By: Jason Salmon, Executive Vice President, Managing Director, Kay Properties and Investments

Key Takeaways:

- What are the Four Stages of a Real Estate Cycle?

- What are some Current Macro Real Estate Trends Impacting Investment Real Estate?

- Why Should Delaware Statutory Trust Investors Be Aware of Current Real Estate Trends?

One of the common topics that frequently pops up in investment conversations these days involves questions about what stage of the “real estate cycle” is the market currently in, and how does the current real estate market cycle impact the world of Delaware Statutory Trust 1031 exchanges?

The first caveat that must be iterated here is that nobody can predict the future of any market, and there are always material risks associated with investing in real estate, which investors should carefully consider with their own tax and legal advisors. However, by taking a closer look at typical real estate cycles and why these cycles are important to understand, investors can be better prepared for the future, and maybe recognize why more and more real estate owners are selling their properties and moving into DST 1031 exchanges.

What is a Real Estate Cycle?

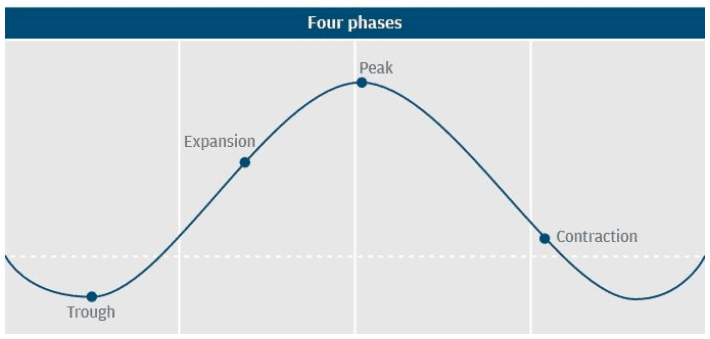

A market cycle basically refers to the periodic ebbs and flows that occur in the economy and across individual sectors, such as technology, stocks and bonds, and real estate. Real estate cycles typically include a wave pattern that moves across the four phases of trough, expansion, peak, and contraction. Understanding the real estate cycle can help people anticipate shifts in the market and make more informed decisions relating to their real estate asset, whether it’s single-family home, multifamily building, commercial building, or net leased property.

Understanding the Four Real Estate Cycles:

- Trough/Recession: In the recession phase, supply has over-exceeded demand, and demand drops—causing downward pressure on values, high vacancy rates and negative rent growth. Anyone who owned real estate during the“Great Recession” faced dramatic events such as loan defaults, massive layoffs, and vacated homes that owners abandoned after property values plummeted. Still, some speculative investors look at this cycle phase as a good time to buy as property values will be at rock bottom. Some of the advantages of buying real estate during recessions include lower prices, less competition, and many sellers might be more willing to offer provisions as improvements and amenities. If successfully executed, a buyer who purchases during a trough or recession will wait and hold the investment property until the real estate cycle circles back, and the downturn is over—as the market begins to recover and eventually expand.

- Recovery/Expansion: English theologian and historian Thomas Fuller once famously said, “It’s always darkest before the dawn”, which many real estate investors apply to the earliest moments of a recovery. In the recovery phase, the real estate market begins at a low point from the recession and gradually rises in strength. Some people who invest in the recovery phase look at Core real estate assets that will generate stable income with very low risk. These assets include a NNN property with a long-term lease or a fully leased office building in a prime location. Other assets that savvy investors target during a recovery phase of real estate investment include value-add real estate, and opportunistic investments like distressed properties or even raw land. While many people have a hard time identifying when the trough stage segues into the recovery phase, experts look at trends like gradual occupancy increases or growing demand to identify when the recovery stage has begun. The recovery phase is a popular time for real estate investment and speculation since prices of properties are typically high, which helps the potential for a solid return upon the sale of the asset.

- Peak: The peak phase will be when supply catches up with and even exceeds demand pushing prices up. During this phase, assets are fully priced, and some real estate investors feel eager to sell at attractive prices and reap profits. However, the peak market can also be a good time for savvy investors to refinance any leverage while interest rates are low and fixed.

- Contraction: The contraction phase generally occurs after the business cycle peaks, but before it becomes a trough. If growth stalls or becomes negative, it can fall into a recession, which is usually defined as two consecutive quarters of negative growth. During this period, investors need to act very cautiously while simultaneously monitoring the market for opportunities – because while contraction cycles can be difficult, they can also coincide with some great opportunities. For example, in a recessionary environment, the worst-performing assets are those that are highly leveraged, very speculative, and fraught with risk. For many years, Kay Properties has avoided the sectors of hospitality, senior care, and oil & gas for this exact reason.

