View press release on Yahoo Finance here LOS ANGELES, May 06, 2020 (GLOBE NEWSWIRE) — Kay Properties and Investments is honored to announce the completion of a 1031 exchange five years in the making. When the clients reached out to Kay Properties and Investments (www.kpi1031.com) looking for replacement properties after the sale of their 2,000+ acre ranch, they were trying to determine their options. Kay Properties Vice President Alex Madden stated, “After looking around the … Read More

Kay Properties and Investments Helps Facilitate a $10.19 Million-Dollar Delaware Statutory Trust – DST 1031 Exchange on Behalf of Clients

View press release on Yahoo Finance here LOS ANGELES, April 30, 2020 (GLOBE NEWSWIRE) — Kay Properties and Investments today announced the completion of another 1031 DST exchange on behalf of a husband and wife out of Northern California. The couple had acted as multifamily owners and operators for over a decade. They utilized the Kay Properties 1031 DST marketplace at www.kpi1031.com for a number of years to educate themselves on how the DST would potentially fit … Read More

Buyer Beware: Are Oil and Gas Investments a Good Idea

By: Matt McFarland, Associate at Kay Properties & Investments With any and every investment comes risk. Investors everywhere are continually trying to balance the risks of an investment against the potential rewards. As a national leader in DST 1031 Exchange and real estate investments, Kay Properties is constantly presented various investment opportunities to offer our clients. We do not and will not participate in an oil and gas investment, as the inherent risks greatly outweigh … Read More

Kay Properties Completes $32.4 Million DST 1031 Exchange on Behalf of Clients

View press release on Yahoo Finance here LOS ANGELES, April 14, 2020 /PRNewswire/ — A husband and wife who have built their net worth using multifamily properties have accessed the Kay Properties 1031 DST marketplace at www.kpi1031.com to complete a tax deferred 1031 exchange into multiple DST 1031 properties. The Delaware Statutory Trust 1031 exchange investments were completed by Kay Properties and Investments team members Chay Lapin, Senior Vice President, and Steve Haskell, Vice President. Dwight Kay, the founder and CEO … Read More

Cash Investments in DSTs – An Alternative to Investing in the Stock Market

By: The Kay Properties Team Delaware Statutory Trusts are potentially a great investment vehicle for those accredited investors doing a 1031 exchange, but what some investors don’t realize, is that you can also invest in DSTs on a cash basis. Why invest cash in a DST? DSTs offer many benefits to those doing a 1031 exchange, for example, the ability to defer their capital gains from the sale of their investment real estate as well … Read More

Being Defensive Pays Off: Kay Properties’ Clients Avoid Potential Hospitality & Senior Care Crash and Burn – Why Avoiding Hospitality and Senior Care is the Kay Properties Way

By Alex Madden, Vice President at Kay Properties and Investments For many years Kay Properties has taken the position that we will not offer three asset classes to Investors because they carry too high of risk to investors equity: Hospitality, Senior Care, and Oil & Gas. While other groups have gleefully entered into some of these sectors searching for higher potential returns, Kay Properties has maintained the position that they are much too volatile, and … Read More

Founder, Dwight Kay Featured on Forbes.com For Insight on the 1031 Exchange and DST Investment Industries

The founder of Kay Properties and Investments, Dwight Kay, was recently featured in an article on Forbes.com regarding the potential benefits and risks of DST 1031 investments. The media, 1031 exchange investors, CPAs, Attorneys, DST sponsor companies and other industry participants, often turn to Kay Properties for guidance regarding 1031 DST offerings and Forbes.com is another example of this. Please enjoy the Forbes article here: A Better Way To Co-Invest In Real Estate: DSTs And … Read More

Dwight Kay Featured in National Real Estate Investor

The founder of Kay Properties and Investments, Dwight Kay, was recently featured in an article in National Real Estate Investor (NREI) which is a national publication on all things commercial and investment real estate. Kay Properties is recognized by many to be a thought leader on 1031 exchanges and Delaware Statutory Trust (DST) investments and is frequently featured in various magazines and newspapers nationwide. Please enjoy the article here: https://www.nreionline.com/investment/downside-crowdfunding-every-real-estate-investor-should-know

