By The Kay Properties and Investments Due Diligence Team

Kay Properties has long believed that certain asset classes are too risky for investors for many 1031 exchange investors, and perhaps at the top of the list of these is the oil and gas production/mineral rights asset class.

While it is true that oil and gas mineral rights have long attracted investors with the promise of outsized cash flows (often touting 10% or more), it is also true that beneath the allure of potential high returns lies a highly speculative and volatile investment class. Unlike traditional investment real estate such as industrial net lease properties, mineral rights are subject to risks that can be difficult, if not impossible, to quantify accurately. For many investors, this can translate into much lower cash flows than the oil company projected and potentially include the total and permanent loss of capital.

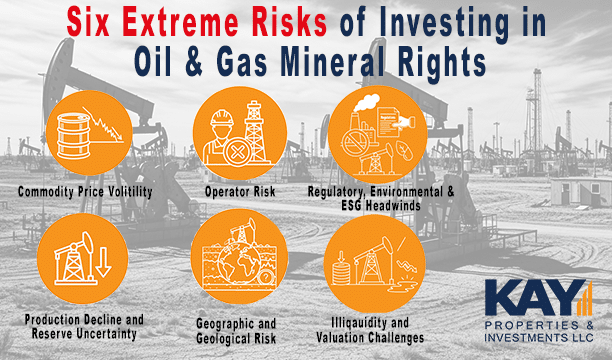

So, what exactly are some of the risks associated with oil and gas production and mineral rights? Six specific areas pose extreme risk to investors.

Risk Number One: Commodity Price Volatility and the Impact to 1031 Exchange Investors Cash Flow

The most obvious risk is the direct exposure to oil and gas prices, which are notoriously volatile. Investing in a mineral rights offering that is trading at $100 a barrel looks like a good investment; however, this same offering can quickly become economically unfeasible when prices fall to $50. Unlike properties with long-term leases to credit tenants, mineral rights do not offer predictable cash flow. Instead, revenue is entirely dependent on commodity prices set by global markets beyond an investor's control.

Risk Number Two: Production Decline and Reserve Uncertainty and How this Can Decrease Cash Flow to 1031 Exchange Investors

Even when drilling is successful, oil and gas wells follow a steep decline curve: production is strongest in the first few months or years and then falls off sharply. Forecasting long-term returns requires accurate reserve estimates, which are inherently uncertain. Overstated reserves or disappointing well performance can leave investors with dramatically lower distributions than expected. The main reason why an investor that is in a 1031 exchange would even consider investing in mineral royalties is because of the high cash flow stated however the reality often is much worse than expected.

Risk Number Three: Operator Risk

Mineral rights owners are typically passive. They rely on exploration and production (E&P) companies—the operators—to drill, extract, and market hydrocarbons. There are numerous variables associated with engaging in these types of operations. For example, if the operator delays drilling, shifts focus to other acreage, or suffers financial distress, mineral rights owners have no recourse. Operators frequently declare bankruptcy during downturns, leaving mineral rights holders stranded. Without an operator drilling on your acreage of mineral rights you will receive no distributions and cash flow. This is a 1031 exchange risk that many are unaware of.

Risk Number Four: Geographic and Geological Risk

Not all acreage is created equal. A few hundred yards can separate highly productive shale formations from uneconomic rock. Investors in mineral rights often lack the technical expertise to evaluate geology and drilling potential. Worse, they may be reliant on aggressive projections from brokers or promoters who profit regardless of whether wells ever get drilled.

Risk Number Five: Regulatory, Environmental, and ESG Headwinds

For decades, the oil and gas industry has faced significant regulatory and political pressure. Typically termed "ESG", or Environmental, Social, and Governance influences have increased restrictions on everything from drilling permits to carbon emissions targets.

As the ESG-focused capital markets continue to influence investors' motivations, institutional investors continue to divest from the fossil fuel industry. This shift creates significant long-term uncertainty for mineral rights, calling their future political support and economic viability into doubt.

Risk Number Six: Illiquidity and Valuation Challenges

Unlike publicly traded stocks or even certain real estate investments, oil and gas mineral rights are incredibly illiquid. There is no open and transparent exchange, and therefore valuations are very subjective. Even worse, often these valuations are based on aggressive (and sometimes unrealistic) assumptions about drilling schedules and commodity prices. Investors who need to exit early are likely to do so at a steep discount, if they can find a buyer at all.

Comparison to Traditional Real Estate

Many investors make the mistake of equating mineral rights to traditional real estate ownership. While both involve "land," the risk profile is entirely different. Real estate offers contractual leases, tangible improvements, and predictable rental income potential. Mineral rights, by contrast, represent speculative exposure to drilling activity, commodity prices, and the whims of energy operators. In other words, mineral rights are far closer to a leveraged bet on energy futures than to a stable income-producing investment.

Yes, while some oil and gas mineral rights can sometimes generate significant profits if purchased at the right price, in the correct location, and at the perfect time. However, for most investors, the risks far outweigh the potential rewards. Extreme volatility, steep production decline curves, operator dependence, and illiquidity make mineral rights among some of the riskiest 1031 exchange investment vehicles available today. For investors seeking the potential for predictable income and stability, mineral rights are a speculative gamble rather than a sound strategy.

Considerations for 1031 Exchange Investors

A particularly concerning trend is the number of 1031 exchange investors—many with no prior experience in the oil and gas business—who are persuaded to place their exchange proceeds into mineral rights instead of traditional real estate such as apartments, shopping centers, or industrial warehouses. In doing so, they take on an extraordinary level of risk that they often do not fully understand.

To make matters worse, some mineral royalty salespeople go so far as to advertise these investments as "guaranteed" or "liquid." This so-called guarantee is simply untrue. Mineral rights are neither guaranteed nor liquid—they are speculative, highly volatile, and extremely difficult to exit once purchased.

Compounding these risks, many oil and gas royalty and syndication sponsor companies that 1031 exchange and direct investors have invested in over the years have ultimately ended in bankruptcy, inferior investor returns, complete investor losses, and, in some cases, outright fraud.

Most savvy 1031 exchange investors who have built their wealth exclusively through real estate will not, at the peak of their retirement years, suddenly pivot into high-risk oil and gas royalties that they have no prior experience with. Even though oil and gas syndication sponsors may dangle the promise of higher returns and significant cash flows, sophisticated investors will recognize that these promises can be illusory and carry substantial risk.