By Dwight Kay, Founder and CEO, Kay Properties and Investments

Key Highlights:

- What do the initials “DST” stand for?

- What is the typical investment amount for a DST 1031 investment?

- What does the term “beneficial interest” mean for DST properties?

- Why investors like DST properties for 1031 exchanges?

A DST stands for Delaware Statutory Trust and is an entity that is used to hold title to investment real estate. In some ways this is similar to how a limited liability company or an LLC can hold title to real estate; however, unlike an LLC, a property structured as DST 1031 properties will qualify as like-kind exchange property for a 1031 exchange according to the IRS revenue ruling 2004-86.

The typical investment for a DST 1031 Property is $100,000 which allows investors to diversify* his or her exchange proceeds among multiple properties. DST 1031 investments also have various leverage ratios to potentially satisfy an investor's exchange requirements of taking on equal or greater debt.

Delaware Statutory Trust Example DST Investments for 1031 Exchange

Kay Properties founder and CEO, Dwight Kay sat down to discuss some of the DST real estate properties Kay Properties has made available for accredited investors for their 1031 exchange or direct cash investment. While the specific properties outlined in this video are now fully subscribed, they represent good examples of DST properties that are available on the www.kpi1031.com marketplace and examples of typical DST real estate investment options for 1031 exchanges.

Dwight Kay is a nationally recognized expert on Delaware Statutory Trusts and is considered to be the first person to have authored a book exclusively on the DST real estate structure including explaining what is a DST 1031 exchange property for 1031 exchange investors. This is another “must-view” interview for any potential 1031 exchange investor and because it provides a straight-forward and informative insight into the types of DST real estate properties that are available for 1031 exchanges. In addition, Dwight Kay is regularly published in Kiplinger where he writes extensively about Delaware Statutory Trust properties and 1031 exchange strategies.

How Do DST Properties Help Investors with Their 1031 Exchanges?

DST properties help 1031 exchange investors because in many cases, the properties are often structured with “built-in” debt to satisfy the 1031 exchange requirements (although many DST’s on the kpi1031.com platform are structured without debt). This is important because to qualify for a full tax deferral on capital gains taxes from two of the basic 1031 exchange requirements necessary the sale of a property include:

- Purchase equal or greater value in replacement properties as you had in relinquished property and

- Reinvest 100% of the net sales proceeds into a replacement property or properties.

So, let’s say you sold a property for $300,000, but you had a $100,000 loan on the property. Once you paid off that loan you would have $200,000 in equity left over. In order to successfully complete the full 1031 exchange, you would have to replace the full $300,000. So, what are your options? You could:

- Put in an extra $100,000 out of your own pocket.

- Borrow that $100,000 from a bank or other lender; or

- Invest in a DST that already has the debt “built in” so to speak.

