By Dwight Kay, Founder & CEO of Kay Properties & Investments Kay Properties & Investments is a fully integrated real estate investment firm that is an expert at sourcing deals, closing acquisitions, and performing necessary due diligence/analysis on Delaware Statutory Trust properties for 1031 exchanges and direct-cash investments. While no one has a crystal ball and can predict the performance of any real estate asset, we are encouraged by one corporation that leases thousands of … Read More

DST CASE STUDY: How Kay Properties Helps Investor Complete 15 DSTs in 30 Days

Key Takeaways: Kay Properties registered representatives spent more than one year educating the client on DST investments. Kay Properties worked closely with client’s CPA and real estate attorneys to create a custom investment strategy that fit perfectly with the client’s specific goals. Kay Properties created a workflow plan that achieved the closing of 15 DST investments in 30 days without a hitch. Background: A high-net worth accredited investor spent more than 40 years building a … Read More

How Delaware Statutory Trust Investments Can Play an Important Part of Wealth Preservation

By Jason Salmon, Senior Vice President and Managing Director of Real Estate Analytics, Kay Properties & Investments Key Takeaways: Delaware Statutory Trust Investments Help Investors Defer Capital Gains Taxes Real Estate Investments Are Popular for Building Generational Family Wealth Delaware Statutory Trusts Offer the Potential for Step-Up in Basis Tax Benefits Delaware Statutory Trusts Offer Investors the Ability to Enjoy More Free Time Many people believe that the best thing about a Delaware Statutory Trust … Read More

The Importance of the Private Placement Memorandum (PPM) for Delaware Statutory Trust 1031 Exchange Investors

Key Takeaways: PPMs are part of all Delaware Statutory Trust Investments PPMs provide investors a full picture of the overall investment, including the potential risks PPMs include important information for investors including the DST trust agreement, summary of third-party reports, lease agreements, and most recent property appraisal. All Kay Properties Delaware Statutory Trust 1031 Exchange real estate investments must be accompanied by a unique Private Placement Memorandum (PPM) as part of its due diligence and … Read More

Consider These Potential DST 1031 Exit Strategy Options: Cash Out, 1031 Exchange or 721 Exchange

By Dwight Kay, Founder and CEO of Kay Properties and Investments One of the most important questions all real estate investors should ask themselves is, “What is my long-term strategy?” In the case of Delaware Statutory Trust (DST) investors, exit strategies come into play once the investment period has concluded, or gone “Full Cycle”. Full Cycle is a term used to describe DST property that has been sold on behalf of investors after a period … Read More

Kay Properties & Investments Team of 1031 Exchange Experts Lead Bisnow Webinar on “Why Investors Choose DST Properties”

Presentation covers the top three reasons investment owners are selling their rental properties and looking for alternative investment strategies like Delaware Statutory Trust 1031 Exchanges Recently, Kay Properties & Investments 1031 Exchange experts Chay Lapin, President, and Orrin Barrow and Matt McFarland, Vice Presidents, recently participated in a Bisnow webinar where they discussed some of the most common reasons investment property owners are selling their investment real estate, and why Delaware Statutory Trust 1031 Exchanges … Read More

Picking the Right Delaware Statutory Trust Company

Investors often must juggle multiple investment options, like where to invest and with whom. When it comes to evaluating a Delaware Statutory Trust or DST investment, real estate investors should look for a firm that specializes in DST investments to help ensure their 1031 Exchange is executed, with no detail being dropped. One of the most important reasons investors need to carefully research any Delaware Statutory Trust company is because 1031 Exchange investment decisions need … Read More

Can I 1031 Exchange Out of a DST?

