By Dwight Kay, Founder and CEO, Kay Properties and InvestmentsQualified Opportunity Zone Funds (QOZF) have become an integral part of the investment landscape in recent years for those investors seeking to defer capital gains taxes on the sale of appreciated assets. At Kay Properties, our team has helped many accredited investors nationwide understand and participate in Qualified Opportunity Zone Fund investments. What is a Qualified Opportunity Zone? Qualified Opportunity Zone Funds were implemented by the … Read More

A Comprehensive Guide and Video on Why Investors Should Consider Debt-Free Delaware Statutory Trust (DST) Properties

Learn eight specific and compelling issues 1031 exchange and Delaware Statutory Trust investors might not be aware of when it comes to risks associated with leverage. By Dwight Kay, Founder and CEO, Kay Properties and InvestmentsIn the world of 1031 exchanges and Delaware Statutory Trust investments, mitigating risks where possible is paramount. One strategy that has gained traction among savvy investors is the all-cash or debt-free Delaware Statutory Trust (DST). As the founder of Kay … Read More

Top 4 FAQs on Delaware Statutory Trusts

Kay Properties has one of the most robust educational platforms in the country when it comes to educating investors on the potential pros and cons of Delaware Statutory Trust investments for 1031 exchanges. One of the most impactful of these educational efforts is our educational client dinners throughout the country where we get a chance to speak directly to investors regarding some of the challenges they face associated with active property management and to discuss … Read More

Mastering DST Properties with Dwight Kay

Kay Properties and Investments Book on Delaware Statutory Trust Properties Remains One of the Best Resources for 1031 Exchange Readers Interested in How DSTs Work Article Highlights: Why did Dwight Kay write a book on Delaware Statutory Trusts? The book talks about Delaware Statutory Trust pros and cons. More than 30,000 copies have been distributed to DST 1031 exchange investors. The book was written in a straight-forward, easy-to-read style. When Dwight Kay, founder and CEO … Read More

What Is A DST 1031 Exchange?

By Steve Haskell, Vice President, Kay Properties and Investments, LLC Key Takeaways: A 1031 Exchange helps investors defer capital gains taxes. How are Capital Gains Taxes Calculated? What are the benefits of a DST 1031 Exchange for real estate investors? How does the Kay Properties online marketplace at www.kpi1031.com help DST 1031 exchange investors? While most real estate investors have heard of the 1031 exchange, they may not understand how the Delaware Statutory Trust or … Read More

Why Delaware Statutory Trusts are a Great Resource for 1031 Exchanges

By Brent Wilson, Vice President, Kay Properties and Investments 1031 Exchange investors have probably noticed that over the past year, the Federal Reserve has been increasing interest rates to control the higher-than-normal rate of inflation. When this happens, one of the things that is triggered is that banks start to tighten their own lending standards because with a higher Fed Funds rate, it’s more expensive for banks to borrow from each other. This reality was … Read More

Why You Should Consider Using Both a 1031 Exchange and Delaware Statutory Trust to Defer Your Taxes

By: Jason Salmon, Executive Vice President, Managing Director, Kay Properties and InvestmentsA Look at the 1031 Exchange Basics: If you own investment real estate – whether a rental condo or home, apartment building, a commercial building, raw or vacant land or otherwise—you do not have to pay taxes when you sell the property. Uncle Sam has had section 1031 of the Internal Revenue Code in place since 1921. Also known as a 1031 exchange, this … Read More

What are Pros and Cons of the Delaware Statutory Trust for Investors?

Cracking the Code: Understanding the Pros and Cons of Delaware Statutory Trusts for 1031 Exchange Real Estate Investors By Dwight Kay, Founder and CEO, Kay Properties and InvestmentsIn the realm of real estate investing, the 1031 exchange Delaware Statutory Trust can provide savvy real estate investors a unique opportunity to achieve passive management, the potential for regular monthly distributions, and a way to enter one of the most tax efficient real estate investment strategies available … Read More

What is a Delaware Statutory Trust: The Basic Facts on DSTs and 1031s

By The Kay Properties Team If you are new at commercial real estate investing, you likely have questions about the different types of real estate ownership structures and specific tax benefits that may be available to them. One of the most popular forms of commercial real estate investing is Our Delaware Statutory Trust 1031 Exchanges. But just what are DSTs and 1031s? This article will specifically answer fundamental questions, including: What is a Delaware Statutory … Read More

What is a DST 1031 Property?

