Key Takaways:

- 1031 Exchange real estate investors must replace debt as a condition of their exchange. However, in some cases if the property has been held long enough, there is no debt to replace. That’s why Kay Properties encourages investors to consider debt-free DST real estate offerings.

- If an investor must take on debt, it would be wise to consider minimal leverage in order to avoid lender foreclosure and total loss of capital.

- However, for closure is the only concern when taking on debt. Lenders can sometimes initiate a number of “cash flow sweeps” where monthly cash flow can be diverted to pay off a greater percentage of the principal.

- This article covers four very specific cash flow sweep mechanisms that investors should be aware of.

Understanding the fundamental risk versus reward balance can be one of the biggest keys to investment success, especially in the worlds of the 1031 Exchange and Delaware Statutory Trust real estate investing.

Kay Properties & Investments believes that avoiding leverage whenever possible is a prudent strategy to help mitigate risk, especially in today's world filled with geopolitical and economic challenges. While it is true that using leverage can be a good thing, it is also true that using leverage can be fraught with risk.

Just scan the headlines of any business publication, and you will read about large real estate firms that are walking away from real estate assets because they highly leveraged their investment positions during a low-interest rate environment. Almost overnight, interest rates suddenly shot up, catching many investors off guard with no way to refinance. It is not only smaller investors experiencing this situation, but also large firms led by highly skilled real estate executives with decades of experience in successful transactions.

Leveraged real estate and DST properties (whether they contain a 1031 exchange or 721 exchange exit strategy) are full of potential hazards beyond the interest rate environment; they can also be susceptible to market fluctuations. For example, if you have a property and the market value goes down by 20%, and you're at a 50% loan to value, you just lost 40% of your equity.

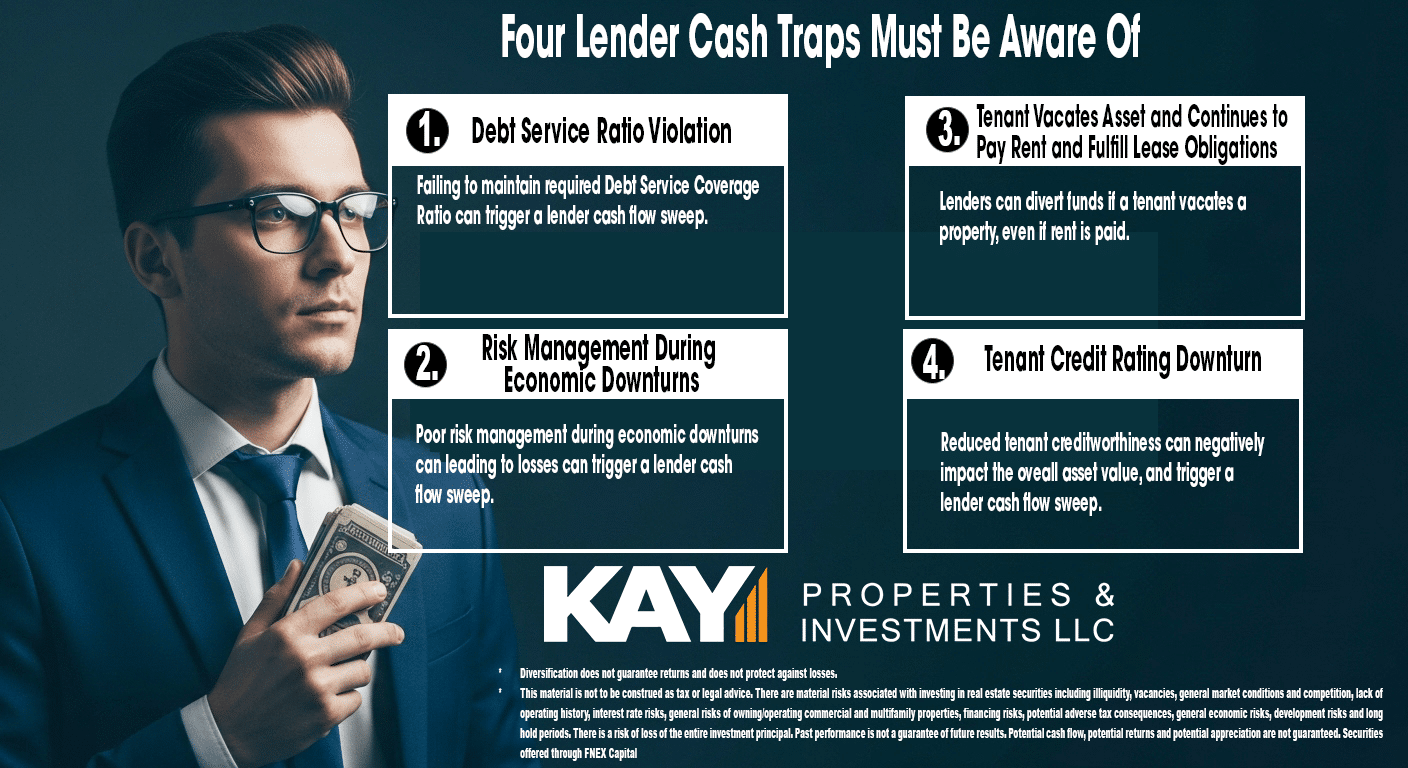

However, in addition to the normal risks associated with real estate, using leverage can also have many risks that many investors (especially DST, 1031 and 721 exchange investors) are unaware of. For example, here are four common lender cash trap provisions that investors should understand when using leverage for a 1031 exchange Delaware Statutory Trust investment. A cash trap occurs when certain conditions occur, and the lender can come in and "sweep" or divert a percentage of excess income created through the asset to pay down the commercial loan.

First Cash Trap Scenario:

Debt Service Coverage Ratio (DSCR) ViolationSecond Cash Trap Scenario:

Risk Management during Economic Downturns:Third Cash Trap Scenario:

Cash Flow Sweep Exercised by Lender if a Tenant Vacates an Asset Even if They Continue to Pay Rent and Fulfill Their Lease Obligations:Fourth Cash Trap Scenario:

Tenant Credit Rating Downgrades:Many DST offerings that have debt associated with them (even when there may be conservative amounts of debt such as a 30-50% Loan to Value) have a provision in the lenders loan documents whereby if a tenants credit rating is dropped below a certain level that the lender has the right to sweep excess cash flow. This immediately halts distributions to investors and could be something that continues for months if not years until the tenant were to have their credit rating increased above the lender's designated rating threshold.

All real estate investors - especially those considering a 1031 exchange, DST investments and 721 exchange UPREITs - must know these and other cash flow sweep provisions and carefully review their loan documents to be aware of any potential for a cash sweep. Again, these examples illustrate why staying debt-free whenever possible can be very important for those investors that are keenly focused on reducing the possibility of an impairment to their monthly cash flow distribution potential. All real estate has risks of tenants not paying rent however when you add on top of that the very real risk of lender cash trap provisions in loan documents it is a potential recipe for decreased cash flow to investors for months and possibly even years. For those investors not wanting the risk of lender cash flow sweeps, lender foreclosure and lender balloon maturity, Cove Capital Investments specializes in debt free DSTs available for 1031 exchange as well as 721 exchange vehicles.