Key Takeaways: Investors can 1031 exchange out of their DST Investments What does it mean to have a DST 1031 exchange go Full-Cycle? Investors must conform to all of the 1031 rules when a DST goes Full-Cycle What is the Kay Properties DST Secondary Market? Many investors that have participated in or are considering a DST 1031 exchange with Kay Properties will oftentimes ask us, Is it possible to 1031 exchange out of a Delaware … Read More

Why Real Estate Syndication Is Important for Delaware Statutory Trust 1031 Exchange Real Estate Investors

Key Takeaways: How does Delaware Statutory Trust Syndication benefit investors? Why Real Estate Syndication via a DST can potentially reduce risk for investors*? What is the Portfolio Optimization and Diversification Theory? How real estate syndication and DST investments can help investors access larger real estate assets? Delaware Statutory Trust 1031 exchanges have never been more popular, and one of the reasons behind this growth and investor appeal is the power and flexibility of real estate … Read More

DST Essential Podcast: Case Study

Join us for the DST Essentials with Kay Properties along with Matthew McFarland, Senior Vice President and Tommy Olsen, Vice President for a conference call discussing a particular DST investor case study. We will be discussing: Investor DST Education The Importance of Staying Debt-Free DST Investment Customization Diversification Amongst Asset Classes Transcriptions Tom Wall: Hi everyone. Thank you for patiently waiting. My name is Tom Wall, a senior associate here at Kay Properties, and thank you … Read More

Custom Kay Properties DST Offering Goes Full Cycle on Behalf of Investors

One of Kay Properties Custom DST offerings located in Greenville, SC has gone full-cycle delivering an annualized return of 12.60%* after providing uninterrupted monthly distributions throughout the COVID-19 Pandemic (Torrance, CA December 21, 2021) Kay Properties & Investments, a national DST investment firm, announced another one of its debt-free DST investments has gone full cycle to deliver successful returns on behalf of investors. According to Dwight Kay, CEO & Founder of Kay Properties & Investments, … Read More

Kay Properties is Pleased to Announce Another Successful Return for Investors in a Custom, Debt-Free DST That Goes Full Cycle

Kay Properties announced another DST offering exclusively through Kay has gone full cycle to post solid returns for investors as the Delaware Statutory Trust offering in Tacoma, WA has sold for $9.9 million Key Properties, the nation’s leading Delaware Statutory Trust 1031 advisory specialist firm,had successfully brought one of its custom debt-free DST investments full cycle on behalf of a group of accredited investors. “Full Cycle” is the name used to describe a Delaware Statutory … Read More

Six Ways to Ensure Your 1031 Exchange is Successfully Completed

Whether you are an investor or a real estate broker, selling investment or business real estate can be an expensive venture unless you are prepared to conduct a 1031 exchange. Section 1031 of the federal tax code dictates that no gain or loss shall be recognized upon the sale of a real estate property held for business or investment purposes, as long as the seller purchases a replacement property of equal or greater value. This … Read More

Kay Properties & Investments DST Essentials Podcast on the DST Full Cycle Process

Listen to Kay Properties along with Carmine Galimi, Senior Vice President and Brent Wilson, Vice President for a podcast discussing in-depth the Delaware Statutory Trust full cycle process. We will be discussing: Full Cycle: Overview of what the DST life cycle means for Investors Hold Periods: Rundown of the DST variables and nuances which affect the process of selling Leveraged vs. Debt-Free DSTs: Held time expectations for investors DST Investor Process Transcriptions Nick Snyder: Hi … Read More

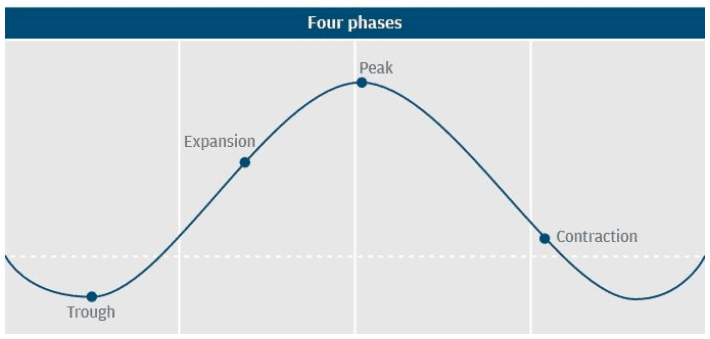

Investing Across Market Cycles and Delaware Statutory Trust Investments

Key Takeaways: What are the Four Stages of a Real Estate Cycle? What are some Current Macro Real Estate Trends Impacting Investment Real Estate? Why Should Delaware Statutory Trust Investors Be Aware of Current Real Estate Trends? One of the common topics that frequently pops up in investment conversations these days involves questions about what stage of the “real estate cycle” is the market currently in, and how does the current real estate market cycle … Read More