Kay Properties and Investments, a National Delaware Statutory Trust (DST) Investment Firm, Announced Today the Completion of a $14 Million DST 1031 Exchange

View press release here. LOS ANGELES, March 16, 2020 /PRNewswire/ — The client was a west coast owner of commercial property and was seeking to do a 1031 exchange into DST properties. The client decided to utilize the Kay Properties 1031 DST marketplace at www.kpi1031.com to reinvest his 1031 exchange proceeds due to the specialization and breadth of knowledge that the Kay Properties team provided. The client’s 1031 exchange into DST properties was handled by Kay … Read More

Acronyms to Know in the Investment World

By Betty Friant, Senior Vice President at Kay Properties & Investments and The Kay Properties Team Becoming a serious investor involves a significant learning curve. There are many acronyms used in the investment world that you will need to know and understand to find success as an investor. Here are some common acronyms to file away in your long-term memory. DST Delaware Statutory Trust or DST is an entity used to hold title to investment … Read More

Why Real Estate is a Powerful Estate Planning Tool

By Matthew McFarland, Associate at Kay Properties & Investments and The Kay Properties Team Real Estate has been and remains one of the most powerful estate planning tools. There are numerous reasons real estate is positioned to be one of the most tax-efficient investment tools that exist— here are just a few: 1) Step-up in Basis: To many investors and tax professionals, this is where the majority of the tax efficiency comes. A “step-up in … Read More

4 Reasons Estate Attorneys Utilize DSTs for Legacy Planning

By Steve Haskell, Vice President at Kay Properties & Investments and The Kay Properties Team Advisors at Kay Properties & Investments have worked closely with Estate Attorney’s to assist with their client’s legacy planning. The Delaware Statutory Trust can offer many potential benefits to investors. Below are four reasons estate attorneys incorporate DSTs in their client’s estate planning. Everyone’s situation is unique. All investors should speak with their tax/legal advisor when conducting their own estate … Read More

What You Need to Know About 1031 Exchanges

By Matthew McFarland, Associate, Kay Properties & Investments If you’re a serious investor, you need to know about the IRS Code Section 1031—this section of the IRS code is commonly referred to as “the 1031 Exchange.” The 1031 Exchange allows investors to defer taxes through the exchange of investment property for investment property, or “like for like.” Recently enacted tax legislation stipulates that the 1031 Exchange can only be utilized if a property is purchased … Read More

The Story Behind Kay Properties & Investments DST Platform

Dwight Kay built Kay Properties and Investments with the vision of reducing concentration risk for his clients by providing investors a broad menu of DST opportunities available for their 1031 exchanges and cash investments. He wanted to ensure that his clients were not putting their hard-earned nest eggs in one single basket. Instead Dwight sought to avoid concentration risk by providing investors with the options of spreading their equity over many properties, geographic locations, tenants, … Read More

What Properties Can be Used In a 1031 Exchange?

By: The Kay Properties Team If you are interested in selling your real estate, the phrase “1031 Exchange” has certainly come up once or twice in your research, as an outright sale can trigger large tax consequences. The capital gains and depreciation recapture taxes can be a serious dent in the return you expected to earn from the sale of your real estate. A 1031 exchange is a process by which an investor can defer … Read More

Kay Properties, Which Operates a 1031 Exchange Property Marketplace, Hit $230 Million in Like-Kind Exchange Equity Investments from Accredited Investors in 2019

LOS ANGELES (January 31, 2020) — Kay Properties, which operates an online 1031 exchange property marketplace, raised and placed $230 million in like-kind exchange equity investments from accredited investors in 2019, the company said today. The $230 million raised from hundreds of accredited investors was invested in millions of square feet of commercial and multifamily properties across the U.S. The total consideration value of the properties at the time of funding was in excess of … Read More

12 Reasons We like Fresenius as a Tenant for a DST 1031 Property

1. One of the World’s Largest: Fresenius is one of the world’s largest dialysis providers. 2. Investment Grade Credit Rating: Fresenius holds an investment grade credit rating by S&P, Moodys and Fitch 3. Publicly Traded Company: Fresenius is a publicly traded company – NYSE: FMS 4. Market Capitalization: Fresenius has a $20+ Billion dollar market capitalization 5. 342,000 Patients: Fresenius serves over 342,000 patients worldwide 6. 150 Countries: Fresenius offers dialysis services and products in … Read More

