TO: All 1031 Exchange, 721 Exchange UPREIT and Delaware Statutory Trust Investors

FROM: Dwight Kay, Founder and CEO – Kay Properties & Investments, LLC

SUBJECT: Advisory Memo – Risks of Forced DST-UPREIT Conversions & Preferred Alternatives

In recent Delaware Statutory Trust (DST) offerings, some sponsors include forced Section 721 UPREIT conversions into perpetual-life REITs (non-traded REITs) at the end of the DST’s hold period. Under this structure, investors receive potentially illiquid REIT operating partnership (OP) units instead of cash proceeds.

This memo outlines the key risks of forced UPREITs and explains why investors should prioritize traditional DSTs or DSTs with fully optional 721 UPREIT elections.

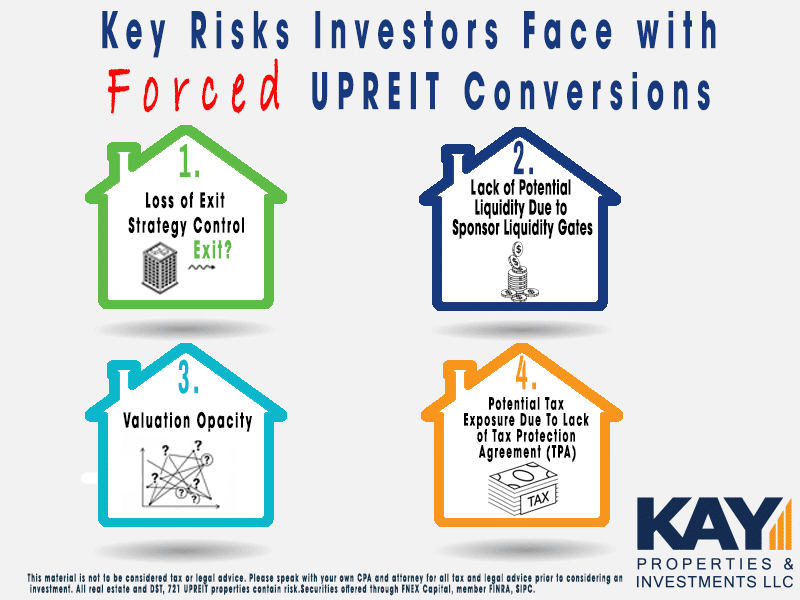

Key Risks of Forced DST 721 UPREIT Conversions

- Loss of Control Over Exit

In a forced DST 721 UPREIT scenario, investors have no choice in the exit strategy – you must exchange your DST interests for REIT operating partnership units on the sponsor’s terms. The timing and terms may not align with your personal financial strategy, and you effectively lose flexibility to choose whether or when to cash out or continue deferring taxes. Investors are essentially locked-in to the UPREIT without the ability to change course or pursue a different 1031 exchange at sale. Investors that participate in a forced 721 UPREIT put themselves into a situation whereby they will not be able to evaluate the health of the final destination REIT at the time of the 721 transaction. This is problematic because the final destination REIT may appear healthy today at the time of the DST transaction; however, in a few years, when the DST is called into the 721 exchange transaction, the final destination REIT may potentially have a completely different financial picture and risk profile.

- Limited Liquidity & Redemption Risks

Non-traded, perpetual life REITs resulting from a 721 UPREIT conversion offer very limited liquidity compared to a straight-forward property sale. The partnership units you receive are illiquid – they are not publicly traded and cannot be quickly converted to cash.

While many non-traded REITs offer periodic redemption programs, those programs are typically restricted and not guaranteed as per the REITs offering documents. In fact, such share redemption plans can be capped, oversubscribed, or even suspended, especially in times of market stress.

It should come as no surprise, therefore, that regulators often caution investors that non-traded REITs often involve a lack of liquidity and sometimes include “uncertain” early redemption provisions for investors. In a forced UPREIT, this means you could be stuck unable to liquidate your investment on your own timetable. Even worse, if many investors seek to redeem, the REIT may simply halt redemptions, as has occurred with some large perpetual-life REITs. In short, you give up the assured liquidity of a sale, and your ability to cash out depends on the REIT’s limited redemption policies (which the REIT can alter or pause at their sole discretion).

Many of the largest non-traded perpetual life REITs have indeed “gated” their liquidity provisions. This leaves investors that may have been told they would have access to liquidity by their “financial advisor” stuck with an illiquid real estate offering that may take them months or even years to access liquidity.

