Cracking the Code: Understanding the Pros and Cons of Delaware Statutory Trusts for 1031 Exchange Real Estate Investors

By Dwight Kay, Founder and CEO, Kay Properties and Investments

In the realm of real estate investing, the 1031 exchange Delaware Statutory Trust can provide savvy real estate investors a unique opportunity to achieve passive management, the potential for regular monthly distributions, and a way to enter one of the most tax efficient real estate investment strategies available today. One of the best ways to maximize this real estate investment strategy is by first understanding the pros and cons of the Delaware Statutory Trust.

This article will jump right into three specific advantages and three disadvantages associated with DST 1031 exchanges and provide a comprehensive look into this popular investment strategy.

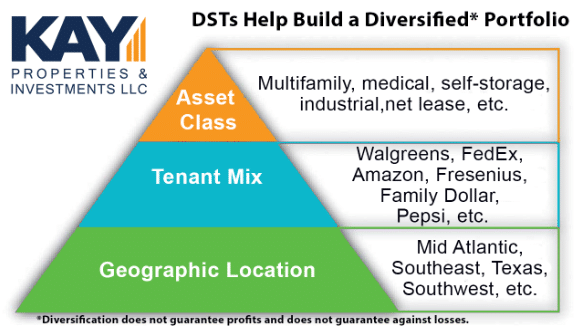

DST Pro #1: Diversification

One of the primary potential benefits of a DST 1031 exchange is diversification*. Typically, Kay Properties works with Delaware Statutory Trust investors who have a net worth that can range anywhere from approximately $2 million to $25 million (although some of our investors have assets totaling far above $100 million).

But just how do Delaware Statutory Trusts help investors achieve potential diversification? Let’s say an investor were to purchase a single property with their entire 1031 exchange proceeds. This might mean they are using a substantial amount of their total net worth in the exchange, and potentially be over-concentrating their net worth into a single asset. For example, an investor with a $5 million dollar net worth, excluding their primary residence, purchasing via a 1031 exchange a property worth $3.5 million. This would be considered a classic case of an investor overconcentrating into a single property and taking on a much higher level of risk to their net worth than they are aware of.

On the other hand, one of the benefits of Delaware Statutory Trusts is that they are designed around the fundamental investment strategy of “not putting all your eggs into a one basket.” Delaware Statutory Trust properties enable investors to diversify* their equity proceeds across multiple properties, thus creating the potential for a more diversified portfolio. This diversification extends across different asset classes, such as medical facilities, multifamily units, self-storage, manufactured housing, industrial properties, and long-term net lease buildings. Moreover, DST investors potentially benefit from diverse tenants, including well-known companies like Walgreens, CVS, FedEx, UPS, Amazon, Fresenius, DaVita, and more. Geographic diversification is also possible, as investors can spread their holdings across various states, cities, and sub-markets, potentially mitigating the risk associated with a single location.

*It is crucial to understand that diversification does not guarantee profits or shield investors from losses. While diversification is a prudent strategy, it does not eliminate investment risks.

If you are interested in learning more about how Delaware Statutory Trust investments can help create a diversified* portfolio, make sure to read this article.

DST Pro #2: 100% Passive Investment

Another distinct advantage of DST 1031 exchanges is that they offer investors the ability to move from an active property management role into a purely passive investment opportunity. Unlike managing properties independently, where owners must constantly deal with the “3 T’s of Tenants, Toilets, and Trash”, DST investors can rely on the DST sponsor company to oversee the daily responsibilities of property and asset management. In this way, DST properties eliminate the need for investors to deal with tenant issues, property maintenance, and other operational decisions.

This is important, especially for investors who are nearing or at retirement age and are looking for a way to get out of the daily responsibilities of property ownership. Delaware Statutory Trust investments allow investors to enter the world of a purely passive investment option that often allows investors to enjoy the benefits of real estate ownership without the burdens of day-to-day management. Many of our clients at Kay Properties enjoy the ability to spend more time with their grandchildren, traveling, or even taking up new hobbies once they have removed themselves from an active property management role.

It's worth noting that while other 1031 exchange options as triple-net lease buildings may appear to be more passive than say managing an apartment building or self-storage facility, these assets still require some level of active involvement from property owners.

Here is a good article that describes how Kay Properties helped a Southern California physician eliminate active management in order to spend more time with his family.

DST Pro #3: Pre-Packaged Investments

Another very important advantage Delaware Statutory Trust 1031 exchange properties provide investors is that they are pre-packaged investment opportunities. This means that the Sponsor has typically already completed all of their property analysis, completed all of the third party reports (such as appraisal, property condition report, environmental report, etc), closed on the property and lastly prepared all of the necessary documents for investors to review prior to making an investment decision. In this way, investors can use a DST property as a reliable option for their 1031 exchange as the property and offering are typically all completed for an investor. The pre-packaged nature of the Delaware Statutory Trust process allows investors to enjoy relatively quick closings - often within 3-to-5 business days. This can be especially beneficial for investors who are facing a tight 45-day identification period.

Make sure to read this article about other ways investors can use Delaware Statutory Trust properties for their 1031 exchange.

Kay Properties has typically has anywhere from 20 to 40 Delaware Statutory Trust offerings from over 25 different sponsor firms. Please review our full property menu on the www.kpi1031.com marketplace where investors can select a variety of pre-packaged DST property offerings that potentially best align with their investment goals. As an investor, you have also the opportunity to review all the information that is available via the Private Placement Memorandum (PPM), which includes items as the business plan, risk factors, and other pertinent investment topics that will help investors to determine if this investment choice is right for them.