1031 Exchange Guidelines and Deadlines

The Delaware Statutory Trust was created to allow property owners or investors to sell a residential or commercial property and defer the capital gains tax that is present from the sale after the transaction is completed. The Delaware Statutory trust 1031 exchange provides investors with the opportunity to obtain a property that is already professionally managed while working with Kay Properties. This makes it possible to earn income off of the property without asset or … Read More

Proceed with Caution – Hotel 1031 DST Offerings

By Dwight Kay and The Kay Properties & Investments Team Investing into real estate always comes with risk. Vacancies, downward pressure on rents due to new developments coming online, the economy, loans maturing, and wider market forces often impacts how an asset performs over time. Integral to the investment’s potential success is the ability for the investor to weigh the risks and to decide if the risk is worth the potential return. Certain asset classes … Read More

Five Interesting Facts about Delaware Statutory Trust Investments

By Alex Madden, Vice President with Kay Properties and Investments There is a lot to read and learn about DST or Delaware Statutory Trust investments and 1031 exchanges. First let’s begin with the basics. What is a DST 1031 Property? A DST is an entity with which investors can hold title to investment real estate. A structured DST property qualifies as like kind exchange property for a 1031 exchange. But there are many more facts … Read More

The Risks in Purchasing a Triple Net Lease Property and a Potential Solution

Purchasing a Triple Net Lease Property (NNN) provides many benefits to investors. They’re usually single tenant retail, medical or industrial properties where the tenant is responsible for the majority of if not all of the expenses including insurance and maintenance costs. They also provide a potentially steady cash flow to the investor as leases are often 10-15 years in length with multiple renewal options. For this reason, many potential investors look for single tenant NNN properties for sale with the goal of securing a steady cash flow. However, just like any investment, there are risks involved in triple net properties (NNN), which we examine below:

Five Things To Remember When Deciding To Do A 1031 Exchange

The Delaware Statutory Trust was created to allow property owners or investors to sell a residential or commercial property and defer the capital gains tax that is present from the sale after the transaction is completed. The Delaware Statutory trust 1031 exchange provides investors with the opportunity to obtain a property that is already professionally managed while working with Kay Properties. This makes it possible to earn income off of the property without asset or … Read More

Kay Properties Process in Spanish

EL PROCESO DE KAY PROPERTIES Planificación y dirección en cambio de DST 1031 Consulta de presentación La llamada de presentación iniciará un diálogo para que nosotros comprendamos su situación: sus preferencias, necesidades y requerimientos para su próximo cambio de 1031. Desarrollo de recomendaciones preliminares Empezaremos a transformar sus palabras en un plan estratégico 1031 teniendo en cuenta las metas y objetivos del cliente obtenidos en la consulta inicial. Empezaremos a recomendar algunas inversiones. Lo cual … Read More

The Fundamentals of 1031 Exchanges

By Dwight Kay and the Kay Properties Team Welcome to 1031 101! If you’ve come to our metaphorical class here, you likely have a few questions. Chief among them: what is a 1031 exchange? What Qualifies for a 1031 exchange? Why should I do a 1031 exchange? What should I 1031 exchange into? Is there an option if I have a failed 1031 exchange? WHAT IS A 1031 EXCHANGE? A 1031 exchange is a procedure … Read More

The Kay Properties Process

1031 Exchange DST Planning and Guidance Introductory Consultation The introductory call will begin a dialogue for us to understand your situation – your preference, needs, and requirements for your upcoming 1031 exchange. Develop Preliminary Recommendations Using the client goals and objectives from our initial consultation, we will begin to transform your words into a strategic 1031 plan. We will provide some initial recommendations for investments. Which will be a starting point to change as needed. … Read More

Qualified Opportunity Zone Funds – A Tax Efficient Investment Vehicle for Those Selling Appreciated Assets