- Valuation Opacity

A perpetual life DST-sponsored REIT often uses internally assessed net asset values (NAVs) for its shares, which introduces valuation opacity. Since there is no active market setting a transparent price, investors must rely on sponsor-provided and commissioned appraisals or NAV calculations, which may lack the transparency of open market pricing. In a forced conversion, you surrender a straightforward payout (sale proceeds at market value) for an opaque stake in a larger portfolio. Determining what your new REIT units are truly worth can be difficult, and the valuation can be subject to conflicts of interest as the sponsor is on both sides of the DST-to-REIT transaction. This opacity can obscure whether you’re getting fair value for your DST property. In contrast, a direct property sale to an unaffiliated third party establishes a clear market value for your investment.

- Tax Deferral Risks

While a 721 UPREIT conversion itself is generally not a taxable event, it can introduce complex tax risks down the line. Crucially, once you hold REIT operating partnership (OP) units, you can no longer do a 1031 exchange on that investment as OP units do not qualify as “like-kind” property for 1031 purposes. This means a forced UPREIT effectively cuts off your ability to continue deferring capital gains tax via future 1031 exchanges.

As a result, your tax deferral will end when you eventually liquidate your REIT units. Any conversion of your OP units into REIT shares or cash redemption is a taxable event that will trigger the capital gains you had deferred.

In other words, the tax bill is delayed but not eliminated, and you will encounter it again upon exiting the REIT. Moreover, you lose control over the timing of that taxable event. If the REIT later forces a merger or compels conversion of your OP units to common shares, you could be hit with a taxable capital gain at a time not of your choosing. There is also the risk that the REIT’s operating partnership might sell the underlying property you contributed, and without careful structuring or tax protection agreements, such a sale could unexpectedly trigger taxable gains to you as an OP unit holder. In summary, a forced UPREIT can create an inevitable tax liability and take away the 1031 “exit ramp” that DST investors often rely on to continually defer taxes.

In fact, many of the DST 721 UPREIT sponsors clearly state in their offering documents that they indeed will not provide a tax protection agreement to their investors. This would leave the investors exposed, if the REIT were to sell their DST property that the DST investors contributed via a 721 exchange to the REIT, to needing to pay capital gains taxes on that contributed property.

Benefits of Traditional DSTs with Full Liquidation Options

- Full Sale Liquidity and Investor Control:

A classic DST has a defined business plan to sell the property outright after a holding period -typically around 5–10 years. When the DST goes “full cycle” and liquidates, investors receive cash proceeds from the sale of the real estate in proportion to their ownership. This provides a clear potential liquidity event – you get paid out in cash rather than being locked into a new vehicle. Importantly, at that point you control your own destiny, including deciding what to do with the proceeds. You may choose to reinvest into another like-kind property via a 1031 exchange to continue deferring taxes – this could be another DST or a regular piece of real estate you would purchase on your own, or simply take the cash (and pay the applicable capital gains tax) if that better suits your needs. This flexibility means you aren’t obligated to stay invested if market conditions or your goals have changed. In a traditional DST, the investor has the freedom at exit to either cash out completely or roll into a new investment – whichever makes the most sense for them. By contrast, a forced UPREIT gives you no such choice at the liquidity event.

- Tax-Deferred Exit via 1031:

If continuing tax deferral is a priority, a traditional DST naturally accommodates a 1031 exchange at exit. Upon the DST’s sale, you can execute another 1031 exchange into any other suitable replacement property (or another DST) on the market, preserving the uninterrupted tax deferral on your gains. This benefit is the cornerstone of why many investors utilize DSTs in the first place – the DST structure qualifies as like-kind property under IRS rules, allowing a seamless 1031 exchange when the DST sells. By rolling into a new property, you can keep deferring capital gains potentially indefinitely (or until you choose to cash out on your own terms). Traditional DSTs keep the 1031 option open at each cycle, whereas a 721 UPREIT path forecloses it. Additionally, with a traditional DST sale you have the option not to exchange if, for example, you prefer to pay the tax and use the funds for other purposes; that optionality is valuable and can be decided at the time of sale. In short, a standard DST offers maximum tax planning flexibility – you can evaluate the market and tax situation at the time of liquidation and decide whether to pursue another tax-deferred exchange or not.

- Simplicity and Alignment of Interests:

When a DST is designed to liquidate and distribute proceeds, the sponsor’s interests are generally aligned with investors to maximize the sale value of the property and return profits. The exit process is transparent – an open market sale of the real estate – with typically an independent buyer setting the price. There’s no affiliated non-traded REIT transaction with complex and internally set pricing issues, as found in the forced 721 UPREIT DST investments. For investors and committees, this straightforward outcome can be easier to underwrite and plan for. The DST ends, and investors walk away with any net cash proceeds and no strings attached. This clear-cut result often suits investors who want control, clarity, and the ability to reinvest on their own terms.

