By Dwight Kay, Founder and CEO, Kay Properties and Investments

Investors often must juggle multiple investment options, like where to invest and with whom. When it comes to evaluating a Delaware Statutory Trust or DST investment, real estate investors should look for a firm that specializes in DST investments to help ensure their 1031 Exchange is executed, with no detail being dropped.

One of the most important reasons investors need to carefully research any Delaware Statutory Trust company is because 1031 Exchange investment decisions need to be made within a tight timeframe, and within strict IRS requirements. These are not easy decisions to make within the timeframe, as they require careful assessment and specialized know-how of both the 1031 Exchange and DST industries.

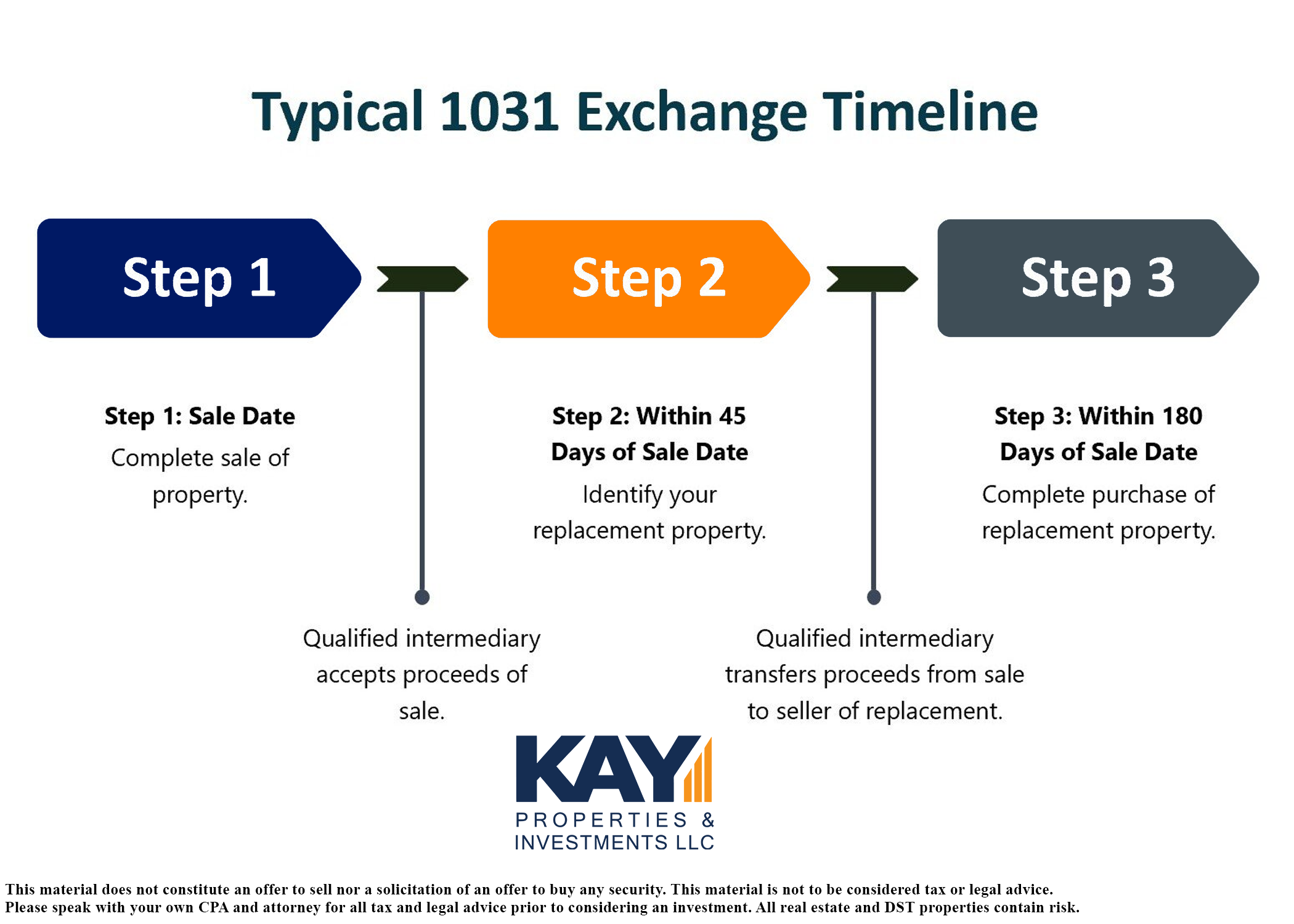

1031 Exchange Timeline Considerations

The IRS timeline on a 1031 exchange can be extremely challenging, including completing the following steps within the specified timeframe as outlined under Section 1031 of the United States Internal Revenue Code:

- Investors must purchase another “like-kind” investment property

- The replacement property must be of equal or greater value

- Investors must invest all the proceeds from the sale (i.e. the sale cannot receive any “boot”.) NOTE:A boot is a portion of the sales proceeds you receive from a 1031 exchange that isn’t re-invested in a replacement property. For example, if you sell a property for $200,000 but only re-invest $180,000, the $20K difference is known as boot.

- The investor must be the same title holder and taxpayer

- Investors must identify new property within 45 days

- Investors must purchase new property within 180 days

How Knowledgeable is your Delaware Statutory Trust Company?

One of the greatest benefits a working with a specialized and skilled Delaware Statutory Trust brokerage company is that they can provide investors not only expert advice and insight into the various property options, but also provide advice on building a conservative, customized, and diversified portfolio for their investor’s. Some firms advise investors to select risky businesses like hospitality, senior care, and oil & gas industries for 1031 exchange property options. Firms like Kay Properties & Investments is focused on building conservative, customized, diversified portfolios for their clients, doing everything possible to minimize risk.

