Invest in DST Properties

Easily Find Replacement Properties For Your 1031 Exchange

As Seen On:

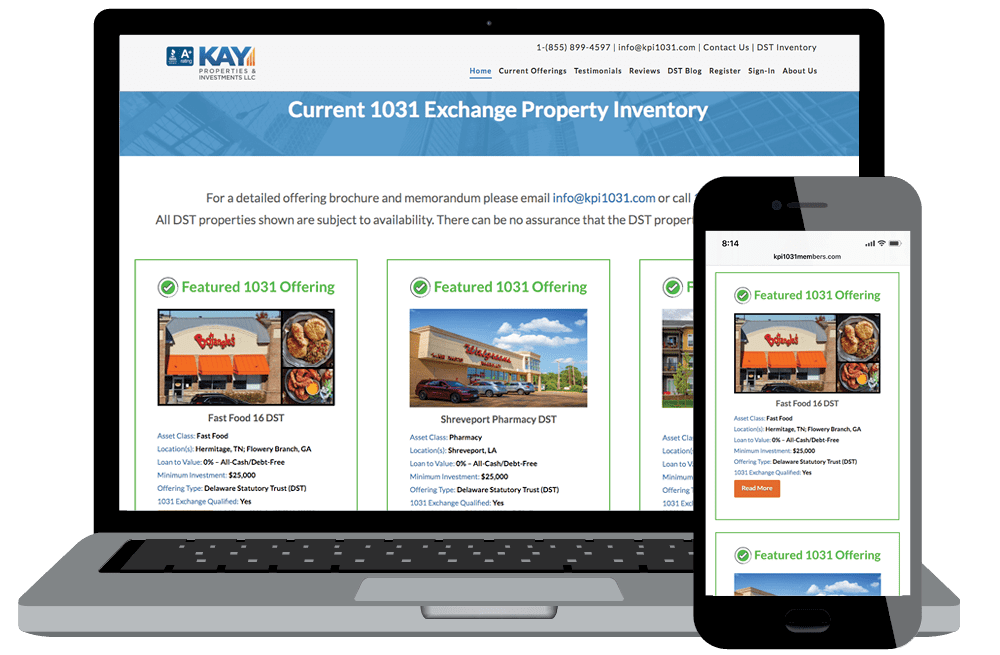

What do our clients get on the

kpi1031.com Online Marketplace?

"My wife and I have four DSTs purchased thru Kay Properties. We are very satisfied with the service they provided during our purchase, and also the monthly returns we are getting…

We have referred Kay Properties to multiple friends, plus have another property that we contemplate using a 1031 into a DST."

-David A., Anne Arundel County, MD

"It was a pleasure working with Dwight Kay and his company this past year on my 1031, DST exchange. Everything has worked as Mr. Kay said it would and the checks arrive at the same time each month. As I do more 1031 exchanges in the future I look forward to working with Dwight Kay and Kay Properties with a DST to defer my taxes on the sale."

-Richard V., Hotel Developer & 1031 DST Investor – Overland Park, KS

“We sold our rental and with Betty’s help, we diversified the proceeds into 4 commercial properties within the Kay Properties network.... The property management is solid. It is a great blessing to have those checks coming every month.... We have just made another investment with Kay and next year, when we sell our last rental, we already know where we will invest – Kay Properties.”

-Larry N. – Delaware Statutory Trust (DST) Investor – Florida

“We sold an office building with a large capital gain and depreciation recapture tax exposure. We needed to do a 1031 tax deferred exchange. When we looked at individual replacement properties, cap rates were low, the prospect of searching for a lender and ongoing property management didn’t seem attractive.

We worked with Jason at Kay Properties. We accomplished a 1031 exchange into a DST that exactly met our investment needs.”

-Investor., Colorado Springs, CO

"My experience working with Betty Friant, of Kay Properties & Investments LLC, was extremely easy and rewarding. She was very professional and responded quickly to any question I had about the properties I was considering purchasing. When I selected a DST to purchase, she set-up a conference call with the sponsor so I could ask specific questions.

When it came to time to close the purchase, Betty made it extremely easy. My wife is now considering purchasing a DST and will only work with Betty."

-Bruce R. - All Cash Debt Free DST 1031 Investor - Mammoth Lakes, CA

"Chay Lapin was an invaluable resource for me as he helped me work through my recent exchange. He was very accessible and worked hard to find just the right replacement property to meet my needs. He also had technology that made finding the right match to my set of unique numbers, so much easier. I would recommend him to anyone with this particular need."

-Vera D., Palo Alto, CA

These testimonials may not be representative of the experience of other clients. Past performance does not guarantee or indicate the likelihood of future results. These clients were not compensated for their testimonials. Please speak with your attorney and CPA before considering an investment.

Some Examples of Our Exchange

Property Listings

Debt Free Washington Pharmacy

Location(s):

Port Orchard, WA

Loan to Value:

0%- All-Cash/ Debt-Free

Offering Type:

Delaware Statutory Trust

Minimum Investment:

$25,000

Tampa International DST

Location(s):

Tampa, FL

Loan to Value:

0%- All-Cash/ Debt-Free

Offering Type:

Delaware Statutory Trust

Minimum Investment:

$25,000

Alexander Pointe Apartments DST

Location(s):

Orange Park, FL

Loan to Value:

52.28%

Offering Type:

Delaware Statutory Trust

Minimum Investment:

$25,000

Kay Properties Custom 1031 Exchange DST Investment Offering Goes Full Cycle on Behalf of 1031 Exchange Investors

Kay Properties and Investments today announced that one of their custom 1031 exchange Delaware Statutory Trust - DST offerings has gone full cycle and was sold on behalf of investors. The offering was a multi-tenant office property located in the Tampa, FL MSA and was made available exclusively to Kay Properties clients in 2017.

The offering generated a total return of 131.42% for the 1031 exchange and direct cash investors¹,². This DST offering was a custom 1031 DST offering made available only to Kay Properties clients who were accredited investors under Regulation D Rule 506(c).

1. The Return on Investment (ROI) represents the ratio of total sales proceeds and distributions through the life of the asset over the total initial equity invested, net of fees. The ROI represents a return to an individual investor. No representation is made that any investment will or is likely to achieve profits or losses similar to those achieved in the past or that losses will not be incurred.

2. Past performance does not guarantee or indicate the likelihood of future results. Diversification does not guarantee profits or protect against losses. All real estate investments provide no guarantees for cash flow, distributions or appreciation as well as could result in a full loss of invested principal. Please read the entire Private Placement Memorandum (PPM) prior to making an investment.

Kay Properties Real Estate Offering Goes Full Cycle on Behalf of Investors

Kay Properties and Investments today announced that one of their joint venture private placement real estate offerings has gone full cycle. The offering consisted of an opportunity to participate in an Absolute Triple Net Leased (NNN) hospital in the Kansas City Metro Area.

The offering generated a 22.27% Return on Investment (ROI)¹,² in approximately 1 year and was made available to accredited investors under Regulation D Rule 506(c) at 25k minimum investments.

1. The Return on Investment (ROI) represents the ratio of total sales proceeds and distributions through the life of the asset over the total initial equity invested, net of fees. The ROI represents a return to an individual investor. No representation is made that any investment will or is likely to achieve profits or losses similar to those achieved in the past or that losses will not be incurred.

2. Past performance does not guarantee or indicate the likelihood of future results. Diversification does not guarantee profits or protect against losses. All real estate investments provide no guarantees for cash flow, distributions or appreciation as well as could result in a full loss of invested principal. Please read the entire Private Placement Memorandum (PPM) prior to making an investment.