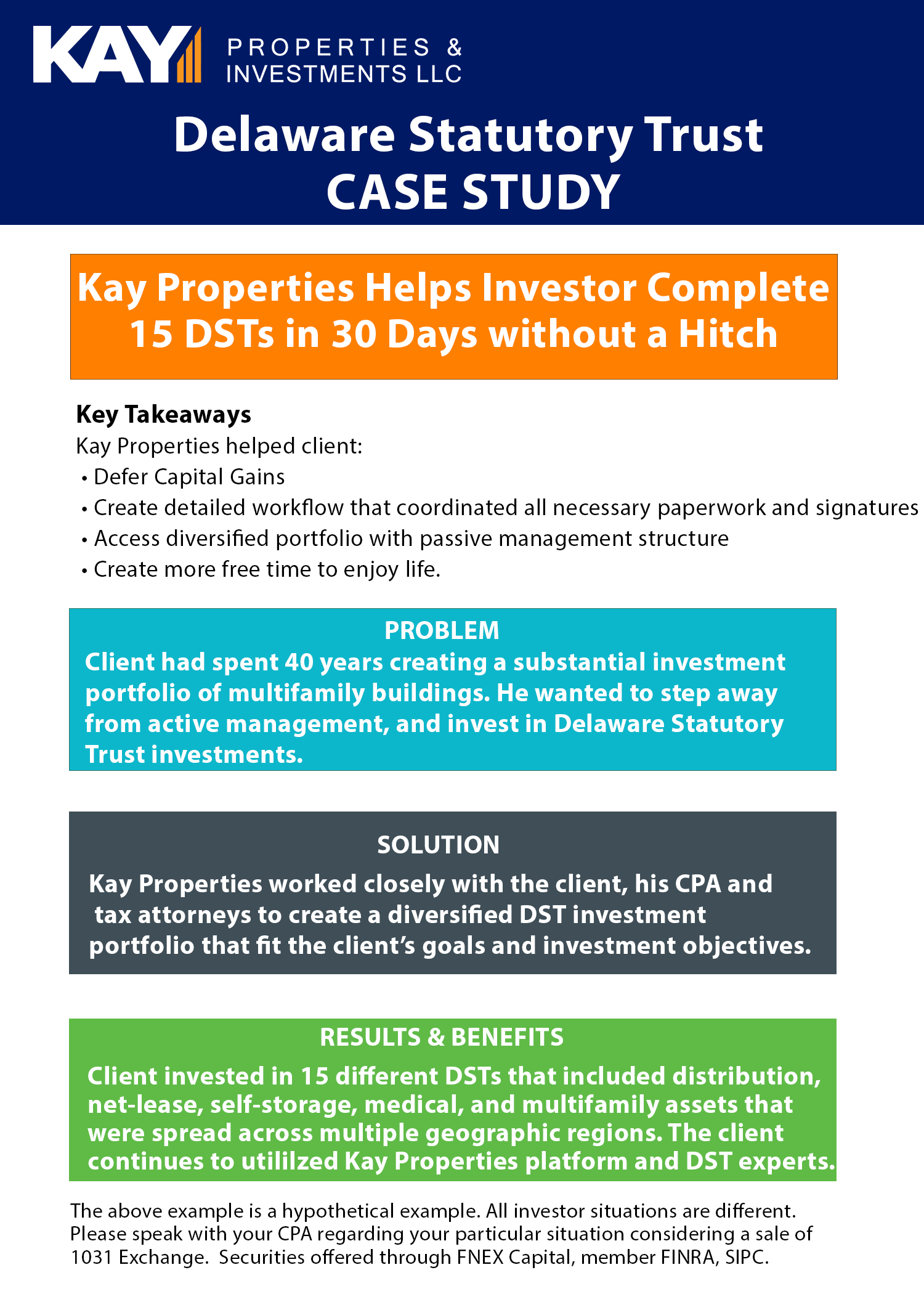

Key Takeaways:

- Kay Properties registered representatives spent more than one year educating the client on DST investments.

- Kay Properties worked closely with client’s CPA and real estate attorneys to create a custom investment strategy that fit perfectly with the client’s specific goals.

- Kay Properties created a workflow plan that achieved the closing of 15 DST investments in 30 days without a hitch.

Click to enlarge

Background:

A high-net worth accredited investor spent more than 40 years building a substantial rental property portfolio of nearly 20 different multifamily buildings. In addition, he managed all the property management challenges himself.

When he decided it was time to start selling some of his real estate holdings, he approached Kay Properties because he wanted to learn more about how he could deploy the Delaware Statutory Trusts for future 1031 Exchanges. For more than a year, Kay Properties worked closely with the investor, utilized the firm’s robust educational platform to help the client fully understand the potential benefits and risks of DSTs. He eventually sold one of his properties and reinvested the proceeds into a DST.

Because he was so pleased with the results of the initial DST investment, he decided to liquidate multiple assets within his portfolio in successive sales and reinvest in multiple DSTs.He once again came to Kay Properties to help coordinate the 1031 exchanges and DST investment strategies.

To learn more about the Kay Properties DST offering, please see here.

Challenge:

The initial challenge was creating an extensive, multi-year, customized educational program that included lots of reading material, one-on-one consultations, and a custom menu of diversified DST investment options that fit his goals and investment objectives. However, the next challenge was how to coordinate 15 different sales and DST investments within a short period of time.

Solution:

Together with his CPA and real estate attorneys, Kay Properties representatives to create a very detailed plan that included anticipated closing times on the relinquished properties, timelines for finding and vetting replacement properties that fit within the investors very specific parameters and creating a custom workflow that coordinated all the necessary paperwork and signatures so that everything was organized, and every closing went smoothly.

Results:

The client ultimately invested in 15 different DST investments that included distribution facilities, net-lease properties, self-storage, medical, and multi-family assets that were spread across multiple geographic regions. The client continues to utilize Kay Properties best-in-class www.kpi1031.com platform and customized advice by DST experts with more than 150 years of combined experience.