By Orrin Barrow, Senior Vice President, Kay Properties and Investments

In the world of Delaware Statutory Trust investments, the position of Senior Vice President plays an important link between the client, the investment real estate asset, and the sponsor company who is presenting potential offerings. Over the course of the past several years as a Senior Vice President with Kay Properties and Investments, I have worked with hundreds of clients on their 1031 Exchanges and Delaware Statutory Trust investments, helping educate them on both the pros and cons of DST investments. It is from this very hands-on experience that I have garnered a wealth of insights and lessons that could help all real estate investors navigate the world of Delaware Statutory Trusts and 1031 Exchange investing.

Now, let's delve into the top 5 things I have learned as a Senior Vice President for Kay Properties and Investments

Practice Strategic Portfolio Diversification:

A key lesson I have learned is the importance of diversifying real estate portfolios. While diversification does not guarantee protection against losses or appreciation, spreading investments across a variety of options is considered a prudent strategy for many seasoned investors. This is one reason investors like Delaware Statutory Trust investments because they allow investors to build potential diversification by investing across multiple asset classes, submarkets, and sponsor companies.Practice the Debt-Free Thesis Whenever Possible

Generally speaking, DSTs without debt are considered a much lower risk profile than those with leverage. Debt-free DSTs have zero risk of lender foreclosure protecting investors from a complete loss of principal invested. Also, debt-free DSTs provide protection from a balloon payment associated with loan maturity. Another reason to stay debt-free involves exit strategy flexibility. Most commercial loans are structured for 10 years. However, in many cases these loans are structured with 30-year payment schedules (like traditional home loans). This means that at the end of the ten-year period investors will likely be presented with a 20-year balloon payment. Generally speaking, DSTs without debt are considered a much lower risk profile than those with leverage. Debt-free DSTs have zero risk of lender foreclosure protecting investors from a complete loss of principal invested. Also, debt-free DSTs provide protection from a balloon payment associated with loan maturity. Another reason to stay debt-free involves exit strategy flexibility. Most commercial loans are structured for 10 years. However, in many cases these loans are structured with 30-year payment schedules (like traditional home loans). This means that at the end of the ten-year period investors will likely be presented with a 20-year balloon payment.

Kay Properties believes that if an investor is debt free, they should remain debt free. For example, those investors who are at or near retirement have typically paid off their investment property (properties), and would be wise to not increase their risk potential by investing in properties with a mortgage. Many of my clients do not want the burden of extra debt, and therefore choose to purchase debt-free DSTs in the multifamily, self-storage and net lease asset classes.

Kay Properties provides access to more debt-free Delaware Statutory Trust offerings than any other real estate investment firm on its www.kpi1031.com platform.

Always Use a Highly Qualified Intermediary / Accommodator

When completing an exchange many investors are not aware that they must retain the services of a Qualified Intermediary (QI). QI’s which are also called Accommodators is the organization that takes constructive receipt of 1031 exchange proceeds on your behalf. However, unlike banks, insurance agents or stock brokers, there is no national standard or federal supervision for Accommodators. In fact, in some states, QIs are not required to be licensed, bonded or insured! even though the IRS requires a qualified intermediary to hold your 1031 exchange funds! Make sure to do a thorough job of researching any Qualified Intermediary before retaining their services, even if they were referred to you by word of mouth. Do your own research for every QI that you’re considering. One source that might be helpful when searching for a reputable Accommodator is the Federation of Exchange Accommodators, which is a trade association for QIs.Avoiding Certain Asset Classes

When it comes to investing in Delaware Statutory Trusts and 1031 Exchanges, investors should understand that not all asset classes are equal. Typically, Delaware Statutory Trusts include core real estate asset classes such as retail, multifamily, net lease distribution centers, medical office buildings, and self-storage facilities. However, when it comes to evaluating which asset classes to include in Delaware Statutory Trust investments, the process should start with asset class rejection. While all real estate investments contain the potential for risk, understanding which asset classes to avoid when investing in a Delaware Statutory Trust can potentially help mitigate excessive risk associated with specific types of real estate assets. Over the years as a real estate investment advisor, there are certain classes that I typically don’t advise my clients to pursue.These include:

- Senior care and memory care facilities

- Hospitality (hotels and motels) assets

- Student housing complexes

- Oil and gas holdings

Kay Properties has a complete platform for real estate investors including providing access to its www.kpi1031.com marketplace of Delaware Statutory Trust properties from more than 25 DST sponsor companies.

Picking the right Delaware Statutory Trust Advisory Firm

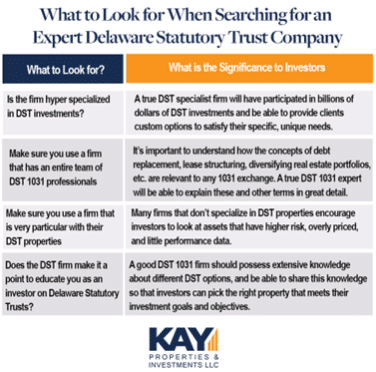

One of the most important reasons investors need to carefully research any Delaware Statutory Trust company is because 1031 Exchange investment decisions need to be made within a tight timeframe, and within strict IRS requirements. These are not easy decisions to make within the timeframe, as they require careful assessment and specialized know-how of both the 1031 Exchange and DST industries. That's why one of the most important criteria investors should identify is whether the firm is hyper specialized in the Delaware Statutory Trust investment arena. If your advisor is not a real estate expert with working 1031 knowledge and has millions of dollars of transactions under their belt, they should not be your DST advisor. Your advisor should have a comprehensive real estate research and analysis platform to avoid uncertain sponsors and asset classes. The advisor should also have a wide inventory of DSTs to choose from including off market and private label DSTs. Finally, your advisor should also be invested into DSTs as a part of their own financial portfolio. If they believe in the product, they should be willing to eat their own cooking, so to speak.

Kay Properties & Investments is considered one of the most experienced and knowledgeable investment firms in the country specializing in Delaware Statutory Trust (DST) and private equity real estate investments. The firm was established with the emphasis on providing real estate investment options to high-net-worth clients looking for passive real estate ownership. In addition, Kay Properties believes it has created www.kpi1031.com, one of the largest 1031 exchange and real estate investment online marketplaces in the country that generates some of the largest DST 1031 investment volume in the United States.