The State of Multifamily Real Estate, 2021

By: Benjamin Sedaghat, Associate and Thomas Wall, Associate at Kay Properties and Investments, LLC

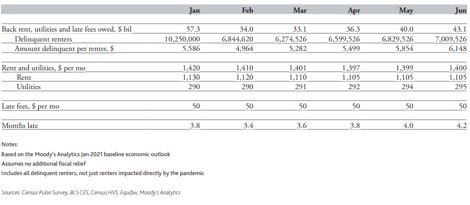

The pandemic has taken its toll on the US economy over the past year rendering millions of Americans out of work. Renters across the country are not able to keep up with their rent payments due to pandemic related unemployment. “According to the Census Bureau’s Household Pulse Survey, as of late December, more than 10 million renters are behind on their rent payments and at risk of being evicted” (“Averting an Eviction Crisis” p. 1, Moody’s Analytics). Policymakers have taken steps to address this issue including increasing unemployment benefits to help people keep up with rent payments, providing states with $25 billion in rental assistance funding, and prohibiting evictions outright. Investors considering purchasing interests in multifamily rental properties are left wondering what this means for them.5

Who is most affected?

In order to understand how the pandemic driven economic shortfall has affected renters and therefore the profitability of multifamily rental properties, we must understand which renters are most affected. According to the Census Bureau’s Household Pulse Survey, distressed renters are more likely to live in urban areas in the Northeast, California, and parts of the Southeast that have particularly high concentrations of low-income households. Renters with lower income and lower education are at greater risk of pandemic related unemployment and therefore tend to fall behind on rental payments at a higher rate.1

What kinds of properties are behind on rent?

According to “The State of the Nation’s Housing 2020” by the Joint Center for Housing Studies of Harvard University, tenants with lower incomes in small rental buildings have had the most difficulty keeping up with rent. As of September 2020, buildings with five or more units were least affected by rental delinquency, with just over 10% of renters falling behind on rent. Prime urban areas have had the greatest increase in vacancies compared to second-and third-tier cities.2

High Performing Multifamily Properties in 2020

The COVID-19 pandemic on its face appears to have been a great disruptor to the US economy. One might assume that real estate investors in particular must be bearing the brunt of this disruption. However, it is becoming clearer that this has not been a mere disruption, rather “the great reshuffling” following the onset of the pandemic is more accurately described as an accelerator. Many of the trends that we see as distinctly linked to the pandemic were actually just starting to emerge in 2019 and early 2020. Real estate investors who were savvy enough to have identified and capitalized on these trends early on seem to be least affected by the burden of economic lockdowns.

The most forward-looking real estate investors who had their eyes on new market trends started acquiring properties in high-growth markets in second-and third-tier cities in places with high population expansion and rapidly growing economies in places like Texas and the Southeast. These trends that accelerated include the flight from urban core housing to lower cost/higher quality of life housing with more space and a greater focus on amenities.

There appear to be a few key drivers of economic performance for multifamily rental properties in this environment. First is geographic location/demographics. Properties located in second-and third-tier cities with relatively high levels of education and expanding economies are performing particularly well. Next, multifamily properties with a greater number of units have lower rates of rental delinquency.2 Finally, another important factor is the capability of the manager of the property.

Over the past year, we have seen the most effective property managers were those who are adaptable enough to implement the technology needed for contactless leasing, virtual touring, and creative marketing strategies to keep occupancy up amid the pandemic. Smart investments require smart teams. The challenges presented by COVID-19 have made the role of the property manager more salient than ever. Property managers that have been flexible enough to leverage technology to adapt day-to-day operations in order to make renters feel safe have played a key role in separating underperforming and over-performing multifamily rental properties and should not be overlooked when considering an investment.

Sources:

1. https://www.nmhc.org/research-insight/nmhc-rent-payment-tracker/

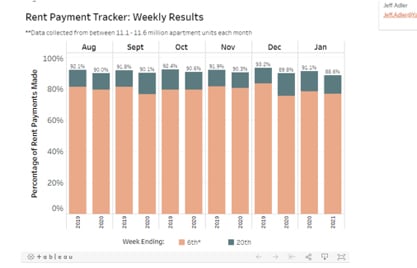

NMHC Rent Payment Tracker

"The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 88.6 percent of apartment households made a full or partial rent payment by January 20 in its survey of 11.6 million units of professionally managed apartment units across the country.

This is a 2.5 percentage point, or 294,224 household decrease from the share who paid rent through January 20, 2020 and compares to 89.8 percent that had paid by December 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.”