By Dwight Kay, Founder and CEO, Kay Properties and Investments Key Highlights: What do the initials “DST” stand for? What is the typical investment amount for a DST 1031 investment? What does the term “beneficial interest” mean for DST properties? Why investors like DST properties for 1031 exchanges? A DST stands for Delaware Statutory Trust and is an entity that is used to hold title to investment real estate. In some ways this is similar … Read More

How to Make Smart Real Estate Investment Decisions with a 1031 Exchange

By Dwight Kay, Founder and CEO, Kay Properties and Investments If you are a real estate investor, the 1031 Exchange is potentially one of the most powerful wealth-building strategies you have at your disposal. Sometimes called a tax-deferred exchange or like-kind exchange, the 1031 Exchange is a provision outlined in the Internal Revenue Code (Section 1031), which outlines how real estate investors can defer capital gains taxes on the sale of investment properties by reinvesting … Read More

An Easy Guide to Delaware Statutory Trust Investing

Investors interested in Delaware Statutory Trust properties could benefit from a guide that clearly explains Delaware Statutory Trust properties for a 1031 exchange and provides valuable information on topics like: Key Highlights: What is a Delaware Statutory Trust? What is the history surrounding the Delaware Statutory Trust? What are the important dates that impacted the Delaware Statutory Trust? What are some of the benefits of the Delaware Statutory Trust? What are some of the risks … Read More

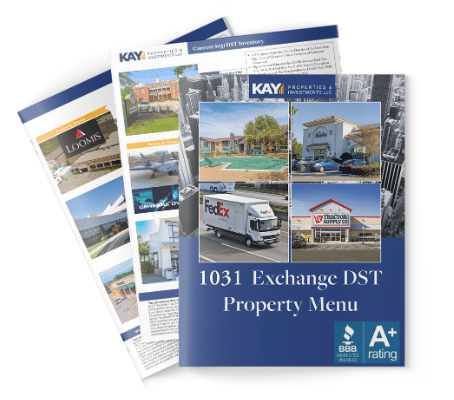

Key Investment Highlights of Net Lease Distribution 64 DST Offering

Recently, Dwight Kay, founder and CEO of Kay Properties, sat down to discuss in detail some of the current custom Delaware Statutory Trust real estate offerings his firm has available on the Kay Properties marketplace at www.kpi1031.com for accredited investors for their 1031 exchange or direct cash investments. These DST 1031 properties are just a handful of current offerings from approximately 20-40 different DST offerings available from roughly 25 DST sponsor companies. One of these … Read More

Delaware Statutory Trusts: Triple Net Lease Properties

Join a couple of our Kay Properties Delaware Statutory Trust experts Betty Friant, Executive Vice President and Matt McFarland, Senior Vice President as they unpack the nuances of triple net lease properties. Triple net real estate investment properties are a popular choice for 1031 exchanges. Kay Properties Executive Vice President and Managing Director Betty Friant and Senior Vice President Matt McFarland take a closer look at NNN properties, and how they fit into the Delaware … Read More

Delaware Statutory Trusts FAQ: Frequently Asked Questions on DSTs

By Dwight Kay, Founder and CEO, Kay Properties and Investments Forward: As one of the nation’s leading expert real estate investment firms specializing in Delaware Statutory Trust investments, Kay Properties is regularly asked about the nuances and strategies surrounding Delaware Statutory Trust investments for 1031 exchanges or direct cash investments. Recently, I sat down to discuss some of Frequently Asked Questions investors ask regarding Delaware Statutory Trusts and 1031 exchanges. I recorded and transcribed this … Read More

Delaware Statutory Trusts: Asset Class Rejection

Listen to Delaware Statutory Trust experts Alex Madden, Senior Vice President, and Orrin Barrow, Senior Vice President as they review the significance of Delaware Statutory Trust Asset Class Rejection. Specifically, they will be discussing: ✔️ What exactly is an asset class for real estate and Delaware Statutory Trusts? ✔️ Why is asset class rejection important when investing in Delaware Statutory Trusts? ✔️ Consider some of the risks of senior care assets in Delaware Statutory Trusts. … Read More

