Recently, Dwight Kay, founder and CEO of Kay Properties, sat down to discuss in detail some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace at www.kpi1031.com for accredited investors for their 1031 exchange or direct cash investments. These DST 1031 properties are just a handful of current offerings from approximately 20-40 different DST offerings available from roughly 25 DST sponsor companies. One of these current offerings is the Kay Net Lease Distribution 64 Delaware Statutory Trust in Frankfort, NY.

Key Investment Highlights of the Net Lease Distribution 64 Delaware Statutory Trust Offering

Brand New Construction:

This industrial DST 1031 exchange property has several interesting aspects to it that make it attractive as a Delaware Statutory Trust property for 1031 exchange and direct cash investors. For example, Net Lease Distribution 64 Delaware Statutory Trust is a brand new industrial distribution warehouse DST consisting of 61,000 square feet of industrial warehouse capacity that was purchased directly from the developer.

100% Occupied with 10-Year Long-Term Net Lease in Place

The Net Lease Distribution 64 Delaware Statutory Trust offering also has a long-term 10-year net lease in place that was recently initiated by Pepsi.

Listen to more about net lease assets for Delaware Statutory Trust 1031 investments in this recently recorded podcast.

Strength of Tenant:

This unique distribution facility is 100% occupied by Pepsi, a global leader in convenient foods and beverages. PepsiCo products are enjoyed by consumers more than one billion times a day in more than 200 countries and territories around the world. PepsiCo generated $79 billion in net revenue in 2021, driven by a complementary beverage and convenient foods portfolio that includes Lay’s, Doritos, Cheetos, Gatorade, Pepsi-Cola, Mountain Dew, Quaker, and SodaStream. PepsiCo’s product portfolio includes a wide range of enjoyable foods and beverages, including iconic brands that generate more than $1 billion each in estimated annual retail sales.1

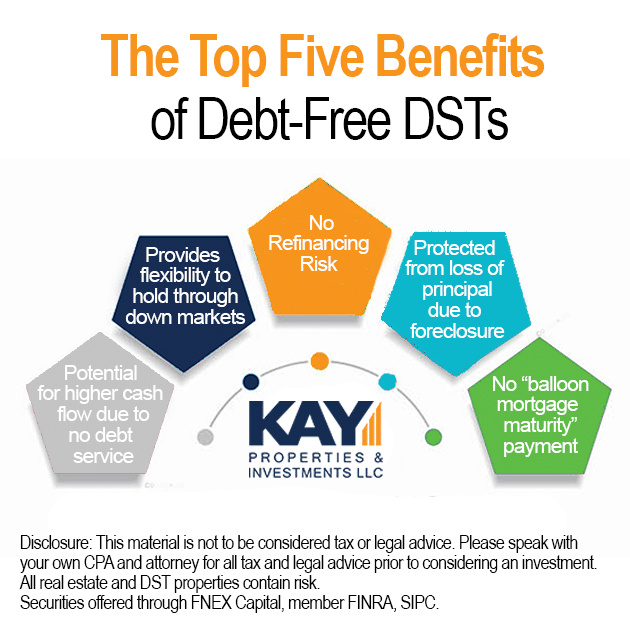

Debt-Free Delaware Statutory Trust Offering

The Net Lease Distribution 64 Delaware Statutory Trust was purchased as a debt-free DST asset. This is important for many reasons including:

- Debt-Free DST Assets Provide Investors with Zero Risk of Lender Foreclosure.

DSTs without debt are considered by many to have a much lower risk profile than those with leverage. Debt-free DSTs have zero risk of lender foreclosure, protecting investors from a complete loss of principal invested. Also, debt-free DSTs provide protection from a balloon payment associated with loan maturity, which many real estate firms are very concerned about in today’s market. - Debt-free DSTs Give Sponsors More Flexibility to Respond to Unforeseen Circumstances.

On a leveraged property, many asset management and leasing initiatives require lender approval before they can be executed. This limits the real estate operator in the speed at which they can operate the property and, at times, may limit the options available to them. In a debt-free DST setting, however, there is no lender that needs to approve an asset management or leasing initiative, so the sponsor has the ability to potentially act quickly on behalf of the property and, thereby, investors. - Debt-Free DSTs Have No Monthly Debt Service to a Lender.

