Key Takaways:

- Build-to-Rent real estate investments are grabbing the attention of Delaware Statutory Trust investors across the country.

- Build-to-Rent real estate investments appeal to multiple generational tenant segments including Millennials, Gen Xers, and Baby Boomers.

- For 1031 Exchange Investors, the Build-to-Rent model provides the potential for upside rental growth and appreciation.

- Discover some great examples of Build-to-Rent DST offerings on the Kay Properties online marketplace at www.kpi1031.com.

The Build-to-Rent (BTR) segment has emerged as one of the most compelling investment opportunities for 1031 Exchange Delaware Statutory Trust investors across the U.S. housing market. As a result, 1031 exchange investors should take a very close look at this asset class when selecting their Delaware Statutory Trust (DST) investments. As a purpose-built, professionally managed residential asset class, BTR uniquely blends the privacy and space of single-family living with the institutional quality and scalability of multifamily real estate.

For starters, let’s define what exactly this asset class is: A Build-to-Rent (BTR) community is a residential development designed and constructed specifically for renters rather than homebuyers. These communities typically consist of single-family homes, townhomes, or duplexes that are professionally managed and leased rather than sold individually.

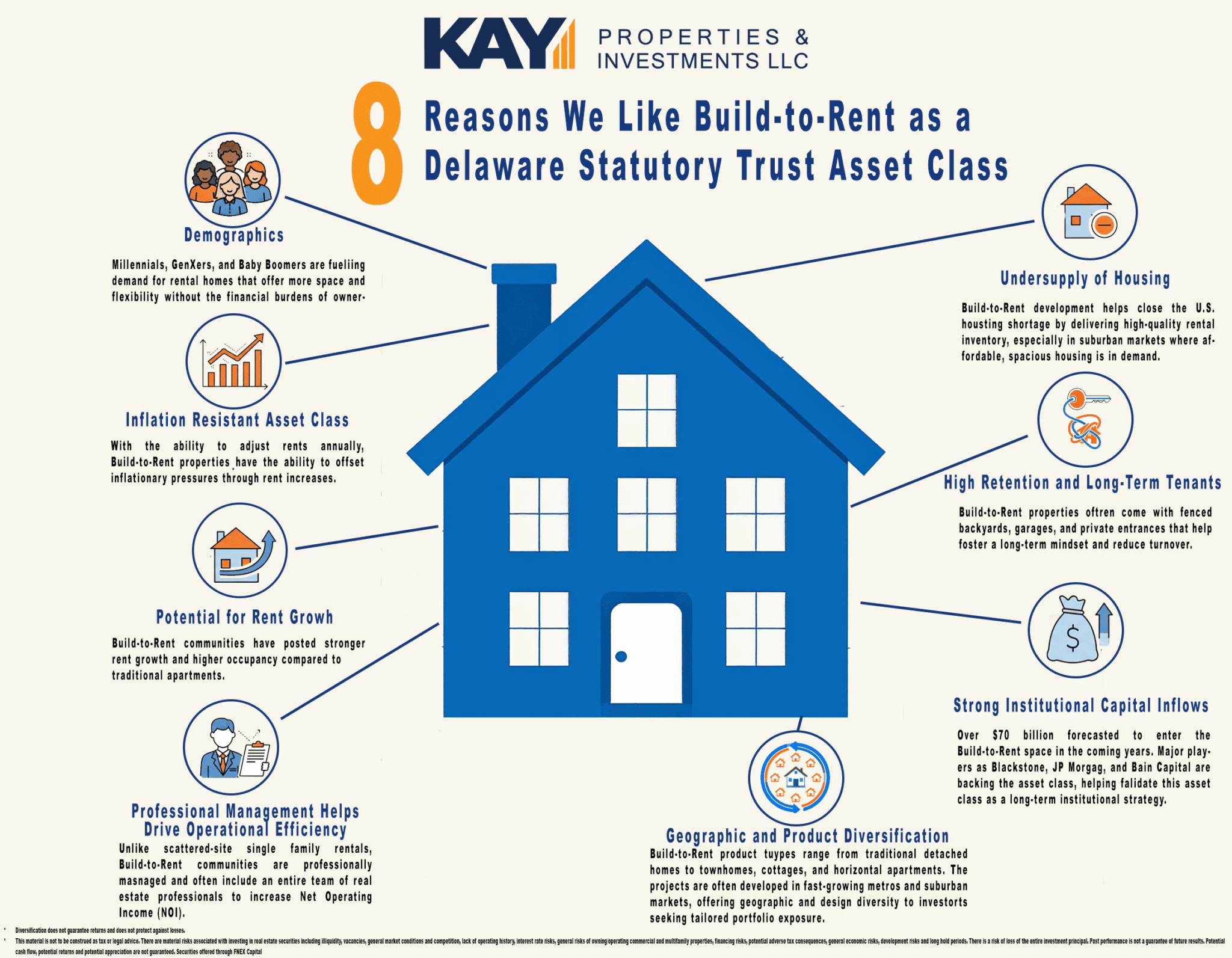

8 Reasons Investors Should Consider Build-to-Rent Assets for Their 1031 Exchange Delaware Statutory Trust

- Demographic-Driven Demand Millennials, Gen Xers, and Baby Boomers alike are fueling demand for rental homes that offer more space and flexibility without the financial burden of ownership. Millennials are forming families, Gen Xers value a low-commitment lifestyle, and Boomers are seeking financial flexibility. BTR properties directly cater to these evolving lifestyle preferences.

- Inflation-Resistant Asset Class * Single-family rents, including those from BTR properties, have consistently outpaced inflation over long periods. * Historical data shows SFR and BTR rents remained resilient even during economic downturns, potentially providing investors with a natural hedge against inflation. *

- Potential Rent Growth and Resilient Occupancy Rates* BTR communities have posted stronger rent growth and higher occupancy compared to traditional apartments. For example, BTR rents rose in over 10 U.S. markets year-over-year as of April 2024, and average occupancy rates remain high due to a typically much lower turnover rate than traditional apartments. *