Delaware Statutory Trusts: The History of the DST for 1031 Exchanges

Recently Kay Properties’ senior team of Delaware Statutory Trust experts Jason Salmon, Executive Vice President and Managing Director, and Senior Vice President, Matt McFarland sat down to discuss the history of the Delaware Statutory Trusts. Specifically, Jason and Matt will be discussing the following: ✔️ How the 1031 exchange laws were formed out of Revenue Ruling 2004-86? ✔️ What exactly is the Delaware Statutory Trust structure? ✔️ What is meant by “passive ownership”? ✔️ How … Read More

Another Reason to Stay Debt Free in a 1031 DST Exchange

By Dwight Kay, Founder & CEO, Kay Properties and InvestmentsIt seems like everyday there is another reason showcasing the reason why more and more investors are choosing to stay debt-free when investing in Delaware Statutory Trust (DST) properties in a 1031 exchange. Headlines Show Dangers Surrounding Leveraged Real Estate Just look at any business or real estate-related publication, and you will see the headlines are full of examples of real estate firms that have been … Read More

Four Ways to Use Delaware Statutory Trusts for Your 1031 Exchange

By Tommy Olsen, Vice President Kay Properties & Investments Key Highlights: How DSTs help investors successfully complete a 1031 exchange Can DSTs potentially provide investors greater diversification? How DSTs are utilized to help investors easily replace debt for their 1031 exchange DSTs can provide investors a good back-up option for a 1031 exchange Regardless of what economic trends are taking place, Delaware Statutory Trusts provide investors four timeless benefits for their 1031 Exchanges including deferring … Read More

Six Potential Benefits of Exchanging into Delaware Statutory Trust Properties

By Dwight Kay, Founder and CEO Kay Properties & Investments There are a number of potential benefits associated with exchanging into a Delaware Statutory Trust (DST) 1031 property. However, it is important to note that these potential benefits should also always be carefully weighed with the potential risks that are possible with DST investments, and as with all real estate investments, investors should consult their tax attorney and or Certified Public Account before investing in … Read More

Kay Properties & Investments DST Essentials Podcast: Liquidity & Exit Strategies

Join Kay Properties along with Matthew McFarland, Senior Vice President and Tommy Olsen, Vice President for a podcast on Delaware Statutory Trust liquidity and Exit Strategies. What We Will Be Covering: Various DST Exit Strategies DST Hold Period Expectations DST Secondary Market Transactions Estate Planning Transcriptions Tom Wall: Hi everyone, my name is Tom Wall, senior associate here at Kay Properties, and thank you so much for joining us this Friday for our investor conference … Read More

Why Delaware Statutory Trust Investors Should Practice “The Anchor and the Buoy Investment Strategy”

Real estate investors currently considering a Delaware Statutory Trust (DST) investment for a 1031 exchange or even a direct-cash investment, one of the first things to consider is what specific investment strategy should you pursue? For example, is the goal to achieve greater appreciation even if it means investing in an asset that carries greater risk? Or is your long-term strategy to have steady monthly income even if it means lower overall appreciation potential? I … Read More

Seven DST 1031 Exchange Terms Every Real Estate Investor Should Know

Kay Takeaways: Knowing key terms for a 1031 Exchange is important for investors What is the definition of “beneficial interest” and how does it relate to DST’s? What is a Tenant In Common Investment? Do you know what a Qualified Intermediary is? Becoming a serious 1031 Exchange real estate investor can involve a significant learning curve. For example, there are many investment terms that every investor shouldknow and understand in order to better understand the … Read More

DST Essentials Podcast: Building a Crisis Resistant Real Estate Investment Portfolio

Listen to the DST Essentials with Kay Properties along with Betty Friant, Executive Vice President & Managing Director and Matthew McFarland, Senior Vice President for a podcast diving into a few tips on building a crisis resistant real estate investment portfolio. We will be discussing: The Importance of Diversification Asset Class Rejection Various Real Estate Access Points The Significance of Avoiding Leverage if Possible Transcriptions Victor Coronado: Hi everyone, this is Victor Coronado, senior Associate here … Read More

How Delaware Statutory Trust Investments Can Play an Important Part of Wealth Preservation

By Jason Salmon, Senior Vice President and Managing Director of Real Estate Analytics, Kay Properties & Investments Key Takeaways: Delaware Statutory Trust Investments Help Investors Defer Capital Gains Taxes Real Estate Investments Are Popular for Building Generational Family Wealth Delaware Statutory Trusts Offer the Potential for Step-Up in Basis Tax Benefits Delaware Statutory Trusts Offer Investors the Ability to Enjoy More Free Time Many people believe that the best thing about a Delaware Statutory Trust … Read More

