By Chay Lapin, President, Kay Properties and Investments

Key Takeaways:

- Investors can 1031 exchange out of their DST Investments

- What does it mean to have a DST 1031 exchange go Full-Cycle?

- Investors must conform to all of the 1031 rules when a DST goes Full-Cycle

- What is the Kay Properties DST Secondary Market?

Many investors that have participated in or are considering a DST 1031 exchange with Kay Properties will oftentimes ask us, Is it possible to 1031 exchange out of a Delaware Statutory Trust?If you’re looking for a clear and concise answer to this question, here it is: Yes, you can 1031 exchange out of a DST.

But let’s dig a little deeper into this subject.

First Things First: What is a DST?

Let’s first look at exactly what is a Delaware Statutory Trust (DST)? DSTs are vehicles for passive real estate ownership that allow investors to remove themselves from day-to-day headaches of property management as well as the opportunity to diversify* their equity in an effort to potentially reduce risk. Each individual investor possesses his or her own share – sometimes referred to as a “beneficial interest”, including potential income, tax benefits, and appreciation of the DST property. A longer and more detailed article of exactly what a Delaware Statutory Trust is and why so many real estate investors are attracted to them can be found here.

Exchanging Out of a DST Following Full-Cycle Investment

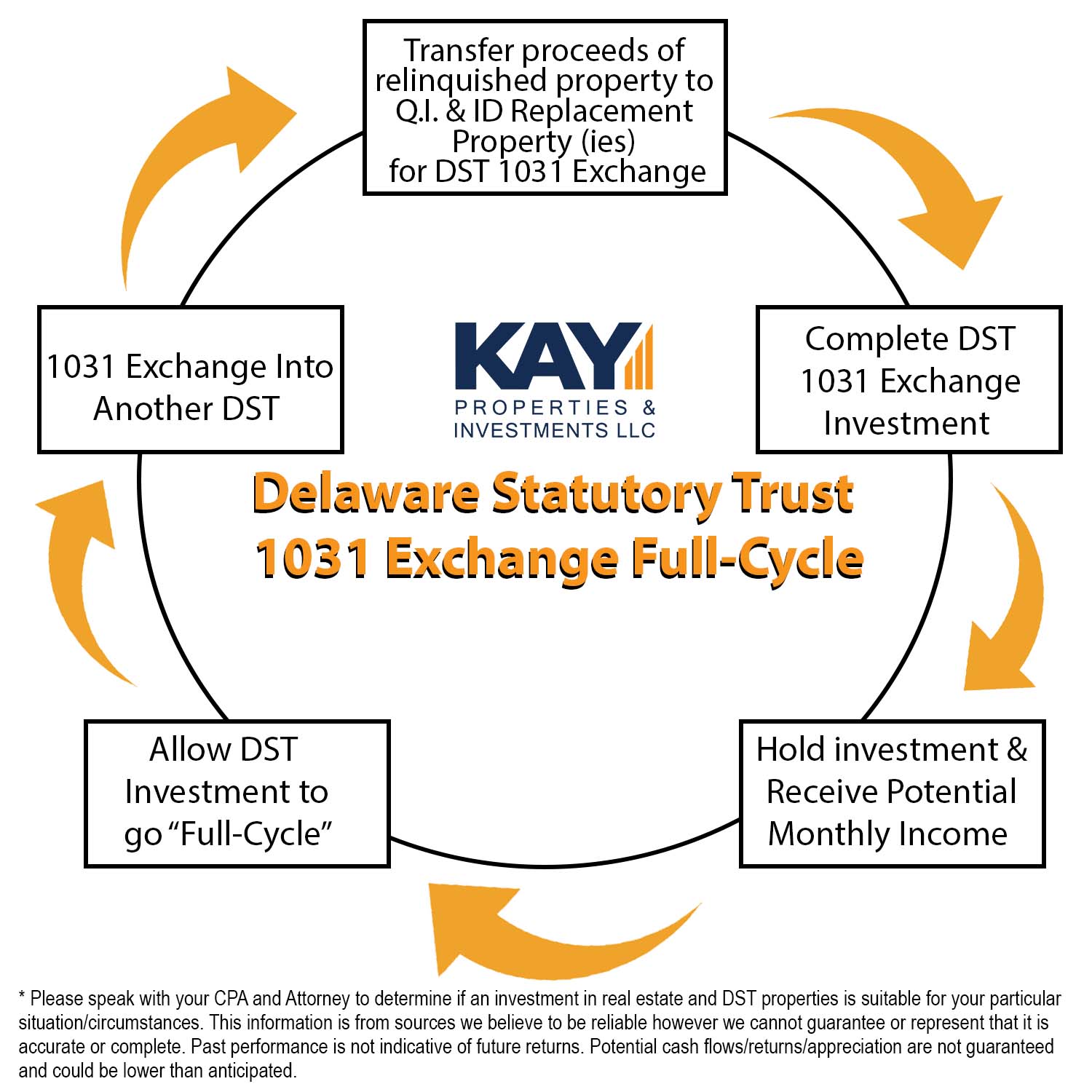

Now the question of “Can I 1031 exchange out of a DST?” can be addressed from two different perspectives. The first perspective involves when a DST property itself goes “full cycle”. The term “Full-Cycle” is used to describe a Delaware Statutory Trust asset that has been purchased and then sold on behalf of a group of accredited investors after a period of time. Once the DST sponsor has sold the asset per the DST’s business plan each individual investor then has the same options as they had when they first exchanged into the DST: They must use a Qualified Intermediary, identify the up leg within 45 days of the closing of the relinquished property and close on the up leg within 180 days of the closing of the relinquished property. If they choose to “cash out” following the full-cycle investment, they are required to pay their taxes.

A good example of a Kay Properties DST investment that went full-cycle is the Alexander Pointe Multifamily DST in Orange Park, FL.

Exchanging out of a DST Prior to the Investment Goes Full-Cycle

Exchanging out of a DST before the investment goes full-cycle is a bit more detailed. Because DSTs are real estate-based investments, they are considered illiquid. There is no stock market exchange that allows you to log online and sell your DST investment quickly. Therefore, investors should only purchase a DST via a 1031 exchange if they are willing to hold for the full life of the investment which could be 5-10 plus years.

However, it may be possible to sell your share of a DST and either cash out or pursue another 1031 exchange. While DST interests can be sold and transferred to an accredited investor, the most obvious purchasers of DST interests are other investors either in the same DST or outside investors who wish to acquire interest in the particular DST.

Please note that exchanging out of a DST prior to the investment going full cycle means that the investor must follow all the same rules as any traditional 1031 exchange. That is, investors must use a Qualified Intermediary, they must identify their up leg within 45 days of the closing of their relinquished property and they must close on their up leg within 180 days of the closing of your relinquished property.

Kay Properties Secondary Market

Because Kay Properties understands investors might need to exit a DST prematurely, they created a DST Secondary Market where investors who want to sell early have a potential market available to buy their interest in the DST investment. The Kay DST Secondary Market is made possible due to the fact that Kay Properties works with many DST buyers on a daily basis. Kay Properties helped clients purchase approximately $30 billion of DST investments since its founding. This volume allows us to be a resource for those wanting to sell a DST investment early as we are working with many, many DST buyers nationwide. Again, there is no guarantee that you will be able to sell your DST investment on the Kay DST Secondary Market however it may be a potential option.

For a list of 1031 DST properties please visit www.kpi1031.com as well as your will find more helpful articles and resources as you are considering 1031 exchange DST properties

*Diversification does not guarantee profits or protect against losses.