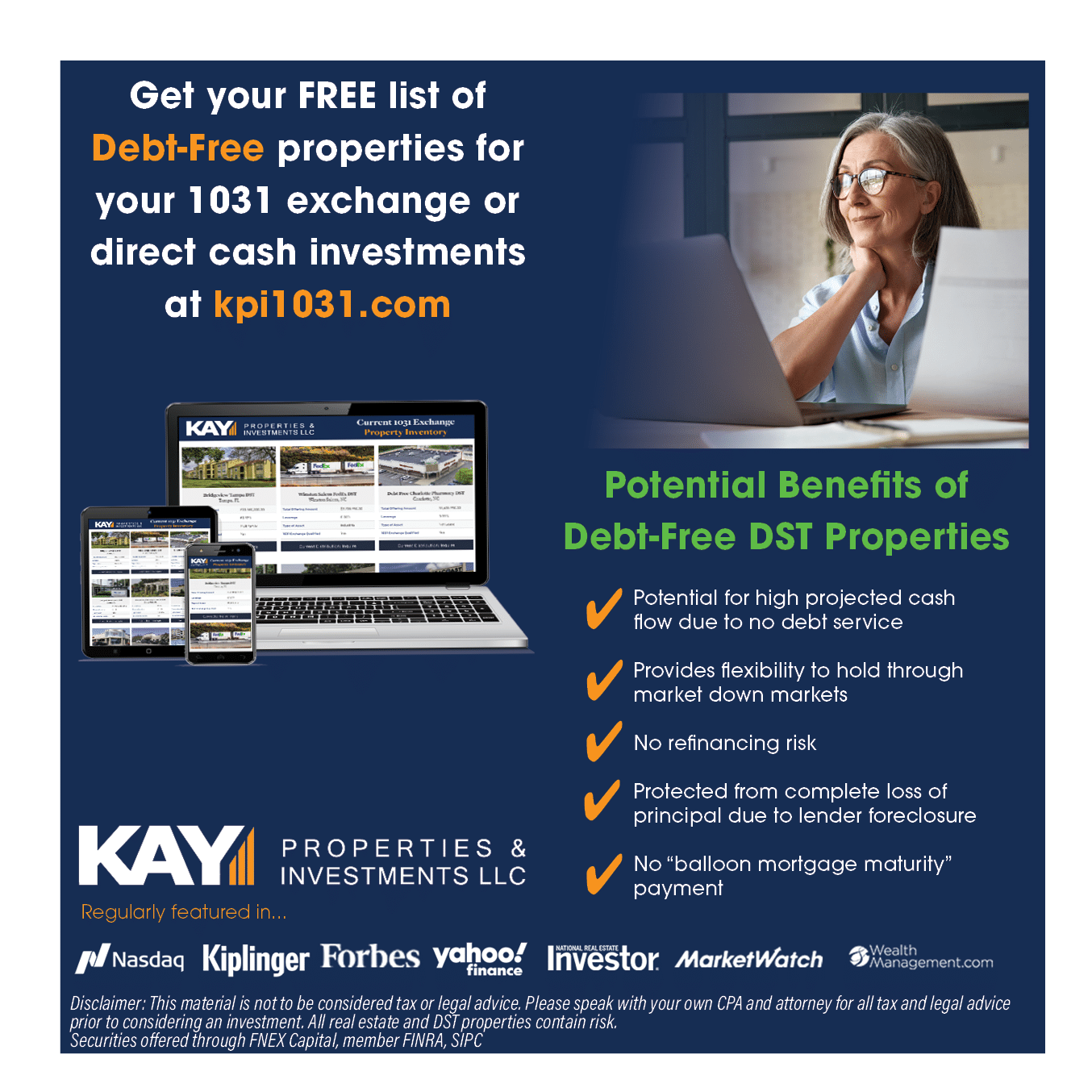

Access to Leveraged and Debt-Free DST 1031 Investment Properties Today

Kay Properties’ DST 1031 exchange online marketplace features investment opportunities that span a wide range of debt levels, from as low as 25% upwards of 70%.

Also, for investors that don’t have any debt to replace since they owned their previous property free and clear with no loans, there are also DST investments that are debt-free which have no mortgages attached to them. Kay Properties and Investments is a leader in providing investors debt-free real estate investment options for their 1031 exchange and direct cash investments. More and more wealth advisers and investors alike are attracted to debt-free real estate investments as a prudent strategy. Recent events such as rising interest rates, bank failures, and of course, the COVID-19 pandemic serve as reminders that black swan events are real and that using leverage comes with risk. The bottom line is that the risk of lender foreclosure, which is always mentioned but rarely considered a realistic possibility, has suddenly become much more of a reality.

So, using the kpi1031.com marketplace, it is relatively easy for investors to find loan-to-value options (including debt-free) that fit their investment objectives and that can match their equity and debt targets.

How DST 1031 Properties Allow Multiple Investors to Hold Beneficial Interest

Another component that is important for investors to understand is that a DST 1031 Property is an ownership structure that allows for multiple investors to hold undivided beneficial interests in the real estate assets of the trust. The term, “beneficial interest” means that investors hold a percentage of the ownership, and that no one owner can claim proprietorship over the DST portfolio or even individual aspects of the real estate.

Another reason investors are attracted to DST 1031 exchange properties is because of the passive nature of a DST 1031 property. Many multifamily residential owners become weary of the midnight calls from the tenant complaining about everything from a mouse to the noisy tenants upstairs. Therefore, they decide to sell the asset and invest in a DST 1031 property, where everything associated with the DST real estate structure is managed by a professional management including rigorous due diligence, day-to-day upkeep, and eventual disposition of the asset. The investor simply sits back and lets their investment work for them. That’s why this is called passive investing, and it is another major strategy of investing in DST 1031 properties.