Another important investment criterion investors should consider when a DST 1031 exchange, is does the firm provide 1031 Exchange investors a diversified menu of real estate assets from which they may choose, rather than forcing them to pick from limited options.

Kay Properties has access to the marketplace of DSTs from working closely with more than 25 DST sponsor companies. This allows investors to close their 1031 Exchange in little as 2-3 days, and invest in quality assets within the multifamily, net-lease, self-storage, industrial and manufactured housing sectors. In addition, Kay Properties offers the industry the largest inventory of custom debt-free DSTs while other firms only have 1 or 2 available. In addition, Kay Properties provides its clients a cash-out refinance option for those investors seeking potential liquidity.

Are They Offering a Breadth of Investment Options?

One of the concerns with having limited investment options is that investors may choose to invest their money in a particular investment not because it is necessarily the most suitable available in the market, but simply because it is the best option amongst those presented to them. For example, Apple and Microsoft are often considered by some to be well managed and profitable companies, but if those were the only options presented to a stock investor by their financial advisor, that investor would not necessarily know about other companies sometimes considered by others to also be well managed and profitable in which they could diversify their holdings, such as Amazon, Google, Netflix, etc… The same is true in the world of Delaware Statutory Trust brokers.

Many 1031-exchange investors are sometimes introduced to DST 1031-exchanges by someone that only has access to one or two DST properties and/or who has very little experience/knowledge in completing and evaluating 1031 DST exchanges.

What About the Education Process for DST 1031 Investors?

Because the Delaware Statutory Trust 1031 IRS laws can be confusing, the best Delaware Statutory Trust broker should offer investors educational tools to help them find the right DST investment vehicle. In addition, a good DST 1031 firm should also possess extensive knowledge about the different types of DST options, and be able to share this knowledge so that their client can pick the right property that meets their goals and objectives, be it in terms of tax deferrals or benefits and of course potential returns. And – depending on your unique goals and objectives – an excellent DST broker may help you select DST investments as you consider all three: potential income, potential capital preservation, and capital appreciation potential.