By: Kay Properties & Investments What is a Qualified Opportunity Zone (QOZ)? A QOZs as described under the 2017 Tax Cuts and Jobs Act is a social program with the intent of redeveloping impoverished districts throughout the country by driving private capital to over 8,700 underserved communities and 35M Americans throughout by offering tax incentives to investors¹. What is a Qualified Opportunity Zone Fund (QOF)? A QOF is a legal entity (partnership or corporation) used … Read More

7 Deadly Sins Q&A with Dwight Kay

7 Deadly Sins: What a funny title for a law about DSTs! Betty Friant, Senior Vice President overseeing the Washington DC office of Kay Properties recently interviewed CEO and Founder, Dwight Kay about a very important topic for anyone investing in DST Properties Betty Friant: Dwight, thanks for taking the time to dig into a very important part of what a DST is and how it works. We’ve all heard of Snow White and the … Read More

1031 Delaware Statutory Trust Guide: The Investment Tool You Need to Know About Today

When it comes to tools available for real estate investment, the options can be overwhelming. Every choice seems to come with stringent deadlines or severe limitations and, in some cases, both. Kay Properties & Investments wants to let investors know about an opportunity that seems to be flying under the radar. “A lot of people still don’t know about the 1031 DST structure,” says Dwight Kay, the company’s founder and CEO, who has published multiple … Read More

What Qualified Intermediaries/Exchange Accommodators Should Know About Kay Properties and Investments

By: Jason Salmon, Senior Vice President- Kay Properties and Investments, LLC With hope, readers of this article have a working knowledge of Delaware Statutory Trusts (DSTs); and further, by the end of this piece, a deeper understanding of their place in 1031 exchanges. It’s important to know who’s who, what’s what and certainly where, when, why and how. Our firm, Kay Properties and Investments, works independently with investors interested in participating in DST real estate … Read More

Triple Net Properties and Delaware Statutory Trusts

The Great Recession probably resulted in a seismic shift in many real estate investor’s risk profiles. In 2007, the primary investment strategy was aimed at residential properties with large amounts of market speculation. These properties were largely financed with debt and when the market collapsed, well we all know the story. In 2019 we are experiencing a 1) very peaky market with 2) compressed cap rates on residential properties 3) throughout secondary markets that are … Read More

Kay Properties Closes Delaware Statutory Trust (DST) Property in Maplewood, MO

Los Angeles, CA and St. Louis, MO Kay Properties has successfully completed the Maplewood Industrial DST in Maplewood, MO. This DST property was made available to accredited investors under Regulation D Rule 506c and had a total equity raise of $5,988,500. The Maplewood Industrial DST is a 37,000 square foot industrial distribution facility. The property is 100% leased and occupied with a corporate guarantee on the lease from a publicly traded company. Additionally, it is … Read More

Kay Properties Successfully Completes Another Delaware Statutory Trust (DST) 1031 Exchange Investment in Tampa, FL

Los Angeles, CA and Tampa, FL Kay Properties has successfully completed the Tampa IBC 2 DST in Tampa, FL. This DST property was made available to accredited investors under Regulation D Rule 506c and had a total equity raise of $35,600,000. The Tampa IBC 2 DST is a 100% occupied, long-term leased property in Tampa, FL. The asset is centrally located with easy access to highways, close to Tampa International Airport, quality residential neighborhoods and … Read More