Why the Delaware Statutory Trust Specialist Can be a Real Estate Broker’s Best Friend

Key Takeaways: Why should real estate brokers present a DST 1031 Expert to their clients? Why is a DST 1031 perfect for a multifamily investor who is ready to sell their asset? What is “mortgage boot” and why should it be avoided? What do DST 1031 experts bring to the table for both the seller and real estate broker? Today’s multifamily market is bustling with activity as the number of owners and investors from Maine … Read More

DST Properties for Investors

Many investors turn to DST properties due to the tax benefits and the hands-off nature of managing the investment. Compared to a traditional real estate investment, DSTs allow investors to collect a more “passive income” while simply providing the capital necessary for the investment. In this article, you’re going to learn about DST investments and how to identify the best DST properties to invest in. What is a DST? DST stands for Delaware Statutory Trust … Read More

What is a Delaware Statutory Trust and Why So Many Real Estate Investors Are Interested in Them?

By Matt McFarland, Vice President, and Thomas Wall, Associate, Kay Properties & Investments We recently attended an Apartment Owners tradeshow and were surprised to hear many experienced investment property owners ask us the same questions throughout the afternoon. That’s why we thought it might be a good idea to write about what exactly were the three most commonly asked questions we heard during that conference that relate to DST 1031 exchanges, including: What is a … Read More

What is a Delaware Statutory Trust | Are DSTs Good Investments

By Dwight Kay, Founder and CEO, Kay Properties & Investments Are you a 1031 exchange investor who is confused about what is a Delaware Statutory Trust, and how it can potentially help you. If so, then read on because this article will not only tell you what a Delaware Statutory Trust is, how they can be used in a 1031 Exchange, and what are the key issues to consider prior to understanding are DSTs good … Read More

Kay Properties & Investments Has One of the Most (if not the most) Robust 1031 Delaware Statutory Trust Educational Platform in the Nation

Kay Properties & Investments believes firmly in education. In fact, many have said that no one in the country does more to educate accredited investors, and anyone interested in DST Investments for their 1031 exchange than Kay Properties does. With a comprehensive platform of educational options, Kay Properties is considered by many nationwide to be the preeminent authority and expert in DST 1031 exchanges and investment strategies. Interested in learning more about DST 1031 exchanges? … Read More

Kay Properties & Investments Helps Accredited Investor 1031 Exchange Into 15 Different Delaware Statutory Trust Investments within 30 Days

High net-worth investor decides to relinquish a portion of his rental property portfolio in a succession of sales before entering multiple DST 1031 exchanges to help achieve diversification, non-active management, and potential monthly income (Torrance, CA) Kay Properties & Investments successfully helped a high-net-worth client complete 15 Delaware Statutory Trust (DST) investments following the sale of five multifamily properties within a short period of time. “This particular client leveraged the full potential of Kay Properties … Read More

As seen in Forbes: The Ins and Out of Qualified Opportunity Zones

By Betty Friant, CCIM, Senior Vice President, Kay Properties & Investments It’s a great feeling when you sell some stock, a piece of real estate or the business you’ve poured your life into for a nice profit that puts a small fortune into your bank account. But then comes the tax bill to take a little bit of the bloom off that rose. It’s downright painful to hand your hard-earned money over to the government … Read More

Executive Women in Business: Betty Friant

Recently, Betty Friant, CCIM and Senior Vice President with Kay Properties was interviewed by the Mid-Atlantic Real Estate Journal as one of its featured Executive Women in Business. Below is a summary of their interview with Betty. Name: Betty Friant Title: Senior Vice President Company/firm: Kay Properties & Investments Years with company/firm: 5 Years Years in field: 29 Years Real estate organizations / affiliations: CCIM, FINRA licenses Series 22 and 63. Tell us how and when you … Read More

As Seen on WealthManagement.com: How to Build a Post-Pandemic Real Estate Investment Portfolio

