Statutory Trusts allow an investor to utilize a 1031 exchange to acquire a professionally managed, institutional grade asset, which potentially provides monthly income without the headaches of property management and asset management.

Access to long-term triple net leased (NNN) properties

One of the most significant advantages of Delaware Statutory Trust investments is that they can offer investors access to triple net leased (NNN) properties that range from 5-20 years on the primary lease term, depending on the specific investment. This provides a potential long-term income stream without the hassle and risks of lease renegotiation. This is particularly relevant for investors who are moving to a Delaware Statutory Trust from a multifamily, apartment or single-family rental investment. Instead of dealing with multiple tenants renewing (or not renewing) their lease once a year, a Delaware Statutory Trust investor may potentially have 5-20 years of income already pre-arranged for. This both reduces the headaches of property management and provides a predictable and durable income stream. It is important to note that long-term leased properties, although attractive, can have problems too, such as tenants going out of business. It is important to review the tenant’s business model, credit rating, and future growth prospects to understand the level of risk one is assuming with a long-term leased property.

Potential for non-recourse debt vs. recourse debt

Most debt on Delaware Statutory Trusts is non-recourse which greatly limits an investor’s liability to the lender. This helps to protect an investor’s other properties, investments, etc., should an investment fail. Especially for those investors switching to a Delaware Statutory Trust in retirement – non-recourse debt adds an extra layer of safety. Non-recourse debt is typically defined as a loan whereby the lender’s only remedy in case of a default is the subject property itself and not the investor’s other assets. Many investors that purchase commercial, multifamily and triple net leased properties on their own are stuck with full or partial recourse loans from their lenders which increases overall risk substantially. With most Delaware Statutory Trust properties, non-recourse debt is enjoyed by investors.

Many 1031 exchange investors utilize Delaware Statutory Trust properties to satisfy debt-replacement requirements, yet those who do not have debt to replace, can choose debt-free DST real estate properties.

Potential for diversification* into smaller dollar amounts

Delaware Statutory Trusts give investors access to institutional grade real estate for smaller dollar amounts with minimum investment of often just $100,000. In contrast, higher quality triple net leased properties (which are often compared to Delaware Statutory Trusts) typically have a price floor around $1,500,000 and can reach up to as high as $25,000,000 and up. This not only allows more potential investors access to Delaware Statutory Trusts, but also allows investors to spread risk across multiple assets instead of concentrating it in one net lease or multifamily property.

Potential Disadvantages of a Delaware Statutory Trust (DST)

Although there are many benefits surrounding DST 1031 exchanges, there are also certain risks associated with them as well. We strongly encourage all investors to closely review the risk section of the Private Placement Memorandum (PPM) in its entirety as well as talk with their tax and legal advisors prior to considering a DST 1031 investment.

However, here are five specific potential disadvantages of the Delaware Statutory Trust:

- No Guarantees of Monthly Distributions or Projected Appreciation

- Material Risks Associated with Real Estate Investments

- Purely Passive Beneficial Interest

- The Seven Deadly Sins” of the IRS Code 2004-86

- Delaware Statutory Trust Properties are Illiquid.

No Guarantee for Monthly Distribution or Projected Appreciation

Like all investments there can be no guarantee of monthly distribution, returns or appreciation. Though due to Delaware Statutory Trust properties being real estate investments, their performance tends to correlate less with stocks and bonds markets, which is why many investors choose to invest in Delaware Statutory Trust properties not only with 1031 exchange proceeds but also with direct cash investments. Investors must understand that all investment properties have no guarantee for rental income as well no guarantee for appreciation and the same is true with Delaware Statutory Trust properties.

Material Risks Associated with Real Estate Investments

Anytime anyone invests in real estate, there are always material risks involved. Some of these risks include unforeseen vacancies, general market conditions, interest rate risks, general risks of owning/operating commercial and multifamily properties, financing risks, and general economic risks. There can also be inherent problems with the way a DST sponsor acquires and finances the underlying real estate which may introduce risk factors that require a trained and skilled eye to notice.

Completely Passive Beneficial Interest

One of the biggest potential hesitations investors might have about Delaware Statutory Trusts is their purely passive management structure for investors. As mentioned earlier, many investors are actually looking for a purely passive investment strategy. However, because the United States government understood that it might be concerning to remove direct management of any investment vehicle from the investor, the IRS Revenue Ruling 2004-86 is very clear that any DST investor must be a passive holder of real estate, and places specific restrictions on the trustee of the DST in order to protect the investor.

