By: Kay Properties and Investments, LLC

Key Takeaways:- A 1031 Exchange helps investors defer capital gains taxes.

- How are Capital Gains Taxes Calculated?

- What are the benefits of a DST 1031 Exchange for real estate investors?

- How does the Kay Properties online marketplace at www.kpi1031.com help DST 1031 exchange investors?

While most real estate investors have heard of the 1031 exchange, they may not understand how the Delaware Statutory Trust or “DST” can be incorporated into the 1031 exchange for a DST 1031 exchange tax advantaged real estate investment strategy.

A 1031 exchange is an exchange that occurs when an investor sells one investment property to purchase another. When swapping your current investment property for another, the investor would typically be required to pay a significant amount of capital gain taxes. However, if this transaction qualifies as a 1031 exchange, you can defer these taxes indefinitely. This allows investors the opportunity to move into a different class of real estate and/or shift their focus into a new real estate area without getting hit with a large tax burden.

A 1031 exchange, also known as a like-kind exchange, is a tax-deferred transaction under section 1031 of the Internal Revenue Code in the United States. It allows real estate investors to sell a property and reinvest the proceeds in a similar property, deferring capital gains taxes that would normally be incurred upon the sale of the relinquished property or properties. This powerful financial tool is popular among investors seeking to both grow their real estate portfolio while deferring capital gains taxes for a later date.

Summary of the 1031 Exchange Rules

Here’s a quick summary of the 1031 Exchange rules investors should keep in mind when considering selling a piece of investment property:- Entire 1031 Exchange process must be completed within 180 days.

- Day 1 – Sell your property; proceeds are escrowed with a Qualified Intermediary (QI).

- Day 45 – Identify a property(s); you must notify your QI of the identified property(s).

- Day 180 – Close on new property; you must close within 180 days after the first sale.

- Maintain equal or greater amount of equity.

- Maintain equal or greater amount of debt.

Capital gains taxes are levies imposed by the United States Government on the profits gained from the sale or disposal of certain assets, such as stocks, real estate, or other investments. Capital gains taxes are levied on the difference between the adjusted purchase price (initial price plus improvement costs, other related costs, and factoring out depreciation) and the sales price of an investment property. In highly taxed states like California, New York, or Hawaii, capital gains taxes can eat away as much as 40% of the proceeds from the sale of an investment piece of real estate.

Why Investors Like the DST 1031 Exchange

Many real estate investors find that Delaware Statutory Trust (DST) 1031 exchange properties particularly attractive for their 1031 exchanges. A DST 1031 Exchange allows investors to exchange their investment property for one or more pieces of large, high quality real estate assets. The DST 1031 exchange structure provides investors several advantages.

Potentially mitigate risk through diversification*.

It is not uncommon for some 1031 exchange investors to be advised to exchange into a NNN property (like a Starbucks, Bridgestone Tires, Dunkin Donuts, etc.), but they are hesitant to place such a large portion of their net worth into a single asset. They recognize that the idea of placing $2 million into a 7 Eleven, $1.8 million into a Starbucks or $5 million into a Walgreens or CVS is not a prudent decision because it is the textbook definition of over-concentration.

The DST 1031 Exchange is a potentially good solution for accredited investors desiring to insulate themselves from over concentration.

A Delaware Statutory Trust is a real estate ownership structure that allows multiple investors to each hold an undivided beneficial interest in the holdings of the trust. The term “beneficial interest” means that investors hold a percentage of the ownership, and no single owner can claim exclusive ownership over any specific aspect of the real estate. The laws of DSTs allow the trust to hold title to one or more investment properties that can include commercial, multifamily, net lease, retail, medical, industrial, self-storage, etc.

The DST 1031 exchange provides investors the opportunity to invest a portion of their 1031 exchange dollars into multiple high-quality properties that they may not otherwise be able to afford. DST 1031 exchange properties allow investors to invest in multiple geographic locations, with a variety of tenants, and asset classes. In this way, the DST 1031 exchange helps investors manage over-concentration risk.

It is important to note that diversification does not guarantee against losses or guarantee profits. Investors should speak with their CPAs and attorneys for guidance to determine if a DST 1031 property investment is suitable for their situation.