The Importance of the Private Placement Memorandum (PPM) for Delaware Statutory Trust 1031 Exchange Investors

Key Takeaways: PPMs are part of all Delaware Statutory Trust Investments PPMs provide investors a full picture of the overall investment, including the potential risks PPMs include important information for investors including the DST trust agreement, summary of third-party reports, lease agreements, and most recent property appraisal. All Kay Properties Delaware Statutory Trust 1031 Exchange real estate investments must be accompanied by a unique Private Placement Memorandum (PPM) as part of its due diligence and … Read More

Consider These Potential DST 1031 Exit Strategy Options: Cash Out, 1031 Exchange or 721 Exchange

By Dwight Kay, Founder and CEO of Kay Properties and Investments One of the most important questions all real estate investors should ask themselves is, “What is my long-term strategy?” In the case of Delaware Statutory Trust (DST) investors, exit strategies come into play once the investment period has concluded, or gone “Full Cycle”. Full Cycle is a term used to describe DST property that has been sold on behalf of investors after a period … Read More

Picking the Right Delaware Statutory Trust Company

Investors often must juggle multiple investment options, like where to invest and with whom. When it comes to evaluating a Delaware Statutory Trust or DST investment, real estate investors should look for a firm that specializes in DST investments to help ensure their 1031 Exchange is executed, with no detail being dropped. One of the most important reasons investors need to carefully research any Delaware Statutory Trust company is because 1031 Exchange investment decisions need … Read More

Why Real Estate Syndication Is Important for Delaware Statutory Trust 1031 Exchange Real Estate Investors

Key Takeaways: How does Delaware Statutory Trust Syndication benefit investors? Why Real Estate Syndication via a DST can potentially reduce risk for investors*? What is the Portfolio Optimization and Diversification Theory? How real estate syndication and DST investments can help investors access larger real estate assets? Delaware Statutory Trust 1031 exchanges have never been more popular, and one of the reasons behind this growth and investor appeal is the power and flexibility of real estate … Read More

DST Essential Podcast: Case Study

Join us for the DST Essentials with Kay Properties along with Matthew McFarland, Senior Vice President and Tommy Olsen, Vice President for a conference call discussing a particular DST investor case study. We will be discussing: Investor DST Education The Importance of Staying Debt-Free DST Investment Customization Diversification Amongst Asset Classes Transcriptions Tom Wall: Hi everyone. Thank you for patiently waiting. My name is Tom Wall, a senior associate here at Kay Properties, and thank you … Read More

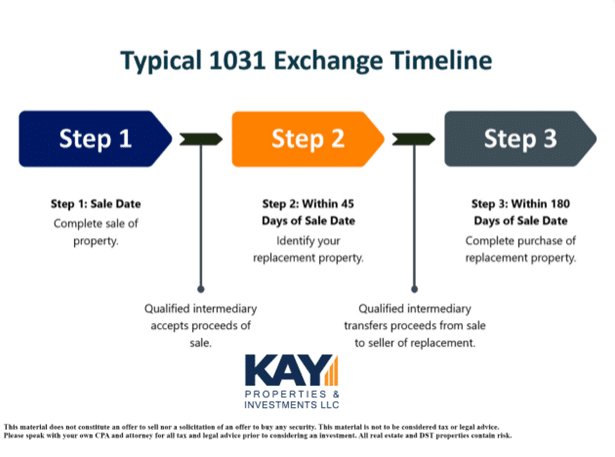

Six Ways to Ensure Your 1031 Exchange is Successfully Completed

Whether you are an investor or a real estate broker, selling investment or business real estate can be an expensive venture unless you are prepared to conduct a 1031 exchange. Section 1031 of the federal tax code dictates that no gain or loss shall be recognized upon the sale of a real estate property held for business or investment purposes, as long as the seller purchases a replacement property of equal or greater value. This … Read More

Kay Properties & Investments DST Essentials Podcast on the DST Full Cycle Process

Listen to Kay Properties along with Carmine Galimi, Senior Vice President and Brent Wilson, Vice President for a podcast discussing in-depth the Delaware Statutory Trust full cycle process. We will be discussing: Full Cycle: Overview of what the DST life cycle means for Investors Hold Periods: Rundown of the DST variables and nuances which affect the process of selling Leveraged vs. Debt-Free DSTs: Held time expectations for investors DST Investor Process Transcriptions Nick Snyder: Hi … Read More