It’s a good time to assess real estate investment opportunities. By Dwight Kay, CEO & Founder, Kay Properties & Investments, LLC As we emerge, fortunately, from the pandemic, including the recent Delta variant surge, it’s a good time to assess real estate investment opportunities if you’re looking to reinvest proceeds in a 1031 exchange transaction or seeking to invest cash as part of a diversified* financial portfolio strategy. Here’s how you could build a post-pandemic … Read More

Select a DST 1031 Expert and Avoid the Four Stages of 1031 Exchange Grief

Key Takeaways: What are the four stages of 1031 grief? Why a DST 1031 expert can help investors avoid major stress with the sale of real estate. What are the most important things to look for when choosing a DST 1031 Advisory Firm? Participating in a 1031 exchange can be challenging for many investors, which is why finding an experienced and knowledgeable professional is critical for anyone thinking about participating in a 1031 exchange. For … Read More

Houston Corporate Headquarters DST Investment Opportunity for 1031 Exchange and All-Cash Investor

Houston Corporate 49 DST The Houston Corporate 49 DST is an All-Cash/Debt-Free investment opportunity for accredited investors who are interested in investing in the corporate headquarters of Blinds.com, a subsidiary of Home Depot. The Houston Corporate 49 investment seeks to provide investors a risk-adjusted, durable income stream, with a debt-free entry point and multiple exit strategies for risk mitigation. The 107,923 square-foot building is 100% occupied by Blinds.com, and is secured by a long-term lease … Read More

Five Reasons Why Kay Properties Likes Houston – The Fourth Largest City in America and with Room to Grow

While Houston may have many nicknames that reflect the city’s culture (H-Town), climate (Bayou City), and chronology (Space City), Houston could also be called a “boom city” as it is also home to one of the fastest growing tech centers in the nation and to one of the most appealing markets for real estate investors. Why? Well, Houston has everything: the people, the diversity, the business climate, and a world-recognized center for energy, medicine, space, … Read More

Houston Multifamily DST Investment Opportunity for 1031 Exchange and Direct Investors

The Houston MultiFamily 42 DST Investment One of the most popular neighborhoods within the Houston city limits is called Montrose. Montrose is a unique pocket of Houston culture: a colorful collection of eclectic hipness and creatively minded neighborhood that is littered with cool restaurants, cocktail bars, art galleries, vintage clothing stores, and quiet shade covered parks. It is also home to the Houston Multifamily 42 DST, one of the many Delaware Statutory Trust investments offered … Read More

Kay Properties President, Chay Lapin featured on Millionacres Podcast to explain Delaware Statutory Trust Investments

Taxes can loom large in our lives but one of the great things about investing in real estate in the first place is that there are structures that can help. One of them is DSTs, Delaware Statutory Trusts. If you’ve never heard of these or you or are curious to learn more this is the podcast for you. Deidre Woollard interviewed Chay Lapin of Kay Properties covering what investors need to know about DSTs and … Read More

What is a DST Sponsor Company?

What is a Delaware Statutory Trust Sponsor Company? By: Alex Madden, Vice President, Kay Properties and Investments, LLC Many 1031 exchange investors have never heard of a DST Sponsor, what they are, or what they do. It is important for investors considering DST properties to understand the role of a DST sponsor and what they do. After reading this article, a 1031 exchange investor should have a better understanding of what a DST sponsor company … Read More

Founder & CEO, Dwight Kay Featured on Forbes.com for Insight on Utilizing Delaware Statutory Trust (DST) Investments for Potential Passive Retirement Income

The founder & CEO of Kay Properties and Investments, Dwight Kay, was recently featured in an article on Forbes.com regarding the potential benefits and risks of DST 1031 investments. The media, 1031 exchange investors, CPAs, Attorneys, DST sponsor companies and other industry participants, often turn to Kay Properties for guidance regarding 1031 DST offerings, and Forbes.com is another example of this. Please enjoy the Forbes article here: Building A Passive Real Estate Portfolio For Retirement … Read More

Kay Properties Helps Place over $130M in Delaware Statutory Trust 1031 Exchange Investments For Family-Owned Real Estate Firm

Kay Properties is pleased to announce the completion of a three-phased 1031 exchange project resulting in an investment into over $130M of Delaware Statutory Trust (DST) properties. Over the course of multiple months, Kay Properties President, Chay Lapin, and Vice President, Steve Haskell, helped a family-owned real estate firm navigate three complex 1031 exchanges into a highly diversified* portfolio of DST properties. In the summer of 2020, the family-owned real estate firm began liquidating their … Read More