Watch Video of How This Kay Properties Client Turned to Passive Management

All investors should make sure to watch this YouTube video where one of Kay Properties clients discusses how the Delaware Statutory Trust structure allowed her to step away from active management of her real estate assets, and move into the passive nature of DST properties. She will never return to active management.

Delaware Statutory Trust Properties: 1031 Exchange Investing

To learn more about the ins and outs of Delaware Statutory Trust properties and 1031 exchange investing, make sure to view the video below for some super helpful information about DST properties from the experts at Kay Properties and Investments.

Examples of Typical DST 1031 Properties

Kay Properties & Investments is a nationally recognized specialist in DST 1031 exchanges. As such, the firm has access to a proprietary marketplace of DST properties that accredited investors can access. On any given day, Kay Properties has anywhere from 20-40 DST 1031 properties available for qualified accredited clients, with a typical minimum investment of $25,000.These DST offerings are available on the kpi1031.com marketplace from typically over 25 DST sponsor companies.

To get an idea of what a typical DST 1031 property can look like, here are some examples of previous DST 1031 properties. Kay Properties believes that essential services like medical facilities, dollar stores, industrial logistic centers, and multifamily residential buildings are well-suited for DST 1031 portfolios. Obviously, specific properties, tenants, lease terms and financing structures will vary greatly. Please note all offerings shown are fully subscribed and not available for investment and future offerings will vary greatly.

Please note that the names listed below are independent of Kay Properties and Investments and belong to their respective copyright and trademarked companies. All images are representative.

Single Tenant Medical DST - A debt-free offering for a Fresenius Medical Care Center located in Capitol Heights, MD that is backed by its corporate parent company Fresenius Medical Care Company (NYSE-FMS) and has 10 years remaining on the primary lease term with three five-year renewable options. The property is in a dense infill location and surrounded by national retailers.

Single Tenant Medical DST

| Loan to Value | 0% (debt-free DST offering). |

| Minimum Investment | $25,000 |

| Type of Asset | Single Tenant Net Lease |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

| Fully Subscribed | Not Available for Investment |

Single Tenant Pharmacy Net Lease DST - A debt-free DST offering in Phoenix, AZ that consists of major pharmacy tenant whose long-term net lease is backed by the parent company. This tenant is considered recessionary-resistant as well as COVID-19 pandemic resistant.

Single Tenant Pharmacy Net Lease DST

| Loan to Value | 0% (debt-free DST offering). |

| Minimum Investment | $25,000 |

| Type of Asset | Net Lease Pharmacy |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

| Fully Subscribed | Not Available for Investment |

Multifamily Community DST- A 50-unit Class A multifamily community located in Houston, TX. The property is 100% occupied and has a loan-to-value of 39.6%.

Multifamily Community DST

| Loan to Value | 58.61% |

| Minimum Investment | $100,000 |

| Type of Asset | Multifamily |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

| Fully Subscribed | Not Available for Investment |

Airport Distribution DST - A 100% debt-free industrial net lease distribution facility Delaware Statutory Trust offering.

Airport Distribution DST

| Loan to Value | 0% (debt-free DST offering). |

| Minimum Investment | $25,000 |

| Type of Asset | Industrial |

| 1031 Exchange Qualified | Yes |

| Offering Type | 506c |

| Fully Subscribed | Not Available for Investment |

How DST 1031 Properties Work Regarding Potential Distributions and Appreciation?

Because DST 1031 properties allows each investor to own a fractional interest in a property with other investors, not as limited partners, but instead as their own individual owner inside the trust, everyone receives their own percentage share or pro rata share of any potential distributions from the property. This includes potential income, tax benefits, and potential appreciation of the whole property (net of sales costs).

Receiving a percentage of the DSTs appreciation is one of the significant benefits investors enjoy about DST properties. This is very much unlike most other forms of real estate private equity investments like LLCs, LPs, and even Private REITs where a large portion of the potential appreciation is given to the sponsor typically thru a waterfall split.

Register for FREE access to the Kay Properties Marketplace of Delaware Statutory Trust listings here.

Please visit our YouTube channel to hear about Delaware Statutory Trust from the Kay Properties team of experts.

*Diversification does not guarantee profits or protect against losses.