DST 1031 Exchange Cons

Con #1: Lack of Control

The first notable disadvantage of a DST investment for 1031 exchange investors is the lack of control. Investors in DSTs relinquish their ability to make day-to-day decisions regarding property management. That means that as a DST investor, you’re not going to be able to decide when to resurface the parking lot or what color to paint the walls or even what tenants to rent to. Instead, the DST trustee, typically an affiliate of the DST sponsor company, takes charge of these decisions. While this lack of control can be advantageous for those seeking a truly passive investment, it can be considered a con to some investors who prefer a very hands-on involvement in managing their real estate assets. If you desire control over property-related decisions, Delaware Statutory Trust properties might not align with your investment goals.Con #2: Leverage Associated with DSTs - “Be Careful of the DST debt!”

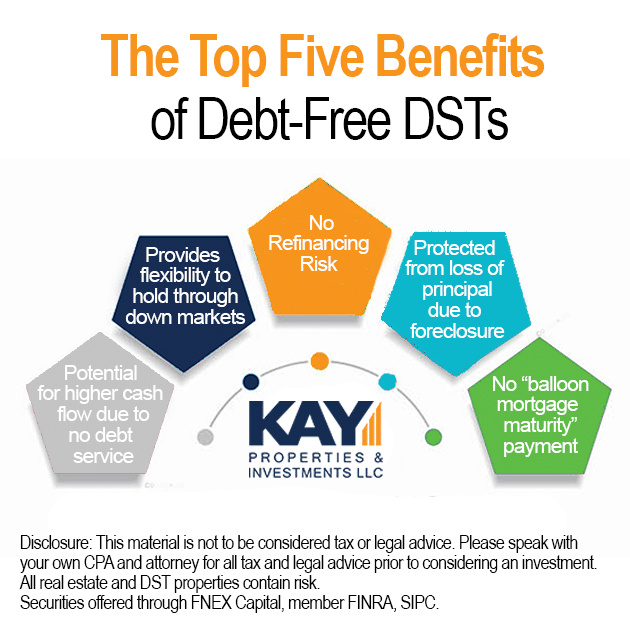

Most DSTs in the market carry leverage (debt), which can be a double-edged sword. For those investors who are needing to replace debt via a 1031 exchange, this leverage can be potentially advantageous. However, for investors who have spent years or even decades methodically paying off the mortgages of their investment properties and therefore are selling it free-and-clear, a Delaware Statutory Trust with leverage can be a major con because it exposes investors to the possibility of lender foreclosure, which could result in a complete loss of investor equity.

Also, let’s say an investor who is debt-free decides to invest into a DST property with a 50% loan-to-value ratio. Now imagine that same DST sells 4 – 7 years later, and it has appreciated in value (although there is never any guarantees in real estate or DST investments and there is always the potential for investors to lose money). But let’s say in this hypothetical property sells at a gain. Now, to complete another 1031 exchange, the investor is going to have to purchase a property of equal or greater value and take on more debt, thus putting the investor in the same position they were before they paid off their original mortgage. That’s why this can be considered a major disadvantage for investors who had previously owned their properties free and clear and wish to maintain a debt-free status. So it is recommended that if a client was debt free on the down-leg (relinquished property) that they should stay debt free on the up-leg (replacement property) and therefore should strongly consider only all-cash/debt-free DST investments.

Kay Properties has created a robust menu of properties on its www.kpi1031.com marketplace that includes a substantial number of 1031 exchange eligible DST properties that are debt-free with no risk of lender foreclosure.

Make sure to read this article on other reason 1031 exchange investors should consider debt-free DST offerings.

DST Con #3: No Guarantees

Like all real estate investments, there are no guarantees with it comes to investing in Delaware Statutory Trusts. That means there are no guarantees of monthly cash flow or property appreciation. Afterall, DST investments are based in real estate investment fundamentals, and real estate never has any guarantees. There are no guarantees that property values will rise, and over the course of history, there are many examples when we’ve seen property values fall. Think back to the Great Financial Crisis of 2008, 2009, and 2010. That is why it’s very important to thoroughly review the Private Placement Memorandum, respective business plan, and associated risk factors surrounding any Delaware Statutory Trust investment. In addition, Kay Properties always recommends that investors discuss any DST investment with their Certified Public Accountant, attorney, and family members before investing as DST investments are subject to market fluctuations and unforeseen circumstances, and investors should be prepared for the potential absence of guaranteed returns.

Conclusion:

As you can see, Delaware Statutory Trust 1031 exchange investments offer various potential pros and advantages, including diversification*, passive investment opportunities, and the convenience of being pre-packaged for 1031 exchange completion. However, they also present cons and challenges such as the lack of control, the presence of leverage in many DSTs, and the absence of guarantees as found in any real estate investment. That’s why investors considering DSTs should carefully weigh these pros and cons, conduct thorough review and analysis of any DST property, and seek guidance from experienced professionals to make informed investment decisions.

As you can see, Delaware Statutory Trust 1031 exchange investments offer various potential pros and advantages, including diversification*, passive investment opportunities, and the convenience of being pre-packaged for 1031 exchange completion. However, they also present cons and challenges such as the lack of control, the presence of leverage in many DSTs, and the absence of guarantees as found in any real estate investment. That’s why investors considering DSTs should carefully weigh these pros and cons, conduct thorough review and analysis of any DST property, and seek guidance from experienced professionals to make informed investment decisions.

Kay Properties has participated in more than $30 billion of DST investments from more than 25 different DST sponsor firms and has helped thousands of investors complete 1031 exchanges into Delaware Statutory Trust investments.

For more information, please register for your FREE Listings Guide of 1031 Exchange DST properties, as well as your FREE book, “An Introduction to DST Properties for 1031 Exchange Investors” by visiting https://www.kpi1031.com/free-listings-1031-exchange-properties/.