Kay Properties & Investments Helps Real Estate Investor with High Loan to Value (LTV) Successfully Complete $1.2 Million DST 1031 Exchange Just In Time to Avoid Significant Tax Consequence

After real estate investor was unable to find a suitable replacement property for a 1031 exchange, recommends DST 1031 specialists Kay Properties & Investments coordinate a successful DST 1031 exchange involving a “Zero Coupon” DST offering (Torrance, CA) Kay Properties & Investments recently announced the successful completion of a DST 1031 exchange that involved a crunched timeline and a large debt replacement challenge. With literally days left on his 45-day 1031 identification deadline, the real … Read More

Kay Properties & Investments Announces a Successful Return for Investors in a Custom Multifamily DST Property That Goes Full Cycle*

Kay Properties announces that another Custom multifamily offering has gone full cycle to post solid returns for Kay Properties clients as the Delaware Statutory Trust offering in Orange Park, FL has sold for $41.3 Million to a private real estate investment firm* Key Highlights: Kay Properties & Investments takes custom multifamily DST property full-cycle Kay Properties & Investments concluded Alexander Pointe presented investors a stable, value-add investment that had good core real estate value Investment … Read More

As Seen on Kiplinger.com: Once the Pandemic Recedes, Where Will the Real Estate Investment Opportunities Be?

Some sectors of real estate are emerging from the pandemic in much better shape than others. Investors thinking about real estate need to know where to look. By: Dwight Kay, Founder & CEO of Kay Properties & Investments The COVID-19 pandemic has been kinder to some real estate asset classes than others. Proactive investors can take advantage of opportunities with the potential to build wealth and generate income from investment real estate, particularly tax-advantaged investments. … Read More

How Real Estate Investors Can Use Delaware Statutory Trust (DST) Properties to Replace Debt in a 1031 Exchange

By Alex Madden, Vice President, Kay Properties and Investments, LLC Savvy real estate investors understand the primary reason for selling and buying real estate via 1031 exchange is to defer capital gains tax that would otherwise be due on the sale. By “exchanging” one or more pieces of property for one or more like-kind pieces of equal or great value helps the investor defer capital gains taxes. However, one of the critical requirements that must … Read More

As seen on WealthManagement.com: Real Estate DSTs — A Haven in a 1031 Tax-Change Storm?

By Chay Lapin, President of Kay Properties & Investments, LLC In the face of the tax policy uncertainty, the question is how to think about current real estate investments and future investment plans. Washington-watchers including many of us in the real estate industry are waiting to see if and how federal policymakers change the tax treatment of capital gains and 1031 like-kind exchanges this year. The capital gains tax rate affects the flow of capital … Read More

Thoughts on Senior Care

At Kay Properties we are very focused on reducing risk wherever possible. We all know that all real estate investments contain the risk of a loss of investment capital and that cash flow and appreciation are not guaranteed. One of the ways that we can help to reduce risk for our clients is by rejecting the higher risk asset classes in the DST marketplace; asset classes like student housing, oil and gas, hotels and senior … Read More

As Seen on Kiplinger.com: How Biden’s Tax Plan Could Affect Your Real Estate Investments

Should you sell your real estate investments before any changes to capital gains taxes or 1031 exchanges get made? That’s what many people are asking. But before you do anything, understand that there’s no telling what will come of President Biden’s tax proposals with a divided Congress, and you do have some interesting options in the meantime. By: Dwight Kay I’ve been a professional real estate investor since prior to the Great Financial Crisis and … Read More

Custom Kay Properties Delaware Statutory Trust Offering Goes Full Cycle

Kay Properties and Investments, LLC today announced that one of their custom Kay Properties Delaware Statutory Trust offerings successfully went full cycle on behalf of multiple 1031 exchange and direct cash investors. The DST investment that was sold was the Maple Springs Apartments in Richmond, VA which was a 268-unit multifamily community. For those investors that closed simultaneously on the DST investment the same day that the property was purchased, the total returns were approximately … Read More