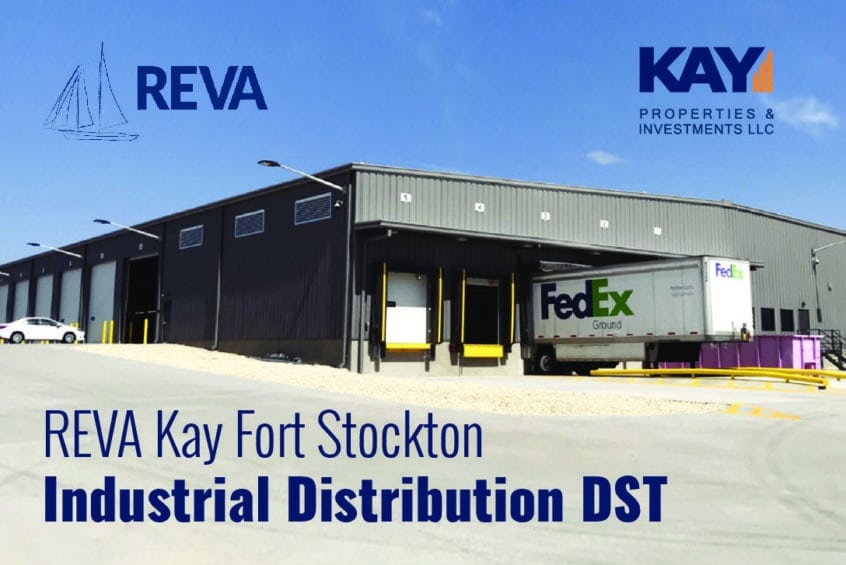

Kay Properties Full Subscribes Delaware Statutory Trust (DST) 1031 Exchange Offering in Fort Stockton, TX

Los Angeles, CA and Fort Stockton, TX Kay Properties has successfully completed the Fort Stockton DST in Fort Stockton, TX. This DST property was made available to accredited investors under Regulation D Rule 506c and had a total equity raise of $7,450,000. The new construction, 29,504 square foot property is 100% occupied on a long-term net lease by an international shipping company and serves as an industrial distribution facility. This DST investment was made available … Read More

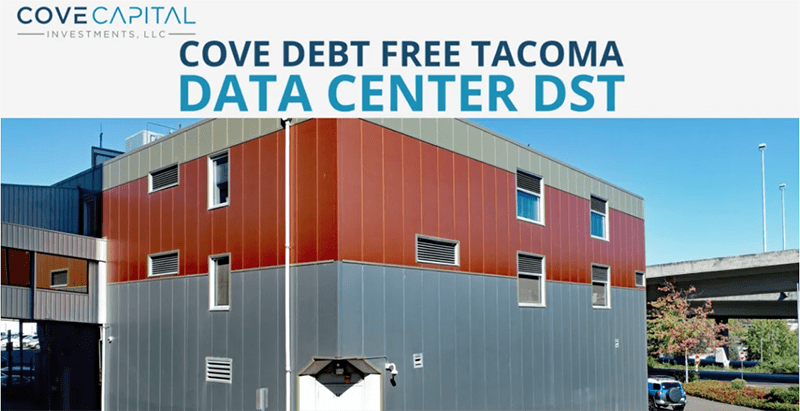

Kay Properties Fully Subscribes Delaware Statutory Trust (DST) 1031 Exchange Property in Tacoma, WA

]Los Angeles, CA and Tacoma, WA Kay Properties has fully subscribed the Tacoma Data Center DST in Tacoma, WA. This DST property was made available to accredited investors under Regulation D Rule 506c and had a total equity raise of $8,398,000. The Tacoma Data Center DST is 100% leased and operates under a long-term net lease with a publicly traded medical company. The facility is mission critical to the tenant as well as it is … Read More

Kay Properties Completes Delaware Statutory Trust (DST) Offering in Port Orchard, WA

Los Angeles, CA and Port Orchard, WA Kay Properties has successfully completed the Washington Pharmacy DST in Port Orchard,WA. This DST property was made available to accredited investors under Regulation D Rule 506c and had a total equity raise of $5,925,500. Dwight Kay, Founder and CEO of Kay Properties noted, “The Washington Pharmacy DST was another example of a net lease DST offering available to Kay Properties clients. We are grateful for all of our … Read More

Phoenix, AZ – Market Overview

In the last five years, there are two markets that have had unprecedented growth in comparison to the rest of the country. Both have surpassed several cities on the rankings of “Largest U.S. City Population” held by the US Census Bureau and they now rank at the fourth and fifth largest city, respectively. Houston in on track to surpass Chicago as the third largest city in the country, and Phoenix is following right behind it. … Read More

Investing in Single Family Homes and Your 1031 Exchange

For the last sixty years, investment in real estate to the average investor meant scraping together capital over a long-term mortgage to invest in residential properties. The primary source of wealth creation in the United States has been investing in your primary residence, with ownership remaining over 60% since 1960 according to the US Census Bureau. However, with a growth in population and prices, it is increasingly difficult for the average family to purchase a … Read More