DST 1031 Exchanges Are a 100% Passive Investment

Another reason investors appreciate Delaware Statutory Trusts, and 1031 exchanges is because they are a completely passive/turnkey exchange option. DST properties tend to be stabilized, generating potential monthly investor distributions, and management is already in place. Potential distributions are typically delivered once a month to investors bank accounts. Tax packets are provided to investors at the end of the year through a 1099 supplemental and goes on the schedule E of the investors tax return similar to how they report income on the properties that investors currently own. Just like any other real estate, there is no guarantee of appreciation or distributions when investing in Delaware Statutory Trust properties. However, 1031 Exchange investors choose DSTs so they can spend less time dealing with tenants, toilets, and trash, and spend more time on the golf course, traveling the world, and with their family.

DST 1031 Exchange Client Testimonial

Make sure to listen to Casey, a real DST client who moved away from active management into the passive real estate world of DST 1031 exchange properties.

DST 1031 Properties are Pre-Packaged for a Fast 1031 Exchange Close

A DST 1031 Exchange typically has no closing risk because they are “pre-packaged” for 1031 exchange investors to close on immediately. This is incredibly valuable to many investors as often traditional exchangers find themselves in a precarious and stressful situation as they frantically search for a replacement property within 45 days of the day they closed on their relinquished (sold) property. Purchasing a single NNN property on your own is not only time consuming, but it has also very real challenges for the investor as well. For example, issues like financing not coming through, issues with third-party reports as appraisals and environmental reports, or even issues with sellers not disclosing material items such as early termination clauses or co-tenancy issues can create some significant changes in the investment picture.

However, DST 1031 exchange properties are already set-up for 1031 exchange investors, complete with building inspection reports, lease overview, environmental reports, appraisals, and more…all provided within the DST Private Placement Memorandum (PPM). The PPM also goes into the Delaware Statutory Trust offerings business plan and risk factors which each investor is encouraged to read and discuss with their CPA and attorney.