Click to Enlarge

Kay Properties has one of the most (if not the most) robust 1031 Delaware Statutory Trust educational platforms in the nation. Some of these educational tools include:

- DST 1031 Conference Calls

- 1031 Exchange Delaware Statutory Trust Seminars and Workshops

- Vast Library of DST blog articles where investors can learn about DST trends, transactions, and insights

- A Regularly Updated Library of Podcast Episodes dedicated to DST 1031 exchanges

What Does their Track Record Say?

Another good idea for investors who are looking for the right Delaware Statutory Trust company should do is to examine the track record of any firm you are thinking of working with to determine whether they have extensive experience with DST 1031 investments. A long track record suggests they have acquired the necessary financial skill set and industry expertise which can help them evaluate several options to help you pick the right one. Plus, with years of experience in the DST sector, the best DST companies boast of a broad network of DST sponsors, offering you many options to choose from.

Kay Properties & Investments is considered one of the most experienced and knowledgeable investment firms in the country specializing in Delaware Statutory Trust (DST) and private equity real estate investments. The firm was established in 2010 with the emphasis on providing real estate investment options to high-net-worth clients looking for passive real estate ownership. In addition, Kay Properties believes it has created one of the largest 1031 exchange and real estate investment online marketplaces in the country that generates some of the largest DST 1031 investment volume in the United States. In 2021, for example, Kay Properties clients participated in thousands of transactions, and the $610 million of equity invested through the Kay Properties platform was invested in more than $8 billion of real estate offerings totaling approximately 50 million square feet of multifamily, manufactured housing, single tenant net lease, industrial, self-storage and medical properties nationwide.

Besides a deep network, what accredited investors deserve is an experienced and knowledgeable 1031 Delaware Statutory Trust broker that can provide them with valuable insight, guidance, and access to a large amount of diverse DST properties from many different DST sponsor companies. Kay Properties, a national Delaware Statutory Trust (DST) investment firm, is such a DST broker.

What to Look for When Searching for a Delaware Statutory Trust Company?

|

What to Look for? |

What does this mean? |

What Questions to Ask? |

|

Make sure the firm is hyper-specialized in DST 1031 Investments |

A true DST specialist firm will have participated in billions of dollars of DST investments and be able to provide clients custom options to satisfy their specific, unique needs. |

Kay Takeaway: Ask how many DST 1031 deals the firm has successfully completed. |

|

Make sure you use a firm that has an entire team of DST 1031 professionals |

It’s important to understand how the concepts of debt replacement, lease structuring, diversifying real estate portfolios, etc. are relevant to any 1031 exchange. A true DST 1031 expert will be able to explain these and other terms in great detail. |

Key Takeaway: Ask very specific questions and demand very specific answers. |

|

Make sure you use a firm that is very particular with their DST properties |

Many firms that don’t specialize in DST properties encourage investors to look at assets that have higher risk, overly priced, and little performance data. |

Key Takeaways: Ask where the advisory firm sources their properties for 1031 exchanges, and what type of due diligence they have performed on the properties. |

|

Make sure to use a firm that has some of its own skin in the game. |

Smart investors work with DST 1031 advisory firms who invest their own money in the investments they are selling. |

Key Takeaways: Ask if your advisory firm personally invests in the specific properties they are advising other people to invest in. |

What Kay Properties Can Do for You?