Optional 721 UPREIT DSTs Can be the Best of Both Worlds

- Investor Choice and Flexibility:

An optional UPREIT DST preserves investor control over exit timing and strategy. Rather than being automatically rolled into the REIT (a forced 721), you are given the option to participate in the 721 exchange. You decide whether converting your DST interest into REIT units is advantageous for your situation. This allows you to assess the REIT's performance, portfolio quality, debt exposure and terms - along with current market conditions - before deciding whether to invest. If conditions are favorable – say the REIT is well-managed and in a financially healthy position in terms of their dividend coverage and debt levels – you may opt in. If not, you simply decline the UPREIT and proceed with a normal cash sale (and 1031 exchange if desired) as you would in a traditional DST. This optionality is crucial as it provides flexibility to align the exchange with market conditions and your financial goals. Essentially, you retain control: the 721 exchange becomes a voluntary tool rather than a forced mandate.

- Timing Benefit and Downside Protection:

With an optional 721 structure, you are not locked into the REIT path if the timing isn’t right. Real estate and financial markets are cyclical – by the end of a DST’s hold period, interest rates, property values, or the REIT’s own liquidity situation might differ significantly from the initial plan. Having the choice to UPREIT or not provides a form of downside protection for individual investors.

For example, if the DST is ready to sell during a market downturn or if the REIT’s redemption queues are backed up, you might prefer to take the sale proceeds and reinvest elsewhere rather than accept illiquid REIT units. Conversely, if the REIT is performing strongly and market conditions favor holding a diversified portfolio, the 721 option is available as a convenience.

In other words, an optional UPREIT lets you time your entry into the REIT structure wisely or avoid it entirely. This flexibility can potentially improve investor outcomes by preventing unwanted entanglement in a vehicle that doesn’t fit your needs at that time. By retaining the 1031 exit as a fallback, you can compare the benefits of joining the REIT versus using your proceeds for other opportunities. The mere presence of investor optionality often incentivizes sponsors to ensure the REIT option is attractive (since they must earn your participation), which further protects investors from being shunted into a subpar investment.

- Preservation of Tax Planning Alternatives:

In an optional 721 DST, if you choose not to contribute into the REIT, you still may receive the sale payout and can do a 1031 exchange into another property of your choice. This means the continuity of your tax deferral strategy remains under your control. On the other hand, if you choose to UPREIT, it’s because you have judged that the benefits (diversification, professional management, potential estate planning advantages, etc.) outweigh the loss of immediate 1031 flexibility. The key is you decide based on your tax and investment objectives. By having an optional UPREIT, you do not automatically forfeit the ability to structure your exchange or sale in a tax-efficient manner; you weigh that decision at the time of liquidity. This is a far superior position to be in compared to a forced conversion, where the path is set regardless of your personal tax situation or preferences.

Considerations and Conclusion

When taking all the above into consideration, many of our investors - over the last nearly two decades - have decided it is clear that forced DST-to-UPREIT conversions potentially introduce significant risks – including loss of investor control, illiquidity and redemption uncertainty, opaque valuations, and constrained tax planning.

Not only can these factors negatively impact an investor’s ability to manage their portfolio, but they can also open the door to potential significant tax liabilities. Therefore, investors would be wise to favor DST strategies that either maintain a traditional full liquidation or at least offer a voluntary 721 UPREIT option. Traditional DSTs provide a clear and controlled exit (with the ability to take cash or do a new 1031 exchange), aligning with investors’ need for liquidity and flexibility. Meanwhile, optional UPREIT DSTs can offer the potential benefits of an UPREIT (diversification and continued deferral under Section 721) without sacrificing investor choice – you participate only if it makes sense for you.

By avoiding forced UPREIT provisions, investors preserve their autonomy and can make more optimal decisions at the time of sale or exchange. We recommend conducting thorough due diligence on any DST’s exit strategy before investing and leaning toward deal structures that prioritize investor optionality and transparency. This approach will potentially help ensure that your 1031 exchange investment remains aligned with your financial objectives and that you are not unwittingly locked into and forced into a potentially unfavorable long-term vehicle.

It’s important to clarify that forced 721 UPREIT DST programs are not inherently bad. In fact, many are offered by well-established and reputable firms—many of which we’ve worked very closely with as a diversified piece for our large 1031 exchange clients. However, investors must go in with eyes wide open and fully understand the structure and implications of a forced 721 UPREIT. A critical step is thoroughly reviewing the final destination REIT’s public SEC filings—specifically the 10-Qs and 10-Ks—to assess key factors such as dividend coverage, leverage ratios, debt maturities, exposure to floating rate debt, and whether a tax protection agreement (TPA) is offered, and for how long. At Kay Properties, our dedicated due diligence team continuously monitors these metrics, which is just one of the reasons why thousands of clients from across the United States over the years have relied on us to help guide them through 1031 exchanges into DSTs and 721 UPREIT investments.