Learn About Delaware Statutory Trust Laws

At Kay Properties & Investments, we specialize in DSTs, offering a variety of qualifying properties. However, if you’ve never invested in a DST, you may have questions regarding what it requires, its benefits, or even simply, what does DST stand for? To see if a DST investment may be right for you, we break down what it entails and what is has to offer investors. What is a DST? Created as a trust under Delaware … Read More

Kay Properties Real Estate Offering Goes Full Cycle on Behalf of Investors

Kay Properties and Investments today announced that one of their joint venture private placement real estate offerings has gone full cycle. The offering consisted of an opportunity to participate in an Absolute Triple Net Leased (NNN) hospital in the Kansas City Metro Area. The offering generated a 22.27% Return on Investment (ROI)* in approximately 1 year and was made available to accredited investors under Regulation D Rule 506(c) at 25k minimum investments. Dwight Kay, CEO … Read More

Can I 1031 Exchange into a REIT?

Many investors that are in a 1031 exchange that are tired of actively managing their investment properties and are looking to diversify* their 1031 exchange eligible equity as opposed to buying a single property again often ask themselves, “Can I 1031 exchange into a REIT?” The answer is yes—not directly—but indirectly, as part of a multi-part process. An investor is not able to do a direct 1031 exchange into a REIT since REIT shares are … Read More

A Client’s First Experience with DSTs

Case Study: A Client’s First Experience with DSTs By Betty Friant, Senior Vice President, Kay Properties & Investments, LLC The client has invested in real estate since 1987. After experiencing difficulties in renting an industrial property she owned for the past 13 years, it was time to sell. Having sold many properties in the past, the concept of doing a 1031 exchange was all too familiar to her. She questioned whether or not to do … Read More

Kay Properties 1031 DST Team Continues to Grow

Alex Madden is the latest team member to join Kay Properties and Investments, LLC. Alex’s experience within Management Consulting at KPMG, serving clients like the US Department of Housing and Urban Development (HUD) and the Federal Housing Administration (FHA), have provided him with an excellent background in single and multi-family housing. Previously, Alex served as an Army Ranger as an Executive Officer, and Chief of Staff in the Special Operations community, including multiple deployments to … Read More

How Kay Properties and Investments Works With Real Estate Brokers

Securing Listing Agreements: Many brokers have expressed that their investors want to do a 1031 exchange but are afraid of not being able to locate and close on their replacement property within the 1031 exchange timeframe. The Delaware statutory trusts have been secured and pre-packaged prior to being available to investors, and therefore potentially reduce closing risk. Delaware statutory trusts can typically be identified and closed on within 24-72 hours. This helps with the sale … Read More

Is a 1031 Exchange Triple Net Lease the Way to Go for You?

By Chay Lapin – Senior Vice President Kay Properties and Investments Please find below a case study when considering purchasing NNN properties versus alternative options such as DSTs. Is a NNN Property the way to go for my 1031 exchange? Are you considering to purchase and manage a (NNN) Net Lease Property on your own? Important Questions to Ask 1. Are you prepared for the potential active management? NNN properties are only passive if everything … Read More

Hotel Retirement Solution: 1031 Exchange into DSTs

Hotel owners frequently contact Kay Properties and Investments looking for a retirement solution. They have labored for decades building up their business and now it is time to sell the property and retire. However, optimism is often replaced by anxiety when their CPA calculates the tax consequence to discover the standard of living hoped for may not be feasible. Kay Properties and Investments works with hotel owners to help achieve their retirement goals through a … Read More

Charlotte Pharmacy Press Release

Los Angeles, CA and Charlotte, NC Kay Properties and Investments, LLC has successfully completed a $5,436,250 equity raise for the Charlotte Pharmacy DST. The Charlotte Pharmacy DST is an all-cash/debt-free DST investment that owns a 100% occupied Walgreens Pharmacy located in Charlotte, NC. The property enjoys a long-term net lease with a Walgreens corporate guarantee as well as the property is located on a signalized intersection with a combined traffic count of 41,000 vehicles per … Read More