- Access matters – It is important for investors to be able to compare multiple 1031 exchange strategies, DSTs & 721 UPREITs in one place.

- Diversification is key * – One of the most important potential benefit of DSTs is being able to spread risk across different sponsors, asset classes, and geographic regions.*

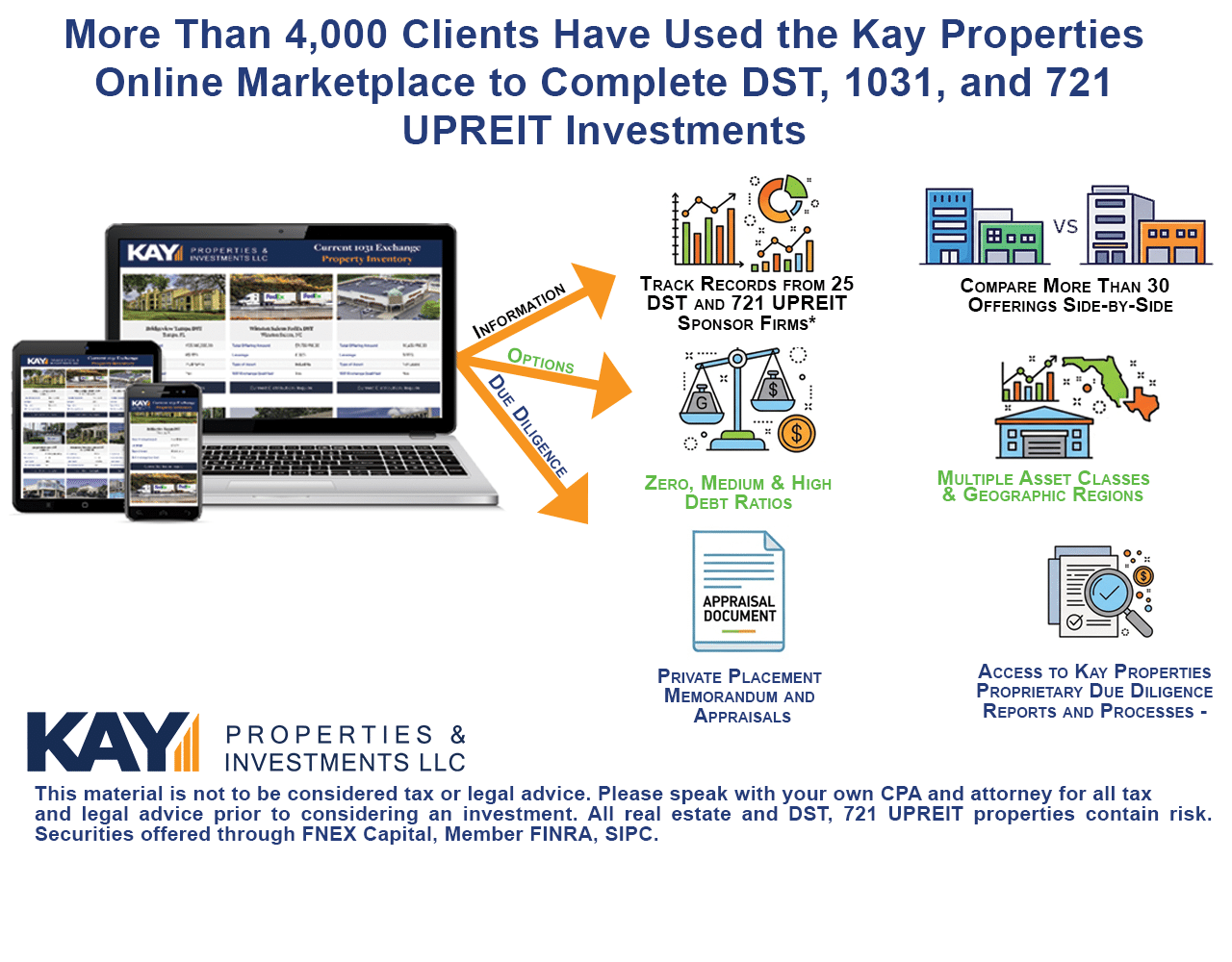

- Due diligence is critical – DST and 721 UPREIT Investors need to review the PPMs, appraisals, and reports, which are all assets available on the Kay Properties online marketplace along with Kay Properties proprietary due diligence models and data.