A leveraged DST has monthly debt-service payments that must be made first and in full each month, allowing remaining funds to be paid out to investors. In economic downturns, an asset’s revenues may be reduced. The equity investors in a leveraged DST bear the burden of this revenue reduction because debt-service payments must still be made, potentially impairing investor monthly distributions. - Debt-Free DSTs Provide Investors the Ability to Diversify a Portion of Their Portfolio into Unlevered Assets to Lower Potential Risk.

Many entrepreneurs who have invested heavily in the stock/bond markets turn to all-cash/debt-free Delaware statutory trust properties as a strategy to diversify away from stocks and bonds. Since these products do not contain the risks of a loan, they are especially interesting to direct cash investors. - Debt-Free DSTs Protect Investors From Lender Cash-Flow Sweeps Associated with Tenant Credit-Rating Fluctuations.

In the event a tenant’s credit rating decreases, under certain loan terms, the lender would have the right to sweep the cash flow until the tenant’s credit rating improves. This is a major risk found in many net lease DST offerings with leverage. In a debt-free DST, if the tenant’s credit rating gets lowered, there is no lender to effectuate a cash-flow sweep, thereby potentially protecting investors’ monthly distributions.

Location:

Frankfort, NY is uniquely qualified as a good location for distribution warehouse operations it is strategically located in the Mohawk Valley region of New York that has major transportation arteries important for efficient distribution operations, including Interstates 90 and 87. In addition, the location is also close to Griffiss International Airport in Rome, NY, which provides significant air cargo services.

Industrial Real Estate for Delaware Statutory Trust Investments

Obviously, there are a number of different Delaware Statutory Trust 1031 asset classes that investors could consider investing in. For example, there is multifamily, office, retail, single-tenant net lease, and industrial properties. However, Kay Properties has participated in more than $30 billion of DST 1031 real estate property investments over the years, so there are some assets that should be avoided and others that have demonstrated more resilience over time than others. One of those asset classes is industrial real estate.

While it must be noted that past performance does not guarantee future results, Kay Properties feels industrial real estate has several factors that make it a potentially attractive investment option for Delaware Statutory Trust investors.

Rental Rates

First and foremost is rental rates. The average asking rates in 2023 rose 20.6% year over year due to an imbalance between supply and demand.. There's just a lot of increased demand for industrial real estate and not as much supply. While new supply is coming online, this new supply has already been absorbed, which is why rental rates continue to rise. So that really bodes well for the owners of industrial real estate, which is one of the reasons why Kay Properties likes industrial real estate.

Low Vacancy Rates

The average vacancy for industrial real estate nationwide is approximately 3.8%, with many markets maintaining a sub 2%vacancy rate. Really anything that's 10% or less vacancy, we would consider relatively healthy. Kay Properties believes in DST 1031 assets with as low of a vacancy rate as possible because that just shows again there's a lot of demand for that particular type of real estate.

Growth trends

Everybody is familiar with the astronomical growth of e-commerce. The number of people buying and shopping online today as compared to 10 years ago, it's staggering. With Amazon, purchasing online, and all the online retailers, there is a huge amount of growth in e-commerce.

Essential Businesses Need Industrial Real Estate

Many DST 1031 exchange real estate assets did not hold up well during the COVID-19 pandemic. However, the one asset class that continued to perform well during this global health crisis was industrial real estate. That is because the majority of tenants occupying industrial DST properties were essential businesses. Many industrial tenants were deemed essential businesses during the COVID-19 pandemic and therefore remained open and paying rent to DST investors each and every month. And obviously, past performance does not guarantee future results, but being that the industrial asset class has some pretty favorable statistics and favorable growth trends behind it, Kay Properties feels that industrial real estate like the Net Lease Distribution 64 Delaware Statutory Trust could potentially make a lot of sense for DST investors and should be considered when thinking about utilizing the Delaware Statutory Trust for 1031 exchange or direct cash investment.

More about PepsiCo here: 1 https://www.pepsico.com/who-we-are/about-pepsico

*Diversification does not guarantee profits or protect against losses.