Colloquially called “The Seven Deadly Sins” of DST investments, the IRS created a strict framework that guides DST trustees and potentially protects investors. These seven rules of Delaware Statutory Trust properties include:

- There can be no future contributions: Once a DST offering is closed there can be no additional contribution of capital by either current or new investors.

- Restrictions on Debt: The DST Trustee cannot renegotiate existing debt terms or initiate new secured loans from any party.

- No reinvestment of proceeds: The choice of where to reinvest is retained by individual investors when the DST real estate is sold.

- Required Distributions: With the exception of reserves, all cash received by the DST must be distributed to investors.*

- Limited Capital Expenditures: The Trustee may only have capital expenditures to cover the following:

- Normal repair and maintenance

- Minor non-structural capital improvements

- Those required by law

- Restrictions Investing Reserves: Any cash retained by the Trustee for reserves or between distributions dates may only be invested in short-term debt obligations.

- Restrictions on Leases: The Trustee may not renegotiate, or enter into a new lease. Some exceptions apply.

So while it is true that Delaware Statutory Trust investments allow investors zero managerial control or decision making authority for both minor and major decisions, investors have the benefit of relying on the DST Trustee to perform active management duties according to the IRS rules as stated within the Seven Deadly Sins. That’s why it is important for any investor to choose an expert DST 1031 specialty advisory firm to work with when considering a DST 1031 exchange.

In addition, all investors are strongly encouraged to thoroughly read the entire Private Placement Memorandum of any DST investment, paying special attention to the risk section prior to investing. Please remember that the Internal Revenue Code Section 1031 is a complex tax code therefore you should consult your tax or legal professional for details regarding your situation prior to considering an investment or exchange.

1031 DST Properties Are Illiquid

Unlike stock shares and other liquid investments which can be bought and sold seemingly with just a couple clicks of a mouse, Delaware Statutory Trust interests are centered around real estate. Real estate investments typically cannot be sold in a day, week, or even a month. Real estate requires time for due diligence, dealing with multiple parties and financial institutions. That’s why DST investments are considered illiquid investments which should be acquired and held for the full investment cycle. In addition, DSTs are part of a fractional beneficial interest in a trust that owns a large piece of illiquid real estate. Investors should be able and willing to hold their investment in a DST 1031 property for the full life of the program, which could last for seven to ten years or even longer.

In addition, investors should remember that DST investments each have their own unique business plan, and different asset classes have different overall business plans. That being said, most DST investments plan for a sale sometime within a five to 10-year period.

Our clients do occasionally (although rarely) find themselves in a need for cash and want to liquidate their interest in a DST investment. These investors can potentially benefit from the opportunity to sell their DST 1031 investments early on the KPI Secondary Market.

There is no guarantee that an investor will be able to find another investor who will want to buy the investor’s DST interest at an agreed upon price. It is a thinly traded market. Even with a DST specialty investment firm like Kay Properties & Investments, that has literally tens of thousands of real estate investors in its network, there’s absolutely no guarantee that a buyer and seller match can be made. Therefore, Delaware Statutory Trust properties again are to be considered illiquid investments and should only be purchased if an investor is able and willing to hold the investment for the full life of the DST offering which may be for 5-10 years or even longer.

Examples of Delaware Statutory Trust Investment Properties

To get a better idea of what a typical Delaware Statutory Trust 1031 property investment might look like, along with some of the pros and cons, make sure to look at some actual DST property investment examples below.

It's important to note that the following properties are fully subscribed DST examples and not available for investment and future offerings will vary. These are Regulation D Rule 506(c) DST offerings. If you'd like to see a list of currently available DST properties for 1031 exchange and direct cash investments from typically over 25 different DST sponsor companies with anywhere from 20 to 40 different DST offerings, please visit and register at www.kpi1031.com for current inventory.

For more information on DSTs and 1031 exchanges please visit www.kpi1031.com You will receive access to articles, blog posts, videos, white papers and more.

Get a FREE book on Delaware Statutory Trust properties and 1031 exchanges PLUS a complimentary list of current DST 1031 properties, just complete the form on this page to register for access.

If you would like to discuss the potential benefits and risks of investing in Delaware Statutory Trust properties through a 1031 exchange or as a direct cash investment with a DST 1031 expert, schedule a consultation or call 1-855-899-4597 today.

*Diversification does not guarantee profits or protect against losses.