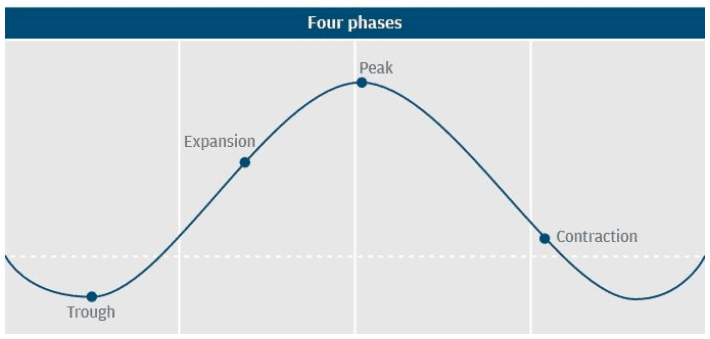

Investing Across Market Cycles and Delaware Statutory Trust Investments

Key Takeaways: What are the Four Stages of a Real Estate Cycle? What are some Current Macro Real Estate Trends Impacting Investment Real Estate? Why Should Delaware Statutory Trust Investors Be Aware of Current Real Estate Trends? One of the common topics that frequently pops up in investment conversations these days involves questions about what stage of the “real estate cycle” is the market currently in, and how does the current real estate market cycle … Read More

Why the Delaware Statutory Trust Specialist Can be a Real Estate Broker’s Best Friend

Key Takeaways: Why should real estate brokers present a DST 1031 Expert to their clients? Why is a DST 1031 perfect for a multifamily investor who is ready to sell their asset? What is “mortgage boot” and why should it be avoided? What do DST 1031 experts bring to the table for both the seller and real estate broker? Today’s multifamily market is bustling with activity as the number of owners and investors from Maine … Read More

What is a Delaware Statutory Trust and Why So Many Real Estate Investors Are Interested in Them?

By Matt McFarland, Vice President, and Thomas Wall, Associate, Kay Properties & Investments We recently attended an Apartment Owners tradeshow and were surprised to hear many experienced investment property owners ask us the same questions throughout the afternoon. That’s why we thought it might be a good idea to write about what exactly were the three most commonly asked questions we heard during that conference that relate to DST 1031 exchanges, including: What is a … Read More

Kay Properties & Investments Helps Accredited Investor 1031 Exchange Into 15 Different Delaware Statutory Trust Investments within 30 Days

High net-worth investor decides to relinquish a portion of his rental property portfolio in a succession of sales before entering multiple DST 1031 exchanges to help achieve diversification, non-active management, and potential monthly income (Torrance, CA) Kay Properties & Investments successfully helped a high-net-worth client complete 15 Delaware Statutory Trust (DST) investments following the sale of five multifamily properties within a short period of time. “This particular client leveraged the full potential of Kay Properties … Read More

What is a DST Sponsor Company?

What is a Delaware Statutory Trust Sponsor Company? By: Alex Madden, Vice President, Kay Properties and Investments, LLC Many 1031 exchange investors have never heard of a DST Sponsor, what they are, or what they do. It is important for investors considering DST properties to understand the role of a DST sponsor and what they do. After reading this article, a 1031 exchange investor should have a better understanding of what a DST sponsor company … Read More

How Real Estate Investors Can Use Delaware Statutory Trust (DST) Properties to Replace Debt in a 1031 Exchange

By Alex Madden, Vice President, Kay Properties and Investments, LLC Savvy real estate investors understand the primary reason for selling and buying real estate via 1031 exchange is to defer capital gains tax that would otherwise be due on the sale. By “exchanging” one or more pieces of property for one or more like-kind pieces of equal or great value helps the investor defer capital gains taxes. However, one of the critical requirements that must … Read More

As seen on WealthManagement.com: Real Estate DSTs — A Haven in a 1031 Tax-Change Storm?