- Transparency drives confidence – Kay Properties team members, for nearly two decades, have been leaders in providing investors full education including detailed information on both the potential benefits & risks of these investments.

Kay, addressed more than 150 accredited investors on the critical topic of “Why Access and Diversification are Critical When Evaluating Delaware Statutory Trust (DST) 1031 exchanges and 721 UPREIT offerings.”

Dwight’s message was crystal clear - investors should never settle for limited options. Instead, they need to compare multiple DST and 721 UPREIT offerings, assess different sponsor track records, and weigh the pros and cons of each real estate deal.

This philosophy was the genesis of the Kay Properties online marketplace (www.kpi1031.com), a best-in-class platform connecting high-net-worth investors with over 25 DST and REIT sponsors. In addition, the Kay Properties marketplace also emphasizes a rigorous focus on due diligence process by offering private placement memorandums (PPMs), third-party appraisals, and proprietary analysis tools. With 20+ years of industry leadership, Kay Properties prioritizes transparency—equipping investors with balanced education on both the opportunities and risks inherent to these strategies.

The Power of Information and Knowledge in 1031 Exchanges, DSTs & 721 UPREITs

Kay emphasized that not all DSTs and 721 UPREITs are created equal, and that investors should have the ability to thoroughly evaluate multiple offerings from several different sponsoring firms. For example, investors should be able to review any potential DST and 721 UPREIT real estate investment model using the following metrics:- Be able to Review Multiple Offerings Side by Side

- The Ability to Assess Multiple Sponsor Track Records * - Although past performance does not guarantee future results, it is an important component to consider.

- Examine full due diligence materials, including:

- Private Placement Memorandums (PPMs)

- Appraisals & property condition reports

- Environmental and zoning reports

- Debt structures & business plans

- Sensitivity analysis and stress tests on sponsor underwriting assumptions

- Proprietary due diligence models completed by Kay Properties team of analysts

- 721 UPREIT Coverage and Analysis – Due diligence and analysis on the various 721 UPREIT programs and their final destination REITS

Include More Options Than Most DST Providers Offer

Kay’s journey in the DST space began nearly two decades ago as an analyst. What he discovered during this time was not only alarming, but it was also something he felt critically important to share with investors.

Specifically, he witnessed on multiple occasions when investors entrusted $5M-$10M 1031 exchanges to financial advisors—experts in stocks and bonds, but often novices in real estate.

“I’d hear advisors say, ‘Real estate? Sure, we can handle that too. Here’s the best deal.’ But that’s not how smart investing works,” Kay recalled. “You need to poll the market, evaluate and diligence 15 or more options, and align investments with criteria such as investor's goals, risk tolerances, liquidity needs, and financial timelines.”

This revelation drove Kay to build its best-in-market platform where investors can access multiple vetted opportunities—not just a single, limited selection.

Kay Proprietary Due Diligence on DST and 721 UPREIT Offerings

Beyond providing information, options, and access, Kay Properties has also created a robust internal due diligence team that reviews offerings before they’re listed.

"At Kay Properties, we have dedicated teams of analysts who carefully review each DST and 721 Exchange UPREIT offering before listing them on our marketplace. Our team evaluates the appraisals, underwriting, assumptions, environmental documents, underlying financial structures, market dynamics, and tenant creditworthiness," Kay explained.

He also stressed the importance of transparency in risk disclosure:

“All real estate investments carry risk— property values can rise or fall. Investors must read the PPMs and understand potential downsides.”

With over 4,000 investors nationwide guided through DST and UPREIT strategies, Kay Properties prioritizes education, due diligence, and access with diversification—key pillars for long-term success.

Our Investors Are Our Top Priority

The Kay Properties marketplace was designed to solve a major industry gap created by not providing investors real choice when considering a 1031 exchange DST or 721 exchange UPREIT. Whether you’re exploring a DST 1031 exchange or a 721 UPREIT, having access to multiple offerings, sponsors, and Kay Properties proprietary due diligence materials can potentially make all the difference.

As Kay puts it: “The smartest investors don’t settle for just one or two options from their financial advisor. They compare multiple offerings, multiple sponsor firms, track records, multiple asset classes, and multiple geographic regions and then from their dig into the proprietary due diligence that Kay Properties conducts on each DST and 721 UPREIT investment. One of the most important parts of the DST is being able to build a diversified portfolio by combining all these factors across multiple DST offerings,” said Kay.