As Seen on Kiplinger.com: Retirement Planning? Don’t Forget About Investment Real Estate

Investment properties have the potential to generate monthly income and appreciation as part of a diversified* portfolio. But you don’t have to be a hands-on landlord. You can make passive real estate investments and avoid the 3 a.m. calls about clogged toilets! by: Dwight Kay You’re planning ahead for retirement and determined to invest in a diversified basket of stocks, bonds, and alternative investments. Maybe you have no exposure to income properties now, or maybe … Read More

Six reasons to sell the income property you love…And how to avoid taxes when you do

Many investors recoil at the thought of selling a piece of investment property. And they usually have a good reason, whether it’s missing out on future appreciation, having to pay a massive tax bill, or some other factor. Yet it can often make good sense to sell your property, thanks to a real estate investment alternative that simplifies your life and lets you defer the taxes via a 1031 exchange. Let’s take a look at … Read More

Cove Multifamily Income Fund 28 – Video

Multifamily Income Fund 28, LLC OverviewThe Multifamily Income Fund 28, LLC is a private placement real estate investment Fund that is targeting unleveraged/debt-free multifamily assets for accredited investors. In addition, the Fund has targeted monthly distribution potential with an 8% preferred return.* Investment Strategy To acquire and actively manage a diversified portfolio of debt-free multifamily assets across multiple U.S. markets that have value-add potential through physical renovations and/or operational improvements. Sample Target Markets Georgia Atlanta … Read More

What Do DST 1031 Sponsors Say About Kay Properties And Investments?

Kay Properties and Investments is known throughout the alternative investment industry as a leader in the DST 1031 marketplace as a national Delaware Statutory Trust (DST) investment firm that specializes in connecting investors with the DST 1031 investment market and the many different sponsors and DST investments available. Here is what DST Sponsors are saying about Kay Properties and the Kay Properties Team. These testimonials may not be representative of the experience of others. Past … Read More

The Case Study of a 1031 DST Specialist

By: Kay Properties and Investments, LLC There are various strategies when using DSTs (Delaware Statutory Trusts) in a 1031 exchange. Some investments are as easy as a simple exchange from one property into a single DST. Other times DST’s are used to invest leftover equity from an exchange so the investor is not taxed on leftover funds, called “boot”. Investors will routinely use DSTs as a backup ID in case their target replacement property doesn’t … Read More

Potential Pitfalls of NNN Properties and a Savvy Alternative

NNN properties seem like passive investments but actually require regular management. Overconcentration is a key risk when it comes to investing in NNN properties. DSTs (Delaware Statutory Trusts) provide an alternative way to invest in NNN properties. *Diversification* and true passivity are unique advantages of DST investments. Frequently investors are seeking out reduced management and or passive real estate investments. Real estate owners are simply tired of the three T’s (Tenants, Trash, Toilets) and are … Read More

Kay Properties and Investments Successfully Completes a $13.68M Exchange on Behalf of Midwest Family

By Matt McFarland, Vice President, and Thomas Wall, Associate, Kay Properties & Investments Kay Properties announces the completion of a 1031 DST exchange for a family that has owned and operated various businesses and real estate for many years. The group was excited to move away from active, hands-on management into a more passive, diversified* investment vehicle while taking advantage of the tax deferral offered through the 1031 exchange. They utilized the Kay Properties 1031 … Read More

As Seen on Kiplinger.com: A Risk-Averse Approach to Real Estate Investing

You can invest in income property in a decidedly defensive way. Here are four conservative strategies to minimize risk while you pursue income and appreciation from investment real estate. By Dwight Kay, CEO & Founder, Kay Properties & Investments, LLC The highest profile professional real estate developers and investors are typically those who have won big or lost big — they made their names taking oversized risks that in some cases paid off handsomely and … Read More

What is a DST 1031 Property?

By: Dwight Kay, Founder – Kay Properties and Investments, LLC What Does DST Stand For? DST stands for Delaware Statutory Trust and is an entity that is used to hold title to investment real estate. What is 1031 Exchange? A 1031 tax-deferred exchange is a way to temporarily avoid capital gains taxes on the sale of an investment property or commercial property. Capital gains taxes can be hefty, running as high as 15-30% when you … Read More