2. https://www.jchs.harvard.edu/state-nations-housing-2020

Harvard Study: State of the Nation’s Housing 2020

“Renter households have been hard-hit by the pandemic with 49 percent reporting lost employment income between mid-March and late September. While most renters have continued to make rent payments, 15 percent reported that they were behind on payments.

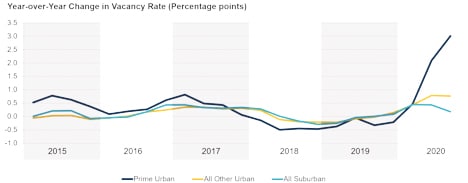

• COVID-19 slowed apartment demand in expensive, high-density urban areas where vacancy rates jumped 3.0 percentage points in 2020. In contrast, rental supply and demand in suburban areas were in balance, lifting the vacancy rate by just 0.2 percentage point.

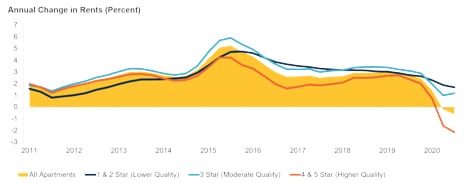

• With decreased demand and new supply coming online, nominal rents declined in professionally managed apartments. Rents for higher-quality units fell the most, down 2.2 percent year-over-year in the third quarter.

• Multifamily investment slowed in the second quarter of 2020 with a 68 percent year-over-year drop in transaction volume. Growth in apartment prices slowed to 6.7 percent in September—the slowest pace since early 2011. 3

• After hitting a 30-year high of 389,000 units started at the end of 2019, construction of multifamily structures with five or more units slowed as the pandemic progressed, falling by more than 30 percent year-over-year in April and May. Starts activity bounced back in June and July before settling into a seasonally adjusted annual rate of 295,000 units in September.

• Most of the additions to the rental supply have been in single-family rentals or in buildings with at least 20 apartments. Units in these structures are most expensive with median rents of $1,200, and their rents have also increased the fastest.”

Rent Growth has slowed sharply, particularly at higher-quality properties.

Note: Apartment quality is based on the CoStar Building Rating System for professionally managed market-rate apartments in buildings with five or more units.

Source: JCHS tabulations of CoStar data.

Vacancy Rates have climbed sharply in prime urban areas.

3. https://www.rentecdirect.com/blog/rental-trends-report-2020/

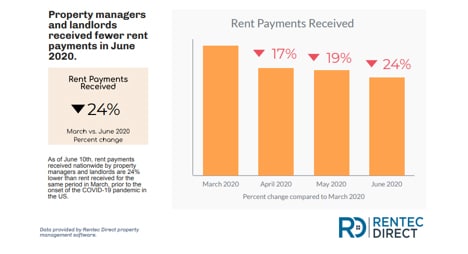

RENT PAYMENTS SEE BIGGEST DROP SINCE COVID-19 PANDEMIC

- Rent received has been steadily decreasing since the onset of the pandemic.

- There has been no significant change to the amount of rent received from renters who pay rent online, via direct bank transfer or by credit or debit card.

- Property managers and landlords are adopting online tools to assist tenants, like online rent payment options.

4. https://www.globest.com/2021/02/04/apartment-rents-are-near-pre-pandemic-highs/

Apartment Rents Are Near Pre-Pandemic Highs

- “Average rents for US apartments now are within a hair of the all-time highs seen in early 2020, as more individual metros are moving back into price growth mode.

- Across the country’s largest 150 metros, effective asking rents for new leases in January 2021 came in only 0.3% below the rates seen at the start of 2020, before the spread of COVID-19 and the resulting economic struggles led to rent cuts.

- The nation’s average effective asking rent is now $1,382 per month.

- January’s apartment occupancy rate for the US as a whole stood at 95.4%, impressively matching the figure from early 2020 despite the turmoil experienced in the nation’s economy.

- Occupancy is especially strong in properties with middle- and bottom-tier pricing. Lower occupancy registers in the luxurious top-end segment of the market, influenced by sluggish initial leasing at high-priced new deliveries in many parts of the country."

5. https://www.moodysanalytics.com/-/media/article/2021/averting-an-eviction-crisis.pdf

“According to the Census Bureau’s Household Pulse Survey, as of late December, more than 10 million renters are behind on their rent payments and at risk of being evicted. At more than one in six renters, that’s three times the typical rate. To put that into some perspective, approximately seven million households lost their homes in foreclosure during the five darkest years of the global financial crisis (2008-2012). Here we have 10 million families facing a similar fate over a matter of months”

https://www.census.gov/programs-surveys/household-pulse-survey/data.html