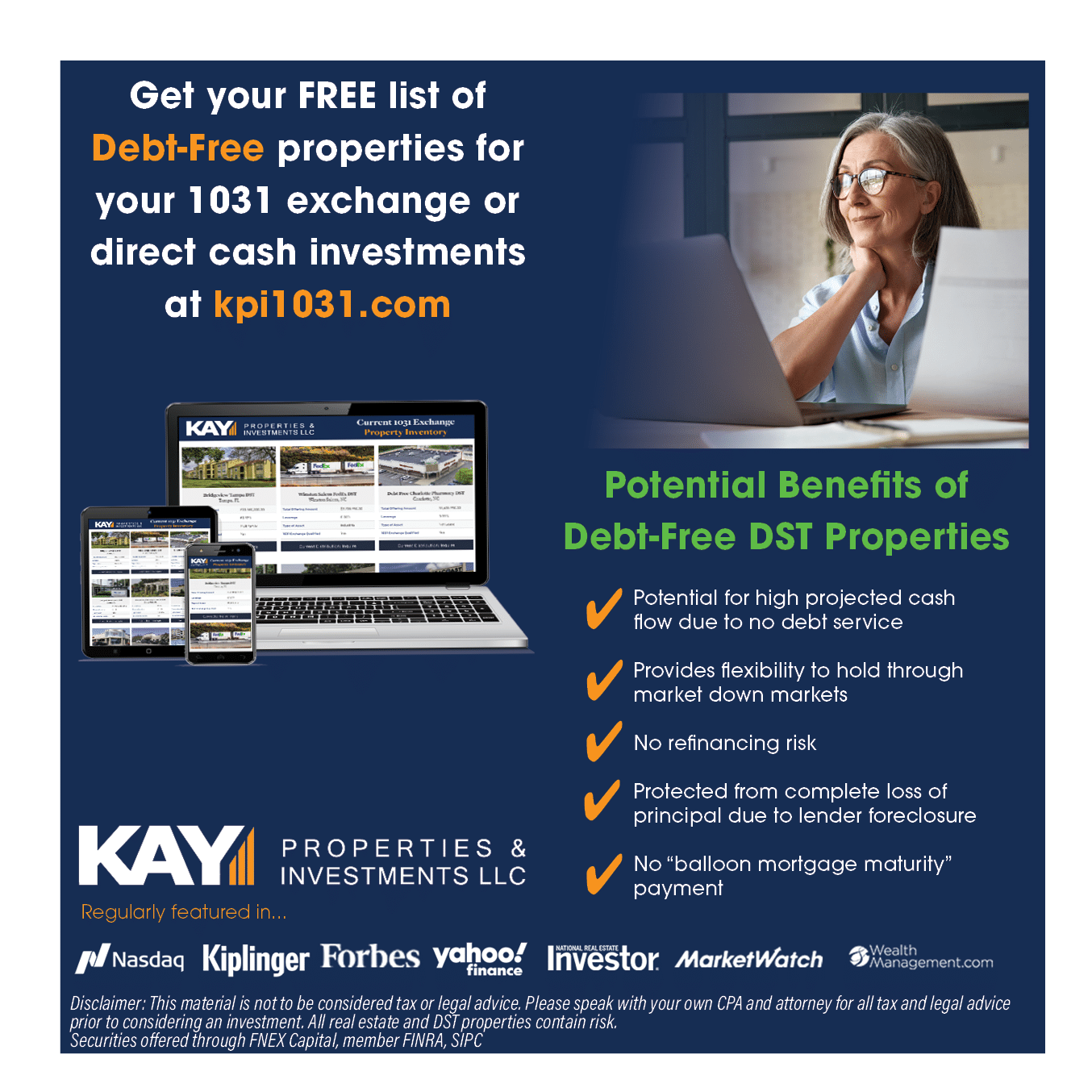

In fact, Kay Properties has created an online 1031 exchange and real estate investment marketplace located at www.kpi1031.com to help investors identify potential DST replacement properties. Investors simply log in for free, and they can view current DST investment opportunities (typically 20-40 different DST investment opportunities) from 25 different sponsor companies. Clients also receive a Private Placement Memorandum for each of the DST investment opportunities they are interested in.

Delaware Statutory Trust 1031 Exchange Property Examples

To get an idea of what a typical Delaware Statutory Trust 1031 exchange property can look like, this article will also provide readers some actual examples of some typical DST 1031 properties. These examples are typical of the type of Delaware Statutory 1031 exchange Trust real estate properties Kay Properties & Investments tries to include in many of its DST 1031 portfolios and what investors will find available at the www.kpi1031.com marketplace.

Delaware Statutory Trust Net Lease Distribution 55 DST, in Colorado

Property Highlights:- New Construction FedEx Ground

- Long term net lease

- Essential Location for FedEx Ground

- Essential Business – Tenant remained open and paying rent throughout the entire COVID-19 Pandemic

- FedEx Ground parent company FedEx Investment Grade Rating of BBB by Standard and Poor’s (S&P)

- FedEx Ground is the fastest growing and most profitable subsidiary of FedEx Corporation* (NYSE: FDX)

- Debt free DST investment - No lender risk.

Pharmacy Net Lease 65 Delaware Statutory Trust in San Diego, CA

Property Highlights:- All-Cash, Debt Free offering; 11,370 sq ft Walgreens Pharmacy.

- 100% occupied.

- Long term 15-year net lease

- The lease is fully guaranteed by Walgreens corporate credit; Walgreens parent, Walgreens Boot Alliance (NYSE: WBA), is a publicly traded company and reported 2019 sales of $136.9 billion.

- WBA has a $40 Billion+ market cap.

Delaware Statutory Trust Net Lease Distribution 64 DST in New York

Property Highlights:- Newly built (2021) distribution center

- A 61,000 SF engineered built-to-suit

- Long term net lease

- Debt free Delaware Statutory Trust - No risk of lender foreclosure.

Read more about the DST Net Lease Distribution 64 DST here.

DST 1031 Exchanges can be an interesting strategy for real estate investors who want to defer capital gains taxes, step away from tenants, toilets, and trash, and generate income and appreciation potential.

*Diversification does not guarantee profits or protect against losses.