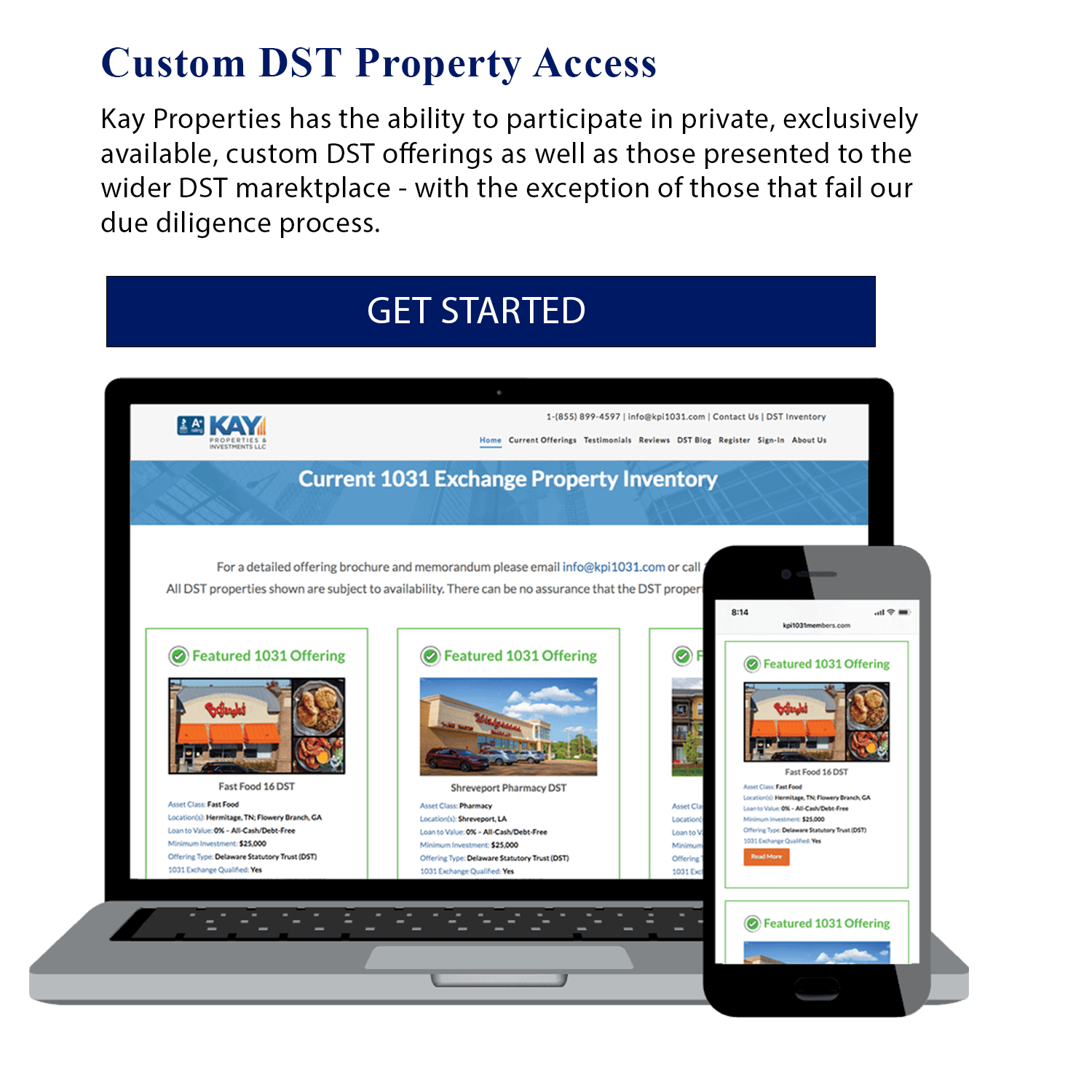

One of the tremendous resources offered to investors by Kay Properties is the kpi1031.com online marketplace. The www.kpi1031.com platform provides access to the marketplace of DSTs from over 25 different DST sponsor companies, custom DSTs only available to Kay clients, independent advice on DST sponsor companies, full due diligence and vetting on each DST (typically 20-40 DSTs) and a DST secondary market. Kay Properties team members collectively have over 150 years of real estate experience, are licensed in all 50 states, and are 1031 exchange DST brokers who have participated in over $30 Billion of DST 1031 investments.

Sophisticated real estate investors know that choosing the right DST broker is critical when looking to place their 1031-exchange or cash-investment dollars into a DST.