By Chay Lapin, President of Kay Properties & Investments, LLC In the face of the tax policy uncertainty, the question is how to think about current real estate investments and future investment plans. Washington-watchers including many of us in the real estate industry are waiting to see if and how federal policymakers change the tax treatment of capital gains and 1031 like-kind exchanges this year. The capital gains tax rate affects the flow of capital … Read More

How do I use a DST for replacing the debt in a 1031 Exchange

Fractional Ownership of DSTs Creates more Options What happens if I don’t replace the full sale price? By: Dwight Kay, CEO and Founder of Kay Properties and Investments and the Kay Properties team When doing your calculation on replacement value for a 1031 Exchange, don’t leave out an important part of the equation – replacement debt. One of the basic 1031 Exchange requirements necessary to qualify for a full tax deferral on capital gains taxes … Read More

How to guard against the pitfalls of financing used in DSTs

Investors going into a DST investment are often laser focused on the property they are buying. Where is their money going – perhaps it’s an apartment complex in Dallas or a portfolio of dollar stores in the Midwest? Investors often “kick the tires” so to speak looking at factors such as the location, occupancy, rental income and credit quality of the tenants. One question that often gets pushed lower on that checklist is what type … Read More

Do DSTs work for a 1033 exchange due to eminent domain or involuntary conversion?

By Dwight Kay, CEO of Kay Properties and Investments and the Kay Properties Team Understanding the rules of a 1033 Exchange aka Involuntary Conversion DSTs provide replacement options for a property sold under eminent domain. Property owners initiating a 1031 Exchange often end up in that situation by choice after deciding to sell an investment property or business. However, a 1033 Exchange is used when the government steps in to acquire a property by exercising … Read More

The Tax Advantages of Zero Coupon DSTs

By Betty Friant, Senior Vice President, Matt McFarland, Vice President and the Kay Properties Team Investing in a Zero Coupon DST, frankly, sounds a little crazy. Why would anyone want to buy into a DST with no cash flow? The simple answer is for the tax advantages. How does a Zero Coupon DST work? In a Zero Coupon DST, all of the cash flow goes to the lender to service the debt on a property. … Read More

How To Create a Diversified DST Portfolio

By Jason Salmon, Senior Vice President and the Kay Properties & Investments Team Diversification* is one of the basic building blocks to any investment portfolio strategy. It’s the simple concept of not wanting to put all of your eggs in one basket. Diversification across asset types helps to avoid concentration risk – and potentially a basket full of broken eggs. Diversification also has the potential to create other positives, such as achieving a potentially higher overall … Read More

Generational Assets: Leveraging DSTs to Transfer Wealth

By Jason Salmon, Senior Vice President and the Kay Properties Team at Kay Properties & Investments, LLC Real estate has long been a popular asset used to build generational family wealth. One of the key tax advantages to passing real estate property to heirs is that those recipients benefit from a step-up in basis. That step-up is much like hitting the reset button on a property’s current market value. That step-up in value alone can … Read More

How to Identify a 1031 Exchange with the 200% Rule

By Dwight Kay, Founder & CEO; Betty Friant, Senior Vice President and The Kay Properties Team “Is that your final answer?” You may recognize the question made famous by the popular TV game show Who Wants to Be a Millionaire? Choosing the right answer in this game gives you a shot at winning big money, while the wrong answer leaves you with nothing. Investors conducting a 1031 Exchange face a similar make or break decision … Read More

Good to Have a 1031 Exchange Backup When You Need One: Kay Properties Helps DST Investors Avoid a Potentially Significant Tax Consequence

By: Alex Madden, Vice President, Kay Properties and Investments, LLC Kay Properties and Investments is pleased to announce a completed exchange for an investor who did not originally intend to invest into Delaware Statutory Trust (DST) properties. Vice President Alex Madden explained: “After discussing the client’s background in real estate investing, he expressed his first choice was to continue with active management for a few more years before he began moving his substantial real estate … Read More

Three 1031 Exchange Alternatives

By: Jason Salmon, Senior Vice President; Managing Director of Real Estate Analytics, Kay Properties and Investments, LLC Are you considering a 1031 exchange? There’s no doubt that in cases of like-kind exchanges, the Section 1031 offers tax gains that may amount to a substantial figure. It helps explain the popularity of the exchange option in the U. S. However, in many cases, in order to take advantage of the reduced and deferred taxes, the 1031 … Read More

July 15th 1031 Exchange Deadline Approaching! How Fast Can I Close on DSTs?

By: Orrin Barrow, Vice President – Kay Properties and Investments, LLC Many investors were granted an extension on their 1031 exchanges so that they would not have to identify their replacement property until July 15th, 2020. However, we are quickly approaching this deadline for investors to properly identify and select their replacement property. Given the very unsure nature of the economy and how Covid-19 will continue to affect us, many investors have been reaching out … Read More

- Page 1 of 2

- 1

- 2