Los Angeles, CA and Fort Stockton, TX

Kay Properties has successfully completed the Fort Stockton DST in Fort Stockton, TX. This DST property was made available to accredited investors under Regulation D Rule 506c and had a total equity raise of $7,450,000.

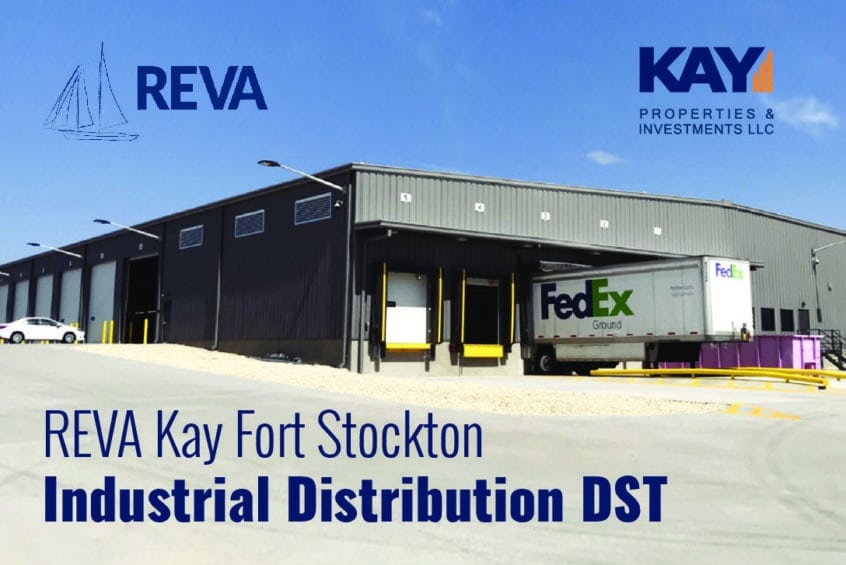

The new construction, 29,504 square foot property is 100% occupied on a long-term net lease by an international shipping company and serves as an industrial distribution facility. This DST investment was made available to investors as an all-cash/debt-free DST offering whereby the risks of financing have been removed from the equation.

Dwight Kay, Founder and CEO of Kay Properties remarked, “The Fort Stockton DST is a fantastic example of another Kay Properties fully subscribed DST 1031 investment offering. The Kay Properties real estate investment platform continues to grow and expand at a pace that we are very pleased with and thankful for.”