- Professional Management Drives Operational Efficiency Unlike scattered-site SFRs, BTR communities are professionally managed and often include leasing teams, maintenance staff, and high-end amenities. This structure potentially reduces vacancy risk and operating expenses while improving the tenant experience.

- Undersupply of Housing The U.S. continues to face a severe housing shortage—over 3.5 million units according to some estimates. BTR development helps close this gap by delivering high-quality rental inventory, especially in suburban markets where affordable, spacious housing is in demand.

- High Retention and Long-Term Tenants Approximately 43% of single-family renters plan to stay in their home for five or more years. BTR properties, which often include fenced backyards, garages, and private entrances, foster this long-term mindset and reduce costly turnover for investors.

- Strong Institutional Capital Inflows Institutional investors have taken note, with over $70 billion forecasted to enter the SFR/BTR space in coming years. Major players such as Blackstone, JP Morgan, and Bain Capital are backing the asset class, helping validate BTR as a long-term institutional strategy.

- Geographic and Product Diversification BTR product types range from traditional detached homes to townhomes, cottages, and horizontal apartments. These projects are often developed in fast-growing metros and suburban markets, offering geographic and design diversity to investors seeking tailored portfolio exposure.

Conclusion

As the housing landscape evolves, Build-to-Rent is emerging as a foundational piece of the future rental market. Offering the potential for strong demand fundamentals, inflation protection, professional scalability, and institutional-grade opportunities, BTR investments stand out as a strategic allocation for both potential long-term income and capital appreciation.

To view currently available Build-to-Rent DST investment opportunities please login at the www.kpi1031.com marketplace for DST properties from over 25 different DST sponsor companies. Once logged in, you will be able to view current inventory as well as proprietary Kay Properties due diligence data and materials for each of the available DST offerings.

Source: Berkadia- Single-Family Rental & Build-to-Rent Market Overview (September 2024)