If you are new at commercial real estate investing, you likely have questions about the different types of real estate ownership structures and specific tax benefits that may be available to them. One of the most popular forms of commercial real estate investing is Our Delaware Statutory Trust 1031 Exchanges. But just what are DSTs and 1031s?

This article will specifically answer fundamental questions, including:

- What is a Delaware Statutory Trust?

- How does the DST ownership structure work?

- What is a 1031 Exchange?

- How can DSTs and 1031 Exchanges work together?

In addition, please review the Kay Properties resource section to learn even more basic facts and explain how DSTs and 1031 exchanges work together, for the benefit of investors.

What is a Delaware Statutory Trust?

A Delaware Statutory Trust (DST) is an entity used to hold title to investments, including income-producing real estate. Most types of real estate can be owned in a DST, including retail, office and multifamily properties.

Make sure to view this video about how Kay Properties helps investors with their Delaware Statutory Trust investments and 1031 Exchanges.

There can be up to 499 individual investors in a DST. Each investor holds an undivided fractional interest in the property. Decision-making authority typically rests with a trustee who is an experienced asset manager designated by the sponsor of the offering. The sponsor also can be an investor in the DST. A DST is considered a security and is governed by securities laws.

Now that we’ve understood “What is a Delaware Statutory Trust”, let’s examine the important distinction between two participants of a DST: beneficial owners and trustees.

A trustee holds the legal title to the assets while a beneficial owner holds equitable ownership. However both the trustee and owner are under an obligation to follow the terms stated in the trust agreement.

Per the Delaware Statutory Trust Act (DSTA), the trust is a separate legal entity. Therefore the creditor of a beneficial owner is not allowed to gain possession of any of the properties that belong to the trust. Moreover the beneficial owner cannot terminate the trust unless it is in line with the private trust agreement. These restrictions help protect other beneficial owners from the individual liabilities of any owner.

Owners of a DST receive an operating statement at the end of the year showing their pro-rata portion of property income and expenses, in the same way that they would with any other commercial or rental properties that they may own directly.

You can learn more about how potential distributions are calculated in this video:

What is a 1031 Like-Kind Exchange?

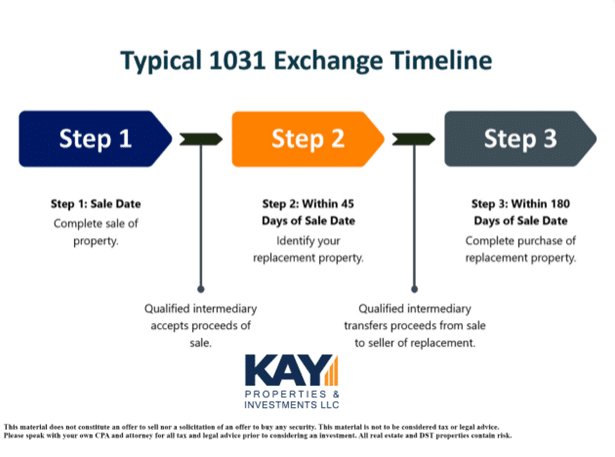

After understanding what is a Delaware Statutory Trust, it’s time to examine the 1031 Exchange facts. One of the most attractive real estate tax benefits available in the U.S. is the like-kind exchange, which is governed by Section 1031 of the Internal Revenue Code. A like-kind exchange allows an investor to defer taxes on capital gains and depreciation recapture at the time a real property investment is sold if the net equity from the sale is reinvested into a similar property of the same or greater value. However the reinvestment of the proceeds of the sale into another property of like kind must occur within a certain time threshold.

While the main purpose of opting for a 1031 exchange is to take advantage of the tax deferral, there are several scenarios in which a 1031 exchange would be a feasible option. If you own investment real estate but are fed up with tenant or property management issues, then opting for managed property in the form of a 1031 exchange would make sense. Or if you wish to diversify your capital or assets or would like to invest in a property with higher returns, then again a DST 1031 would be the ideal solution.

What is a Like-Kind Property?

According to the Internal Revenue Service: “Properties are of like-kind if they’re of the same nature or character, even if they differ in grade or quality. Real properties generally are of like-kind, regardless of whether they’re improved or unimproved.” For example, an apartment building could be exchanged into a warehouse, a warehouse into a piece of raw land, a piece of raw land into a single-family rental property, etc. As long as the property is held for investment or business purposes, it is considered like-kind.

As a result of 1031-exchange investing, the initial invested capital and the gain can continue to grow, potentially, without immediate tax consequences. Then, if and when the new investment is sold without the equity reinvested in another exchange property, the prior gain is recognized. Investors should consult their tax or legal advisors prior to selling or exchanging a property, as everyone’s tax situation is different.

How Can a DST and 1031 Exchange Work Together?

Delaware Statutory Trusts for 1031 exchanges have been used by investors since the ’60s and ’70s. However, back then it was largely done with a letter from an investor’s CPA or an attorney explaining that, “We believe that this is eligible for 1031 exchange.” It wasn’t until 2004, the IRS actually put this in the internal revenue code, the Revenue Ruling, 2004-86, is where the IRS officially blessed DSTs as eligible for 1031 exchanges. As described earlier, the DST structure permits multiple investors to pool their resources into a DST property or portfolio, thus, enabling investors to access higher-value properties that might otherwise be beyond an individual’s reach. In addition, DSTs are a purely passive investment, professionally managed by a management team that handles everything from rent collection to repair and maintenance. As noted above, this is general information. Investors should consult their tax or legal advisors prior to investing in, selling or exchanging a property, as everyone’s tax situation is different.