While this cycle pattern is widely accepted to view the real estate market over the long-term, there are many variables that come into play with real estate. For example, real estate is a highly localized industry with different conditions in every state, market, and sub-market making real estate a constantly moving target.

Record-breaking expansion cycle and DST Investment Opportunities

Timing investments correctly may potentially help to increase returns. Yet getting market timing exactly right is never easy unless you happen to be a fortune teller. Right now, the length of the current economic expansion has many people suspecting that we are close to a peak market cycle. However, others suggest current slow and steady growth may be sustainable, and there doesn’t appear to be anything imminent that could derail that pattern. The peak could very well turn out to be more of a plateau than the beginning of the end. Even if there is a contraction or trough ahead, it could be a slight downturn rather than a sharp drop off a cliff. There are numerous variables that contribute to the shape of market cycles that range from Fed monetary policy to market bubbles that pop, such as the housing and Dot.com booms that caused the last two recessions.

But real estate experts point to several macro real estate trends that suggest it might be a good time for investment property owners to consider selling their buildings and consider DST 1031 investments. Even if we cannot know if we are currently experiencing a peak in the real estate market cycle, many real estate investors have seen their properties appreciate significantly and recognize an opportunity to sell and potentially unlock trapped equity.

Some Macro Real Estate Trends That Could Benefit DST Investors

Macro Real Estate Trend #1:Low Inventory –

According to the National Association of Realtors, inventory of available homes was down nearly 30% in 2021 compared to a year ago, multifamily buildings are attracting institutional real estate investors, and according to real estate firm CBRE in is first quarter 2021 report on the industrial and logistics market, demand for this type of asset is through the roof, after nearly 100 million square feet was absorbed during the first quarter – the third highest absorption rate on record.

- How This Could Benefit DST Investors? Whether you are talking about a multifamily apartment building or a single-family home, low inventory means higher selling prices and shorter sales cycle – all good news for the seller’s position. However, this low inventory could also cause trouble for a seller who will find it hard to purchase a replacement property to avoid a large capital gains tax bill at the end of their sale. The DST marketplace allows sellers to easily find a 1031 like-kind exchange for nearly every level of transaction, providing sellers a strategy to not only defer their capital gains taxes but also gain access to a much more diversified portfolio with monthly cash flow potential. DST 1031 specialty advisory firms like Kay Properties & Investments has access to the largest menu of DST 1031 exchange properties in the nation and works with more than 25 different sponsor companies.

Macro Real Estate Trend #2:Rising Real Estate Asset Prices-

While real estate prices have slowed slightly in recent months, they have still grown by nearly 20% compared to last year, and according to a recent report on net leased real estate points out that net leased real estate is experiencing its highest level of demand in history, with billions of dollars flooding in from seemingly everywhere.

- How Could This Benefit DST Investors? Rising real estate prices might indicate the real estate cycle is nearing its peak, and so it could be a good opportunity for investors to sell their multifamily investment buildings. However, selling in an expansion market cycle could trigger a significant capital gains tax bill! DST 1031 exchange investments help sellers defer their capital gains taxes while gaining access to institutional quality real estate assets with the potential for monthly income. DST 1031 exchanges can be structured with leverage for replacing debt, or all-cash/debt-free eliminating the risk of lender foreclosure..

Macro Real Estate Trend #3:Low Interest Rates –

With historically low interest rates in place, buyers are more motivated and capable of financing investment property more quickly.

- How Could This Benefit DST Investors? According to the Quantity Theory of Money, any time the money circulation increases (either through government spending or lower interest rates) inflationary pressures tend to surface. DST 1031 properties may potentially help investors reduce the negative effects of inflation. For example, many DST investments have access to properties that have historically shorter lease terms that allow the investor to pass along any inflationary pressures to their tenants. On the other hand, most single-tenant net leased investment properties commonly have 20–25-year leases that generates flat to minuscule rental increases over the course of the lease term. Over time this flat rental structure could be devastated by inflationary pressures.

Today’s Real Estate Cycle Could Be a Good Time to 1031 Exchange into DST Properties

There is no doubt that mature market cycles are fueling an increase in property sales and 1031 tax deferred exchanges. Property owners who believe values may be at or near peak see it as a good time to take chips off the table and sell real estate that has experienced good appreciation. DST Properties are blessed by the IRS for use in a 1031 tax-deferred exchange. Individuals also have an opportunity to reinvest proceeds into a variety of different property types and geographic markets. For example, Kay Properties has DST opportunities with a minimum investment amount of $100,000 for investors with offerings that span multifamily, self-storage, net lease (NNN), industrial and medical office properties.

The Delaware Statutory Trust 1031 exchange vehicle can be a potentially smart strategy for investors who want to take advantage of the current real estate trends and leverage the tax deferral aspects of the 1031 exchange process.